| In addition to its mort-gage lending business, Beeline Holdings owns Beeline Labs, which is focused on AI-powered mort-gage solutions, including:

MagicBlocks – A conversational AI chatbot for mort-gage lead conversion, following the success of ‘Bob,’ the first-ever AI mort-gage chatbot.

BlinkQC – An AI-powered mort-gage quality control (QC) platform that automates compliance, auditing, and risk mitigation for lenders.

Early traction for BlinkQC has been strong, with lenders leveraging the platform to reduce processing times and improve accuracy.

Beeline Holdings (NASDAQ: BLNE) Continues to Build Momentum—Here’s What’s New

Beeline Holdings and CredEvolv: Expanding Access to Homeownership

Beeline Holdings (NASDAQ: BLNE) recently announced a strategic partnership with CredEvolv, a company that helps borrowers improve their credit scores to become eligible for mortgage approval.

Through this collaboration, individuals who have been declined for a mortgage now have a clear path to improving their financial standing.

Borrowers can work with CredEvolv to strengthen their credit profiles, and once they meet the necessary requirements, they can return to Beeline Holdings (NASDAQ: BLNE) for a more seamless and efficient mortgage approval process.

This initiative not only helps more people move toward homeownership but also allows Beeline Holdings (NASDAQ: BLNE) to reach a wider pool of borrowers.

By integrating a credit-building solution into its process, Beeline Holdings (NASDAQ: BLNE) is enhancing its mortgage platform while reinforcing its commitment to making home financing more accessible and streamlined.

Beeline Holdings (NASDAQ: BLNE) Teams Up with RedAwning to Streamline Real Estate Financing

Beeline Holdings (NASDAQ: BLNE) has joined forces with RedAwning, a powerhouse in vacation property management and rentals, to make securing financing for short-term rental properties faster and more accessible.

This partnership integrates Beeline Holdings (NASDAQ: BLNE)’s DSCR mortgage application directly into RedAwning’s platform, allowing buyers to receive instant, customized mortgage quotes and secure funding with greater speed and efficiency.

By eliminating unnecessary delays and simplifying the process, the collaboration enables buyers to expand their property portfolios with ease.

Designed to be intuitive and hassle-free, this system cuts through the complexities of real estate financing, reducing paperwork and approval times.

With millennials making up 38% of all home purchases in 2024, according to the National Association of REALTORS® (NAR), this partnership is particularly well-timed to meet the needs of a tech-savvy generation looking for a seamless approach to property ownership.

By combining RedAwning’s extensive marketplace with Beeline Holdings (NASDAQ: BLNE)’s AI-driven mortgage solutions, the two companies are breaking down financing barriers and making property ownership more accessible, efficient, and streamlined.

Why Beeline Holdings (NASDAQ: BLNE) May Not Stay Under the Radar for Long…

With a Nasdaq listing now secured, a razor-thin float, and AI-powered mortgage solutions gaining traction, Beeline Holdings (NASDAQ: BLNE) is reaching a pivotal moment.

The company is backed by strong internal support, tapping into a $1.23T market, and actively expanding through key strategic partnerships that position it for further growth.

Momentum is building, and with all the pieces coming together, the question remains—how long will this name stay under the radar?

Here’s The Top 5 Reasons Why We Have All Eyes On Beeline Holdings (NASDAQ: BLNE) Right Now…

1. Recent Nasdaq Listing: Now listed on a major exchange, Beeline Holdings (NASDAQ: BLNE) is in a broader spotlight where more institutions and market participants can take notice.

2. Ultra-Low Float: With just 410,120 shares available, far fewer than many names in the space, Beeline Holdings (NASDAQ: BLNE) could see significant moves if demand shifts.

