|

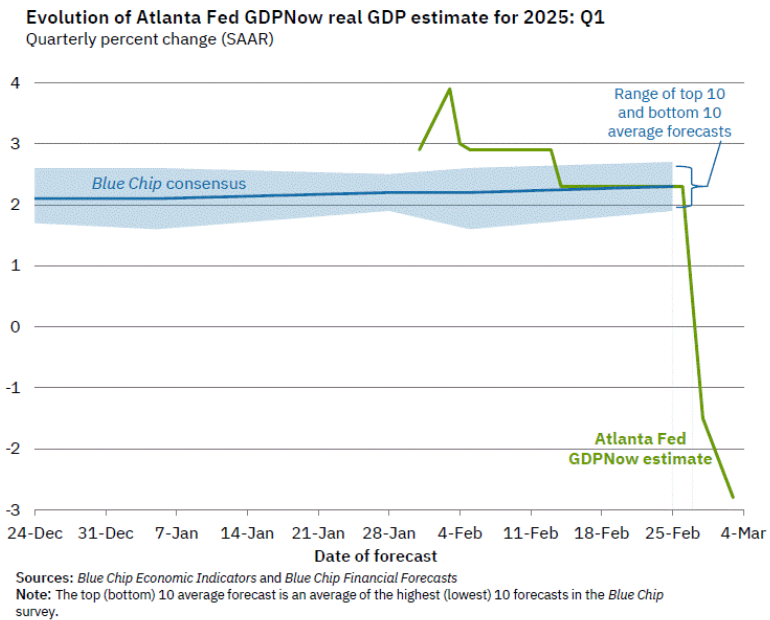

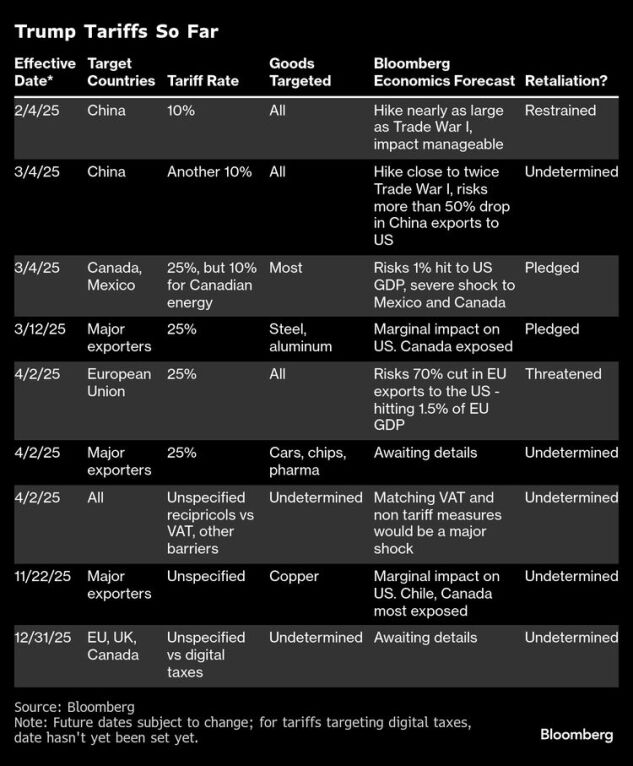

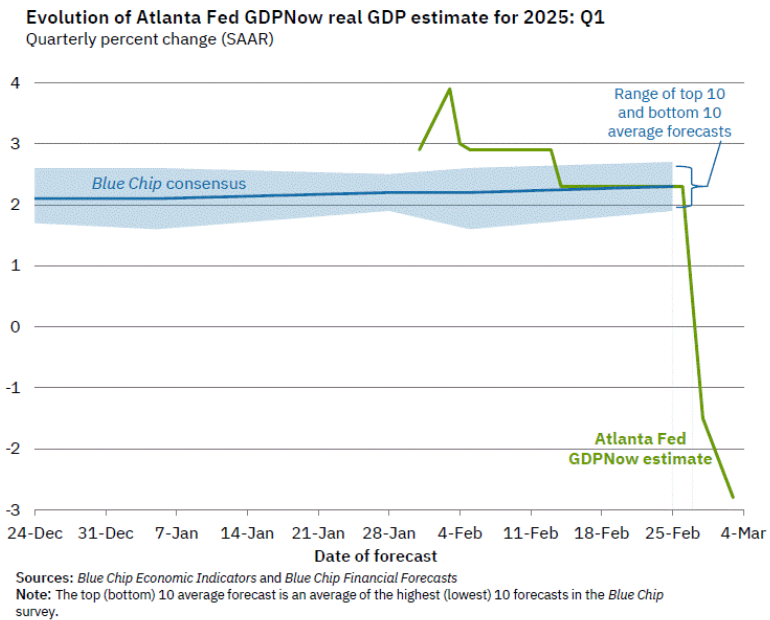

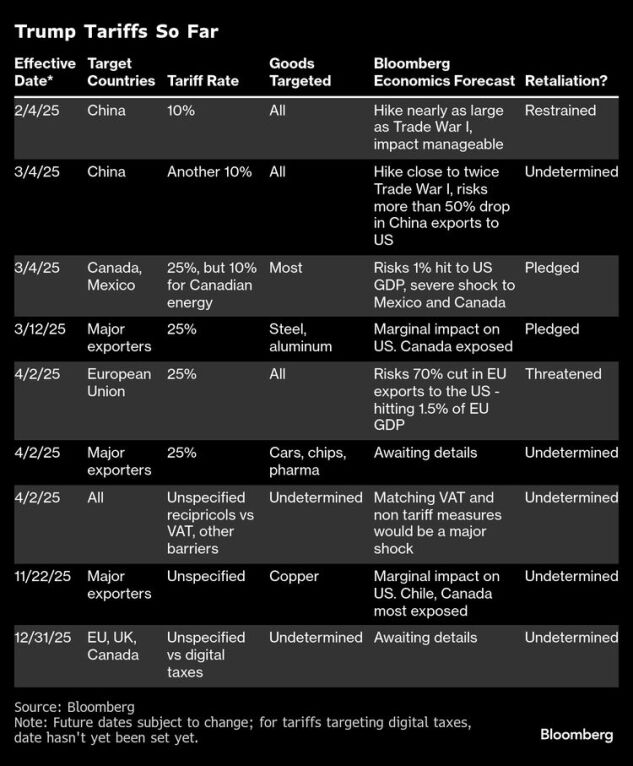

Right now, the U.S. economy is slowing rapidly. According to the Atlanta Federal Reserve’s GDPNow model, “the estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -1.5% on February 28, down from 2.3% on February 19. The nowcast of the contribution of net exports to first-quarter real GDP growth fell from -0.41 percentage points to -3.70 percentage points, while the nowcast of first-quarter real personal consumption expenditures growth fell from 2.3% to 1.3%.” And as recent data from ADP’s employment report shows, employers added just 77,000 jobs in February, far below January’s upwardly revised 186,000 and below the 148,000 estimate. All this weak data and ongoing economic uncertainty has kept the stock market in volatile territory. As the following chart shows, the S&P 500 has endured near-constant up-and-down action for the past several months. In fact, just in the past five days, the index has fallen about 3%. It has tested and broken its 100-day moving average (MA) and is now approaching a test of its 200-day MA.  With President Trump’s trade war with Mexico, Canada, and China looming large, things could get even worse in the coming months, potentially tipping the global economy into a recession and plunging stocks into a full-blown bear market. That’s the bad news. But here’s the good news. We actually see huge opportunities emerging amid all this economic uncertainty and stock market volatility. Follow me here… Weak Economic Data Abounds In our view, there’s no arguing that the U.S. economy is buckling under the pressure of policy uncertainty. No matter where you look, the data is weakening. Consumer sentiment has crashed, as shown by the Conference Board’s Consumer Confidence Index, which declined by 7.0 points in February. Consumer spending has slowed, with personal consumption expenditures (PCE) decreasing $30.7 billion (0.2%) in January, according to the Bureau of Economic Analysis. Inflation expectations have surged higher, from 5.2% to 6% in February. Business investment has slowed, down from $938 billion in Q3 of 2024 to $809 billion in Q4. At the end of 2024, the U.S. economy was growing at a 2.3% clip. But based on real-time estimates from the Atlanta Fed, the economy is now contracting at a 2.8% clip. In other words, over the past two months, we’ve gone from steady growth in the U.S. economy (+2.3%) to meaningful contraction (-2.8%). That’s not good.  