Don't Miss Today's Key Market Insights and Information

| | | | | | | | | | | | | Today’s TBUZ TV

I'll be live today at 3pm ET with my Weekly Wrap Up! Don't miss out. Watch today's video for my key levels in the market.

"Success consists of going from failure to failure without loss of enthusiasm" ~ Winston Churchill

This Week at DTI

Friday

- 3pm ET - Weekly Wrap Up (Register)

Market Review - Chuck Crow

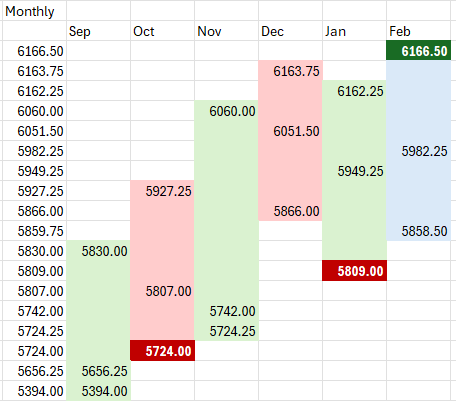

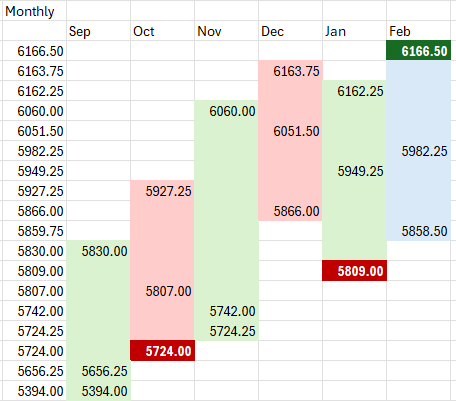

Thursday’s market attempted to stay higher, but failed. Already overnight trading has moved below the 5873.00 Thursday low. On the closeout day of February there are two numbers to consider. The lower number is the January low at 5809.00 and the higher number is the February open at 5982.25. The midpoint between these two numbers is 5895.62. The market has challenges in the next few days. The first challenge will be to move the February close, away from the new low. The bulls obviously want the market to move higher. The odds of the market being able to turn on a dime and put up a 100 point rally moving from an overnight open of 5883.00 to the February open at 5982.25 are not great. They are not zero though.

The outcome of the market whether it be bullish or bearish will likely not be determined before the end of the day on Friday. However, the performance of the market on Friday, could influence the market moving forward into the month of March. It is likely February will indeed be negative, but it is also likely that February will maintain a higher low than January.

In terms of trend the market did make an all time high last week. In that case, even if the marker were to move below 5809.00 it would only be establishing an outside bar. Outside bars with a higher high and a lower low are typically signs of indecision with volatility. The real problem for the bulls would be that as March starts up, if the March open is too close to the February low, then the market could quickly break the trend by pushing the March low below the February low. establishing an outside bar. Outside bars with a higher high and a lower low are typically signs of indecision with volatility. The real problem for the bulls would be that as March starts up, if the March open is too close to the February low, then the market could quickly break the trend by pushing the March low below the February low.

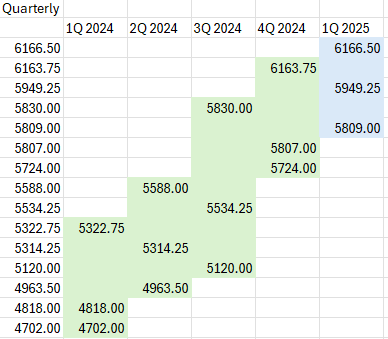

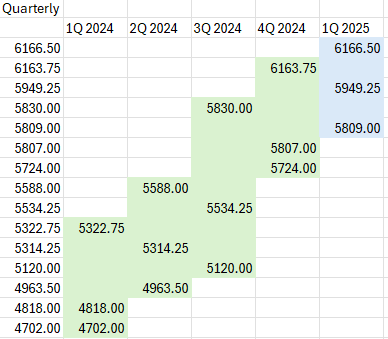

The bigger quarterly picture shows support at 5724.00. In contrast to the monthly picture which has been a little unstable, the quarterly trend is solid. Every time the monthly trend changes, it puts the quarterly trend into a vulnerable state. Which means that a solid quarterly trend could be in trouble if the market carries bearish momentum into next week. The major support levels at 5809.00 and then 5724.00 are closer to the current market than last week’s high. However a rally on Friday could change that equation. If the market moves higher into the weekend it could break that bearish momentum. the market carries bearish momentum into next week. The major support levels at 5809.00 and then 5724.00 are closer to the current market than last week’s high. However a rally on Friday could change that equation. If the market moves higher into the weekend it could break that bearish momentum.

Even though the week and month seem to be headed to a negative close, this market could still maintain a positive trend. The resistance levels to watch are first the 5895.62 midpoint, and the next resistance level is likely to be the 5949.25 open of the year. That January open is only 4 points above the midpoint between the high of the first quarter, and the low of the 4th quarter of 2024. All this means the market is still in flux. A rally could open up some buying opportunities.

