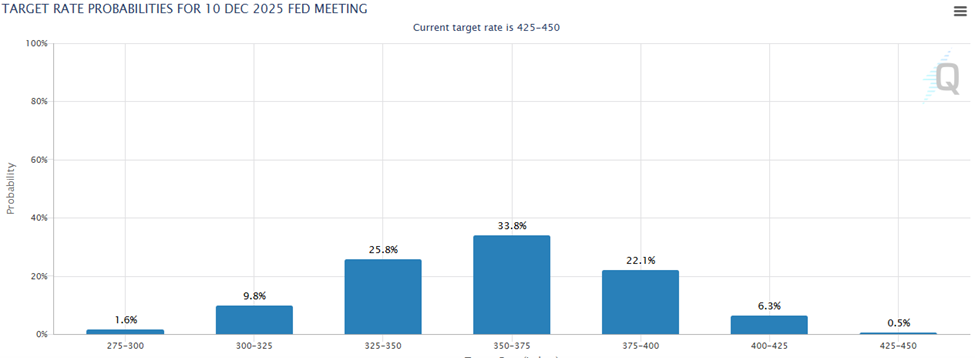

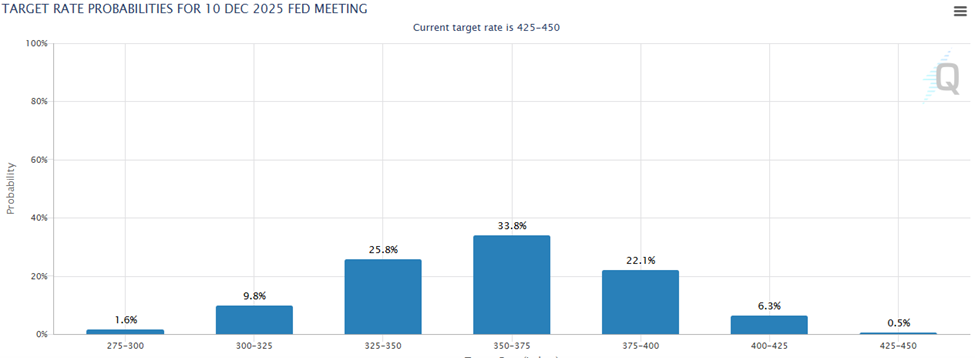

Hiring comes in soft yet steady … ECB rate cuts, tariff fears, and the Fed … market expectations for rate cuts have jumped … get ready for quantum computing The market was anxiously awaiting this morning’s jobs report as a barometer of an economic slowdown… We didn’t learn that much. February’s payroll growth clocked in at 151,000. This was less than the consensus forecast of 170,000 yet more than January’s revised number of 125,000. Meanwhile, the unemployment rate rose to 4.1% from 4%. What are we to make of this? On one hand, the data was softer than forecasted. Plus, yesterday’s Challenger Job Cuts Report showed that layoff announcements jumped to more than 170,000 last month. That’s the highest level since the Covid pandemic and a level consistent with previous recessions. And that jump to 4.1% means unemployment is moving in the wrong direction. On the other hand, this morning’s data didn’t miss by much. And the spike in layoff announcements is largely attributable to Elon Musk’s Department of Government Efficiency (DOGE), tasked with streamlining the federal workforce. Excluding these DOGE-related job cuts, the number of layoffs aligns more closely with historical averages. Finally, that jump to 4.1% could be just noise. The takeaway, for now, is that the private sector job market remains stable. While this morning’s report doesn’t leave us with much in the way of new clues about the Fed’s interest rate policy, there are other factors that we can consider… How will ECB rate cuts and tariffs affect the Fed’s rate policy? The U.S. labor market is just one of many variables that will impact the Fed’s rate-cutting policy this year. A second is what happens with European interest rates. Legendary investor Louis Navellier regularly makes the point that global central banks like to move in parallel fashion. This would mean that European Central Bank (ECB) rate cuts will put pressure on the Fed to make similar cuts. On that note, yesterday, the ECB cut rates again, but this time, there was a twist. Here’s Louis from his Growth Investor Flash Alert podcast: The ECB cut key interest rates, as anticipated, but it signaled it was nearing the end of its easing cycle. [Yesterday’s] rate cut was the second one of this year. Despite the ECB’s comments that its monetary policy is now “meaningfully less restrictive,” I suspect more rate cuts are still on the table for this year. The reality is several European economies are in dire shape, and the ECB needs to cut rates a few more times this year in order to help shore up these economies. More rate cuts are good news for the U.S., as it will cause U.S. market rates to decline as foreign capital flows to U.S. Treasuries – and that will pressure the Federal Reserve to cut rates. To make sure we’re all on the same page, when the ECB cuts interest rates, European bond yields typically fall. European investors see reduced cash flows on those holdings and sell their bonds to buy higher-yielding U.S. Treasuries. This buying puts upward pressure on U.S. Treasuries prices. And since bond prices and yields are inversely correlated, this means downward pressure on yields. If you’ve followed Louis for a while, you’ve likely heard him say “The Fed doesn’t like to fight market rates.” So, if these market rates drop, the Fed is likely to feel greater pressure to lower short-term rates. | Recommended Link | | | | In 2016, 40 year Wall Street legend Louis Navellier went on record with a shocking Nvidia prediction… and at its peak Nvidia soared more than 7,000%. But unlike his big call in 2016… this time, he’s saying you should NOT buy Nvidia’s stock. Instead, he’s found an opportunity he believes will kick off just days from now when Nvidia holds its first ever “Q Day.” Which is why Louis is hosting an urgent briefing to give you all the details. ** NOTE: This webinar goes LIVE ON THURSDAY MARCH 13TH AT 1 PM ET. CLICK HERE TO REGISTER FOR FREE |  | | The market is moving toward Louis Less than one month ago, after the January Consumer Price Index (CPI) inflation report came in hotter than expected, traders put majority odds on the Fed cutting rates just once in 2025. Louis wasn’t buying it. About two weeks ago, he was adamant that the Fed would cut rates four additional times here in 2025. Well, here we are today after a string of soft economic data and fears of a tariff-related economic slowdown, and traders are moving into Louis’ camp. According to the CME Group’s FedWatch Tool, traders now assign the greatest probability to not one, but three rate cuts this year.