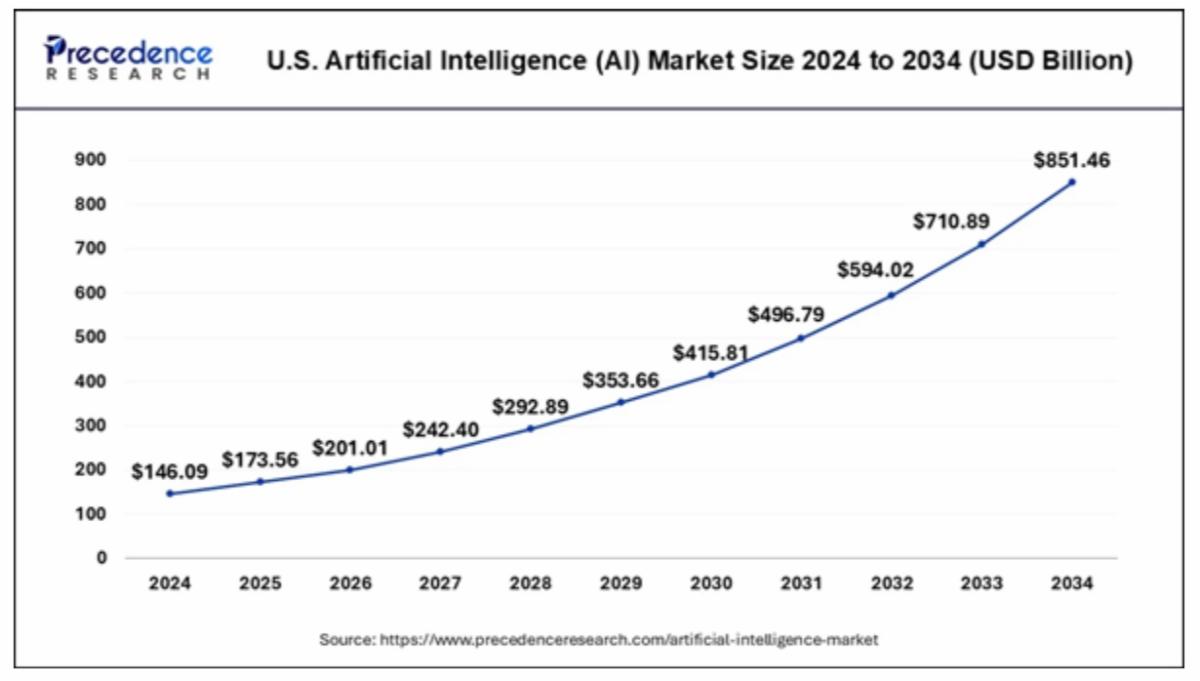

3. AI Meets Mortgage Lending: Positioned in the $12.59T mortgage sector and the rapidly expanding AI market, Beeline Holdings (NASDAQ: BLNE) is bringing advanced technology to an industry that has remained largely unchanged.

4. Strong Leadership Backing: With over $2.9M personally committed in a $5M private placement, CEO Nick Liuzza has shown strong confidence in the company's future.

5. Strategic Growth and Partnerships: Expanding through collaborations with CredEvolv and RedAwning, Beeline Holdings (NASDAQ: BLNE) is increasing its reach, improving borrower accessibility, and integrating its mortgage solutions into established platforms.

Beeline Holdings (NASDAQ: BLNE) Is on Our Radar For Tomorrow Morning—Is It on Yours?

Some names fly under the radar, and then there’s Beeline Holdings (NASDAQ: BLNE)—a company with an incredibly tight float, a fresh Nasdaq listing, and a foothold in two of the fastest-moving industries today: AI and mortgage lending.

Legacy lenders are stuck in the past, but Beeline Holdings (NASDAQ: BLNE) is rewriting the playbook.

By leveraging AI and automation, it’s eliminating inefficiencies, reducing costs, and accelerating the mortgage approval process in a market that has been slow to evolve.

With leadership making a major capital commitment to its future, this is more than just another tech name—it’s a company positioning itself for serious disruption.

This is the kind of thing that doesn’t stay quiet for long.

We’ll be watching (BLNE) closely tomorrow morning.

Consider putting it on your radar tonight—and keep your eye out for my next update coming early tomorrow.

Have a good night. |

ليست هناك تعليقات:

إرسال تعليق