Don't Miss Today's Key Market Insights and Information

| | | | | | | | | | | | | Today’s TBUZ TV

The market stayed strong overnight after last night’s open. A lot is happening in the market right now. I’m paying close attention to crude. Listen to today’s TBUZ TV for my key levels in the market.

“I am a great believer in work. I find that the more I work, the more I have it.” ~ Thomas Jefferson

This Week at DTI

Tuesday

- 10am ET - Academy (Learn More)

- 8pm ET - Market Power Keg (Register)

Tuesday

- 10am ET - Academy (Learn More)

- 10:45am ET - Connect the Dots (Learn More)

Wednesday

- 10am ET - Academy (Learn More)

- 4pm ET - Midweek Market Update (Register)

Thursday

- 10:30am ET - Academy (Learn More)

Friday

- 3pm ET - Weekly Wrap Up (Register)

Market Review - Chuck Crow

The Start of this Week

This week the focus shifts back to AI with Nvidia (NVDA) earnings midweek. Wednesday’s earnings report could be make or break, not so much for NVDA itself, but rather for the overall market. Guidance going forward has the potential to either be the rising tide and lift all boats, or it could prove to be a riptide pulling the market into deeper waters. Between NVDA, and the typical end of month economic reports this stands to be an exciting week. When we look at the ES Futures, the first thing we want to look for is the market stopping the bleeding. Focus on support. Even though last week finished down, it closed above the prior week’s open and low, 6016.00 and 6014.00 respectively. If those numbers are not broken then we are looking to see if the market can recover.

Update on last week’s stocks.

In Walmart (WMT), our premise last week is that there was a strong trend coming into the week with an earnings report due. If WMT could push above the 105.30 high from the previous week then following the trend would make sense. However, that is only after confirmation of that trend. What we saw in WMT though was first hesitation, and then after earnings a rejection of the trend. WMT’s low on Friday at 94.11 was, at the time, the low of the week. In fact, just like with the overall market, if WMT is to become worthwhile of purchasing, the first, but not the only step is to stop the bleeding. The second step to once again become bullish would be to get above a previous day high. That could be as early as Friday’s high at 97.65, or we could see some consolidation before the stock is ready to start climbing again.

Meanwhile Super Micro Computer (SMCI) continues to impress. Last week’s high was 66.44. The major support we were watching last week was Tuesday’s low at 48.88. That could still be the number to watch. The Thursday low at 54.30 might be a better support number. Or at the very least an early warning sign. Keep in mind that the Feb 25 deadline is coming. A safe way to play this stock would be to either step aside or hedge in front of the news both on Tuesday the 25th, and on the following day for NVDA earnings. Actually, all told, from a risk standpoint, this might be the day to say thank you and put SMCI to rest. There is still potential topside movement with this stock, but the risk looms a little too large, especially after the way last week ended for the broader market.

Looking ahead

This week’s key earnings will be none other than NVDA. Now it is difficult to argue NVDA as a worthwhile investment. Of course they are, but at what price. With AI being the leading economic forefront, and NVDA being the most marketable name this is definitely a stock to consider. In that consideration though, you should take into account that while NVDA does indeed have a dividend it is somewhat laughable. The dividend payout is approximately $0.01/quarter. During the earnings call check to see if they raise that. Keep in mind that NVDA did have a significant split last year. Even if we assume a 10x multiplier could be coming in, it is still an underwhelming dividend. NVDA though is more of a growth stock than an investment stock. The investment that you make in a stock like this assumes the AI industry will be booming and that NVDA will be a major player in that industry for the foreseeable future.

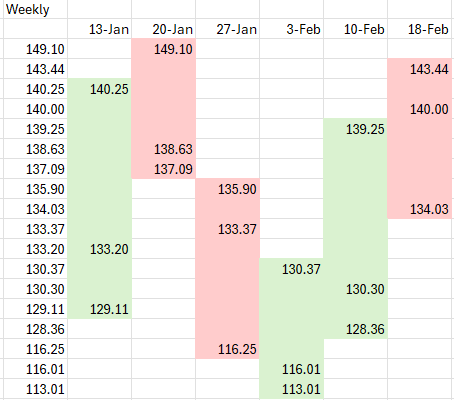

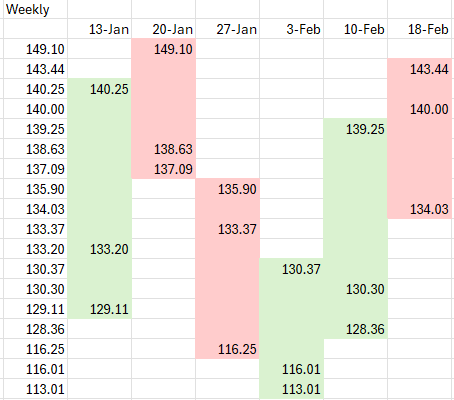

In terms of pricing and finding the trend, our weekly trend is tenuous. The start of last week saw a push that for NVDA was not an all time high, but certainly higher than the prior week. The downside though is that last week for the general market ended with a bit of a turn lower. That puts last week’s NVDA low of 134.03 right in the spotlight. If the low is to be held, then we look for that typical bounce, but confirming it becomes a bit rough. Last week’s open was 140.00, and confirmation could come that quickly. However before Wednesday it may be best to be a little more circumspect. Last week’s high was 143.44, and it was not an all time high. Even the high on the week of Jan 20 was not all time high. Though that open area between 143.44 and 149.10 does present a nice possible trading range.