And this slowdown to -2.8% GDP growth happened before the onset of a global trade war. Trump has enforced 25% tariffs on Mexico and Canada and has also levied additional tariffs on China. All three countries have responded with reciprocal tariffs of their own… meaning the global trade war has officially begun. According to calculations from Bloomberg Economics, all these tariffs will raise the average U.S. tariff rate from 2.3% to 11.5% – the highest it has been since World War II.  Such a drastic rise in the average U.S. tariff rate will only further hinder economic growth. Understanding the Risks to the Economy According to estimates from the Fed, hiking the U.S. tariff rate from 2.3% to 11.5% would negatively impact the U.S. GDP growth by about 1.3%. We’re running at -2.8% GDP growth right now… before the trade war. Current tariffs already in place should knock that down another 1.3%... which means we’re looking at potentially -4.1% GDP growth. And that doesn’t even include any of the other tariffs Trump plans to enact over the next month. He’s said that he wants to implement 25% tariffs on all steel and aluminum imports, as well as 25% tariffs on cars, chips, and pharma goods. He is also planning to launch global reciprocal tariffs next month.  If even just a portion of these threatened tariffs go into effect, that would negatively impact U.S. GDP growth by at least another 1%. If so, then with all these tariffs, we’re looking at a potential pathway to -5% GDP growth by the summer. By any and all metrics, that negative growth would be consistent with a recession. In fact, a -5% GDP would actually be consistent with a very bad recession – not a mild one. In other words, the global trade war – if it persists – could tip the U.S. economy into a recession by summer. Of course, if that happens, the stock market is likely to crash. | Recommended Link | | | | While China races to catch up, one American innovator has secured a breakthrough that could control computing’s next revolution. This company’s unique technology could potentially become as essential to AI’s next phase as Nvidia’s chips were to its first wave. Click here for the full story. |  | | Will Drastic Tariffs Guide the U.S. Toward Recession? The U.S. economy has only recorded -5% GDP growth or worse twice in the last 40 years – during the 2008 financial crisis and the COVID-era lockdowns. Both times, the stock market was in the midst of a 30%-plus crash. The S&P 500 is down just about 5% from all-time highs right now. If indeed the U.S. economy is tracking for -5% growth because of a global trade war, then the market has a lot further to fall. So… thanks to the onset of a