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the DTI Trader team or Tom Busby will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk. | | | | | |

|

|

|

|

|

| | |

|

Today’s TBUZ TV I'll be live today at 3pm ET with my Weekly Wrap Up! Don't miss out. Watch today's video for my key levels in the market.

"Success consists of going from failure to failure without loss of enthusiasm" ~ Winston Churchill

This Week at DTI

Friday

- 3pm ET - Weekly Wrap Up (Register) Market Review - Chuck Crow  Thursday’s market attempted to stay higher, but failed. Already overnight trading has moved below the 5873.00 Thursday low. On the closeout day of February there are two numbers to consider. The lower number is the January low at 5809.00 and the higher number is the February open at 5982.25. The midpoint between these two numbers is 5895.62. The market has challenges in the next few days. The first challenge will be to move the February close, away from the new low. The bulls obviously want the market to move higher. The odds of the market being able to turn on a dime and put up a 100 point rally moving from an overnight open of 5883.00 to the February open at 5982.25 are not great. They are not zero though. Thursday’s market attempted to stay higher, but failed. Already overnight trading has moved below the 5873.00 Thursday low. On the closeout day of February there are two numbers to consider. The lower number is the January low at 5809.00 and the higher number is the February open at 5982.25. The midpoint between these two numbers is 5895.62. The market has challenges in the next few days. The first challenge will be to move the February close, away from the new low. The bulls obviously want the market to move higher. The odds of the market being able to turn on a dime and put up a 100 point rally moving from an overnight open of 5883.00 to the February open at 5982.25 are not great. They are not zero though.

The outcome of the market whether it be bullish or bearish will likely not be determined before the end of the day on Friday. However, the performance of the market on Friday, could influence the market moving forward into the month of March. It is likely February will indeed be negative, but it is also likely that February will maintain a higher low than January.

In terms of trend the market did make an all time high last week. In that case, even if the marker were to move below 5809.00 it would only be establishing an outside bar. Outside bars with a higher high and a lower low are typically signs of indecision with volatility. The real problem for the bulls would be that as March starts up, if the March open is too close to the February low, then the market could quickly break the trend by pushing the March low below the February low. establishing an outside bar. Outside bars with a higher high and a lower low are typically signs of indecision with volatility. The real problem for the bulls would be that as March starts up, if the March open is too close to the February low, then the market could quickly break the trend by pushing the March low below the February low.

The bigger quarterly picture shows support at 5724.00. In contrast to the monthly picture which has been a little unstable, the quarterly trend is solid. Every time the monthly trend changes, it puts the quarterly trend into a vulnerable state. Which means that a solid quarterly trend could be in trouble if the market carries bearish momentum into next week. The major support levels at 5809.00 and then 5724.00 are closer to the current market than last week’s high. However a rally on Friday could change that equation. If the market moves higher into the weekend it could break that bearish momentum. the market carries bearish momentum into next week. The major support levels at 5809.00 and then 5724.00 are closer to the current market than last week’s high. However a rally on Friday could change that equation. If the market moves higher into the weekend it could break that bearish momentum.

Even though the week and month seem to be headed to a negative close, this market could still maintain a positive trend. The resistance levels to watch are first the 5895.62 midpoint, and the next resistance level is likely to be the 5949.25 open of the year. That January open is only 4 points above the midpoint between the high of the first quarter, and the low of the 4th quarter of 2024. All this means the market is still in flux. A rally could open up some buying opportunities.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk. |

ABOUT US: We believe that the opportunity for financial literacy and freedom belongs to all people, not just those who already have years of investing experience. Diversified Trading Institute provides an array of educational services and products that will help you navigate the markets and become a better investor. Trading is made simple through our online forum full of trading techniques to give you the best tools to kick-start your investing journey. We offer collaborative webinars and training; we love to teach. No matter the opportunity, we bring together a strong community of like-minded traders to focus on analyzing market news as it’s presented each day.

DISCLAIMER: FOR INFORMATION PURPOSES ONLY. The materials presented from Diversified Trading Institute are for your informational purposes only. Neither Diversified Trading Institute nor its employees offer investment, legal or tax advice of any kind, and the analysis displayed with various tools does not constitute investment, legal or tax advice and should not be interpreted as such. Using the data and analysis contained in the materials for reasons other than the informational purposes intended is at the user’s own risk.

DISCLAIMER: TRADE AT YOUR OWN RISK; TRADING INVOLVES RISK OF LOSS; SEEK PROFESSIONAL ADVICE. Diversified Trading Institute is not responsible for any losses that may occur from transactions effected based upon information or analysis contained in the presented. To the extent that you make use of the concepts with the presentation material, you are solely responsible for the applicable trading or investment decision. Trading activity, including options transactions, can involve the risk of loss, so use caution when entering any option transaction. You trade at your own risk, and it is recommended you consult with a financial advisor for investment, legal or tax advice relating to options transactions. Please visit https://www.dtitrader.com/terms-of-service-2/ for our full Terms and Conditions. Unsubscribe

This email was sent to phanxuanhoa60.trade1357@blogger.com by Diversified Trading Institute

3929 Airport BLVD, Ste 2-208, Mobile, AL 36609

DTITrader.com |

ليست هناك تعليقات:

إرسال تعليق