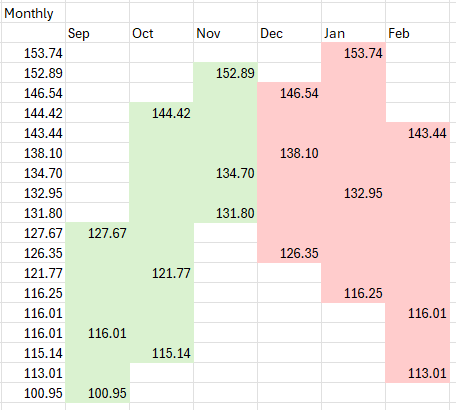

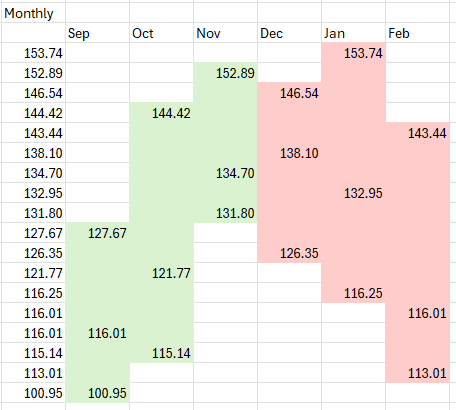

The biggest impediment to this stock is the Monthly view January started well with a new all time high at 153.74, but the stock has seen lower lows in both January and now in February. Here I have a weekly trend trying to break a monthly trend. The part of this that works is that break. Especially after the news from the past few weeks. A price point above 143.44 would be the third week in a row with a higher high. On the risk side last week’s low at 134.03 is the number. A move below that level breaks the weekly uptrend, regardless of what happens at 143.44. This could be a low play though If NVDA earnings were not occurring on Wednesday, then I would want to wait and see if the market could break above 143.44 after March 1. Waiting is not really an option though. To maintain a weekly uptrend NVDA needs to get above 143.44. In that first week of March you would be looking to extend whatever high we get to this week, and that would possibly challenge the high at 153.74. The topside potential here, and the downside risk are somewhat balanced. It all of course depends on Wednesday’s earnings report. Move above 143.44 for the topside action, but also break below 134.03 for the lower end.

Key News and Probabilities for the Week

No matter how successful a trader may be, the market can always prove a trader wrong.

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more! Important Note: No one from the DTI Trader team or Tom Busby will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk. | | | | | |

|

|

|

|

|

| | |

|

Today’s TBUZ TV The market stayed strong overnight after last night’s open. A lot is happening in the market right now. I’m paying close attention to crude. Listen to today’s TBUZ TV for my key levels in the market. “I am a great believer in work. I find that the more I work, the more I have it.” ~ Thomas Jefferson

This Week at DTI

Tuesday

- 10am ET - Academy (Learn More)

- 8pm ET - Market Power Keg (Register)

Tuesday

- 10am ET - Academy (Learn More)

- 10:45am ET - Connect the Dots (Learn More)

Wednesday

- 10am ET - Academy (Learn More)

- 4pm ET - Midweek Market Update (Register)

Thursday

- 10:30am ET - Academy (Learn More)

Friday

- 3pm ET - Weekly Wrap Up (Register) Market Review - Chuck Crow The Start of this Week

This week the focus shifts back to AI with Nvidia (NVDA) earnings midweek. Wednesday’s earnings report could be make or break, not so much for NVDA itself, but rather for the overall market. Guidance going forward has the potential to either be the rising tide and lift all boats, or it could prove to be a riptide pulling the market into deeper waters. Between NVDA, and the typical end of month economic reports this stands to be an exciting week. When we look at the ES Futures, the first thing we want to look for is the market stopping the bleeding. Focus on support. Even though last week finished down, it closed above the prior week’s open and low, 6016.00 and 6014.00 respectively. If those numbers are not broken then we are looking to see if the market can recover.

Update on last week’s stocks.

In Walmart (WMT), our premise last week is that there was a strong trend coming into the week with an earnings report due. If WMT could push above the 105.30 high from the previous week then following the trend would make sense. However, that is only after confirmation of that trend. What we saw in WMT though was first hesitation, and then after earnings a rejection of the trend. WMT’s low on Friday at 94.11 was, at the time, the low of the week. In fact, just like with the overall market, if WMT is to become worthwhile of purchasing, the first, but not the only step is to stop the bleeding. The second step to once again become bullish would be to get above a previous day high. That could be as early as Friday’s high at 97.65, or we could see some consolidation before the stock is ready to start climbing again.