global trade war… the U.S. economy now has a visible pathway to a nasty recession, and the stock market could plunge into a bear market. However… We don’t think that will happen. The bear thesis on the U.S. economy and stock market rests on the global trade war persisting. But we think that’s unlikely. To see why, let’s follow the pattern thus far. In early February, less than 24 hours after Trump first announced sweeping tariffs against Canada and Mexico, all three countries came to a deal to delay those proposed tariffs. Less than 24 hours after Trump paused all military aid to Ukraine, reports leaked that the two came to an agreement to sign an overdue minerals deal that would resume aid. Less than 24 hours after Trump actually did enforce sweeping tariffs against Canada and Mexico, reports leaked that the three were working on a deal to remove some or all of them. It seems that Trump is only using tariffs as a strong-arm negotiation tactic to reach better trade deals for the U.S. We don’t think he intends to keep them in place. That means the global trade war likely will not persist. And if it doesn’t, stocks could soar very soon. The Final Word on the U.S. Economy The market has crashed to its “ultimate” technical support line: its 200-day moving average. If this really is just another run-of-the-mill selloff – and nothing more sinister – then stocks should bounce here. The last time the S&P fell to this level was in October 2023. And at that time, it went on to bounce about 30% higher over the next five months.  So… While Trump’s trade war could cause a global recession and plunge stocks into a bear market, it likely won’t. And the fears that it might have led stocks lower, creating what could be a fantastic buying opportunity. What’s the best way to capitalize on it? Perhaps by betting on the world’s richest man, Elon Musk. It has become clear that the so-called “First Buddy” to President Trump wields a lot of power and influence. Naturally, we expect him to exert some of that influence to help his own companies, like Tesla (TSLA) and SpaceX. But in our view, Musk’s most promising company in 2025 is not Tesla or SpaceX. Rather, it is his AI startup, xAI. Of course, xAI is barely two years old. It is still a private startup, which means you can’t invest directly via stocks. But we’ve found a promising ‘backdoor’ way to take part in its imminent exponential growth. If xAI does win the multi-trillion-dollar AI race… and Elon Musk does it again… this stock could absolutely soar. Learn more about xAI and its portfolio-boosting potential now. Sincerely, |

ليست هناك تعليقات:

إرسال تعليق