So, what might push traders to change rate-cut expectations from three to Louis’ prediction of four? My guess is any additional negative economic data related to tariffs. Separating the “bark” from “bite” of tariffs fears President Trump’s tariffs are resulting in two big fears: an economic slowdown and renewed inflation. This is raising the specter of a troubling scenario: stagflation – i.e., high inflation and stagnant growth. Consumers, business leaders, and policymakers – not to mention investors, who have been selling stocks and shifting into bonds – are clearly feeling unsettled by the possibility. But Louis believes much of the fears are unwarranted. Back to his update: Let’s cut through the crap here. The 10% tariffs on China are no big deal – China has a lot of deflation; they have a weak currency, and we have a strong dollar. We won’t even notice those 10% tariffs on China. The 25% tariffs on Mexico and Canada are obviously being adjusted… The tariffs are just a way to negotiate a better deal for America, period. We hope Trump sees is that way. If not, there’s more market pain ahead because U.S. consumers and corporate planners increasingly do not see it this way. They view tariffs as a driver of longer-term inflation, so the longer Trump uses them, the greater the risk of in inflationary resurgence. Proof of that sentiment came from the Federal Reserve Bank of Richmond earlier this week: In February 2025, households' inflation expectations over the next 12 months rose for the third straight month. They now sit at 4.3 percent, which is the highest mark since November 2023. Worryingly, longer-run inflation expectations rose to 3.5 percent in February, the highest mark in nearly 30 years (April 1995). Now, some economists push back on the extent to which tariffs increase inflation. But if the U.S. consumers and corporate decision makers believe that tariffs are inflationary, that’s all that matters since expectations can drive inflation. Too often, expectation becomes reality. In President Trump’s address to Congress earlier this week, he said, “We may feel a little pain in the short term, and people understand that.” Perhaps. But the question is how long they’ll have to stomach it. And circling back to the Fed, how will it respond? Here’s the quick take of Kansas City Fed president Jeff Schmid from two weeks ago: With inflation just recently at a 40-year high, now is not the time to let down our guard. It could be argued that some of the factors driving up inflation expectations are likely one-off transitory developments, but again, given recent experience, I am not willing to take any chances. Meanwhile, earlier today, Federal Reserve Chairman Jerome Powell didn’t offer anything to investors hoping for rate cuts anytime soon: [The Fed is] focused on separating the signal from the noise as the outlook evolves. We do not need to be in a hurry and are well positioned to wait for greater clarity. Clearly, though the market seems to be getting on the same page as Louis with rate-cut expectations, the Fed doesn’t appear to be there. | Recommended Link | | | | While AI is all the rage… I believe a new, cutting-edge technology will steal the headlines in 2025. And if you’re in before the crowd, it could mean a big winner for you. I’ve found one stock I think will benefit the most. It could be the #1 Tech Stock of 2025. |  | | Switching gears to how to position your portfolio amid this turbulence… Continuing with Louis’ podcast: In the third week of March, we’re going to have the big NVIDIA Corporation annual conference – the developers conference. On the third day, they’re going to be really focused on quantum computing, because they want to be a leader in that area. Yesterday, we began profiling what’s coming with quantum computing. It’s hard to overstate how revolutionary this technology will be. Here’s the sector research website, Quantum Insider: A fully functional quantum processor would be able to solve extremely complex problems. This could lead to revolutionary impact in many areas of research, technology and economy. Quantum computers could help us discover new medicines and advance medical research by finding new connections in clinical trial data or genetics that current computers don’t have enough processing power for. They could also greatly improve the safety of various systems that use artificial intelligence algorithms, such as banking, military targeting and autonomous vehicles, to name a few. Now, as Louis noted in his podcast, on March 20, NVIDIA will hold the first ever “Quantum Day,” or what Louis calls “Q-Day.” Louis predicts the chip giant will make its biggest announcement of the year: a breakthrough that marries AI with quantum computing in a way no one has ever done before. If so, we’re looking at the possibility of a new technological breakthrough that could affect industries worth a combined $46 trillion. As usual, Louis is looking ahead to how to position investors ahead of time, and this has one tiny stock in his crosshairs: I expect Nvidia to announce a new breakthrough technology that could light a fire under the shares of one of its “Q” partners... a stock 1,000 times smaller than Nvidia. It’s my top quantum pick, a small-cap stock protected by 102 patents with close ties to NVIDIA. For more details on the company, as well as the broader opportunity in quantum computing, block off your calendar for next Thursday, March 13, at 1 p.m. Eastern for Louis’ exclusive briefing: The Next 50X NVIDIA Call. We’ll continue to bring you more on this next week, but to go ahead and reserve your seat, just click here. Have a good evening, Jeff Remsburg |

ليست هناك تعليقات:

إرسال تعليق