Meanwhile Super Micro Computer (SMCI) continues to impress. Last week’s high was 66.44. The major support we were watching last week was Tuesday’s low at 48.88. That could still be the number to watch. The Thursday low at 54.30 might be a better support number. Or at the very least an early warning sign. Keep in mind that the Feb 25 deadline is coming. A safe way to play this stock would be to either step aside or hedge in front of the news both on Tuesday the 25th, and on the following day for NVDA earnings. Actually, all told, from a risk standpoint, this might be the day to say thank you and put SMCI to rest. There is still potential topside movement with this stock, but the risk looms a little too large, especially after the way last week ended for the broader market.

Looking ahead

This week’s key earnings will be none other than NVDA. Now it is difficult to argue NVDA as a worthwhile investment. Of course they are, but at what price. With AI being the leading economic forefront, and NVDA being the most marketable name this is definitely a stock to consider. In that consideration though, you should take into account that while NVDA does indeed have a dividend it is somewhat laughable. The dividend payout is approximately $0.01/quarter. During the earnings call check to see if they raise that. Keep in mind that NVDA did have a significant split last year. Even if we assume a 10x multiplier could be coming in, it is still an underwhelming dividend. NVDA though is more of a growth stock than an investment stock. The investment that you make in a stock like this assumes the AI industry will be booming and that NVDA will be a major player in that industry for the foreseeable future.

In terms of pricing and finding the trend, our weekly trend is tenuous. The start of last week saw a push that for NVDA was not an all time high, but certainly higher than the prior week. The downside though is that last week for the general market ended with a bit of a turn lower. That puts last week’s NVDA low of 134.03 right in the spotlight. If the low is to be held, then we look for that typical bounce, but confirming it becomes a bit rough. Last week’s open was 140.00, and confirmation could come that quickly. However before Wednesday it may be best to be a little more circumspect. Last week’s high was 143.44, and it was not an all time high. Even the high on the week of Jan 20 was not all time high. Though that open area between 143.44 and 149.10 does present a nice possible trading range.

The biggest impediment to this stock is the Monthly view January started well with a new all time high at 153.74, but the stock has seen lower lows in both January and now in February. Here I have a weekly trend trying to break a monthly trend. The part of this that works is that break. Especially after the news from the past few weeks. A price point above 143.44 would be the third week in a row with a higher high. On the risk side last week’s low at 134.03 is the number. A move below that level breaks the weekly uptrend, regardless of what happens at 143.44. This could be a low play though If NVDA earnings were not occurring on Wednesday, then I would want to wait and see if the market could break above 143.44 after March 1. Waiting is not really an option though. To maintain a weekly uptrend NVDA needs to get above 143.44. In that first week of March you would be looking to extend whatever high we get to this week, and that would possibly challenge the high at 153.74. The topside potential here, and the downside risk are somewhat balanced. It all of course depends on Wednesday’s earnings report. Move above 143.44 for the topside action, but also break below 134.03 for the lower end.  Key News and Probabilities for the Week No matter how successful a trader may be, the market can always prove a trader wrong. Follow along and join the conversation for real-time analysis, trade ideas, market insights and more! Important Note: No one from the DTI Trader team or Tom Busby will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk. |

ABOUT US: We believe that the opportunity for financial literacy and freedom belongs to all people, not just those who already have years of investing experience. Diversified Trading Institute provides an array of educational services and products that will help you navigate the markets and become a better investor. Trading is made simple through our online forum full of trading techniques to give you the best tools to kick-start your investing journey. We offer collaborative webinars and training; we love to teach. No matter the opportunity, we bring together a strong community of like-minded traders to focus on analyzing market news as it’s presented each day.

DISCLAIMER: FOR INFORMATION PURPOSES ONLY. The materials presented from Diversified Trading Institute are for your informational purposes only. Neither Diversified Trading Institute nor its employees offer investment, legal or tax advice of any kind, and the analysis displayed with various tools does not constitute investment, legal or tax advice and should not be interpreted as such. Using the data and analysis contained in the materials for reasons other than the informational purposes intended is at the user’s own risk.

DISCLAIMER: TRADE AT YOUR OWN RISK; TRADING INVOLVES RISK OF LOSS; SEEK PROFESSIONAL ADVICE. Diversified Trading Institute is not responsible for any losses that may occur from transactions effected based upon information or analysis contained in the presented. To the extent that you make use of the concepts with the presentation material, you are solely responsible for the applicable trading or investment decision. Trading activity, including options transactions, can involve the risk of loss, so use caution when entering any option transaction. You trade at your own risk, and it is recommended you consult with a financial advisor for investment, legal or tax advice relating to options transactions. Please visit https://www.dtitrader.com/terms-of-service-2/ for our full Terms and Conditions. Unsubscribe

This email was sent to phanxuanhoa60.trade1357@blogger.com by Diversified Trading Institute

3929 Airport BLVD, Ste 2-208, Mobile, AL 36609

DTITrader.com |

ليست هناك تعليقات:

إرسال تعليق