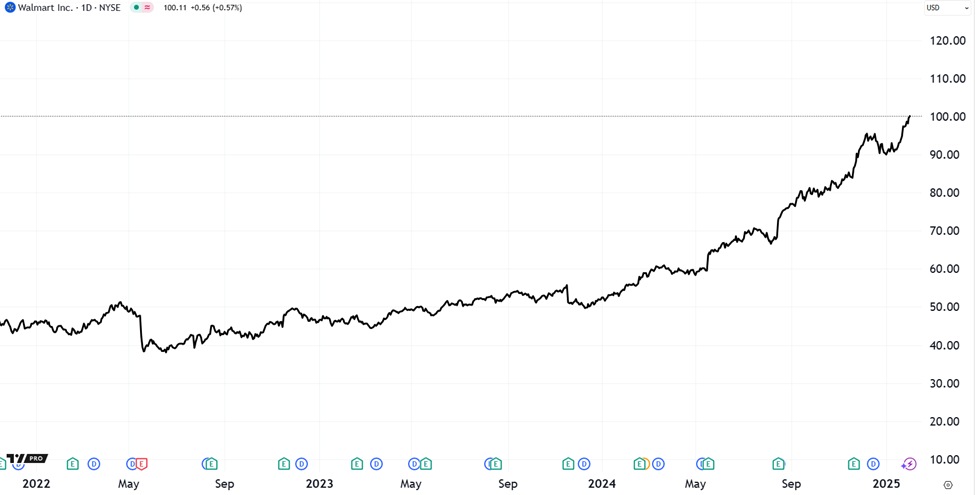

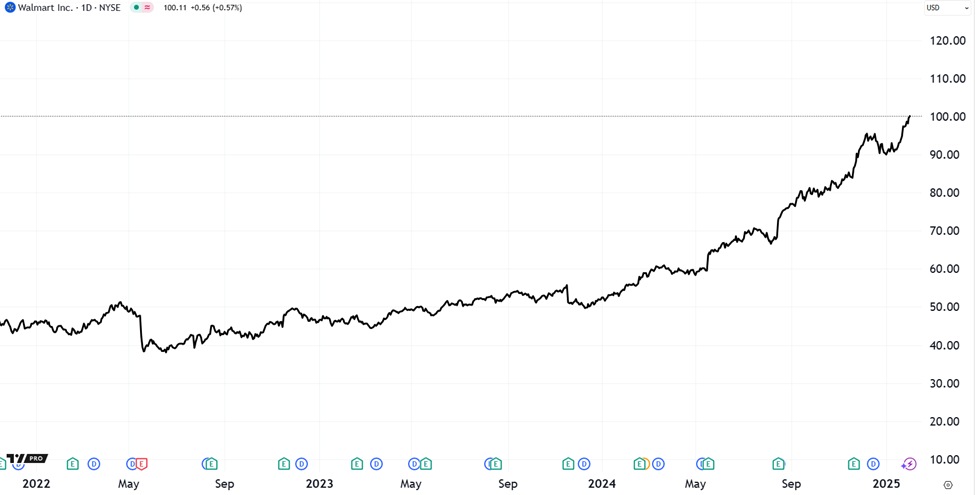

China hits the U.S. with 15% tariffs … Trump wants more drilling and lower oil prices – will he get it? … “financially strained” U.S. shoppers … buy AI Appliers Chinese tariffs are a go. This morning, a 10% levy on Chinese goods took effect. China is already hitting back. A 15% tariff on U.S. coal and liquefied natural gas will begin on February 10. Meanwhile, a 10% levy will be put on American crude oil, farm equipment, and select autos. These moves appear to be mostly symbolic and strategic. For example, part of China’s response included news of an investigation into Alphabet over alleged antitrust rules. However, Alphabet pulled Google’s search engine services to China back in 2010. So, this isn’t exactly an economic A-bomb. The moves appear more intended to give China some poker chips for leverage at the negotiation table. That doesn’t mean the situation won’t devolve into something far worse, but for now, this is a relatively tame reaction. We’ll keep you updated. Oil isn’t getting the spotlight it deserves It’s a key variable on Trump’s economic chessboard. The President wants and needs lower energy prices, but that’s going to be a hard sell to the groups on the other end of the negotiating table. President Trump campaigned on the slogan “drill, baby, drill.” More U.S. oil at lower prices is critical for Trump’s vision for a few reasons: One, more U.S.-sourced energy will have a downward effect on prices at the pump. History shows that this is a big issue for voters, improving sentiment toward the economy. Two, lower energy prices would ease price pressures on all sorts of goods. As we’ve detailed in previous Digests, fossil fuels are a key ingredient in countless consumer items that most people don’t realize (cameras, coffee makers, golf balls, lipstick, and sunglasses, to name a few). This makes more production inherently deflationary, helping stave off the inflation that so many economists predict will result from Trump’s policies. Three, related to deflation, lower energy prices would support additional interest rate cuts from the Fed. Trump wants to juice the economy – lower rates play a big role in how he hopes to achieve that. Bottom line: More U.S. drilling to increase supply and lower prices plays a huge role in Trump’s economic vision. | Recommended Link | | | | For more than four decades, I’ve been known as one of the world’s most bullish investors. Forbes even went so far as to call me a “perma bull”... But today I’m sharing some dark news… It concerns a financial event that’s about to wreak havoc on the stock market… and catch a lot of people off guard. I can’t in good conscience sit idly by and do nothing right now. A lot of people have their heads buried in the sand. Go here now to see my urgent warning. |  | | The potential stumbling blocks to lower oil prices The U.S. energy complex isn’t in the same place it was years ago when advancements in shale technology spurred an explosion of drilling. Here’s The Wall Street Journal: Wildcatters are mostly gone, replaced by more disciplined oil giants. Wall Street has helped instill that discipline, pushing oil companies to focus more on producing cash for investors. Meanwhile, production in most U.S. crude regions is set to decline as fields mature and sweet spots dwindle. What this means: The oil patch is unlikely to see the kind of breakneck growth it saw in Trump’s first term, when daily crude production shot up from about nine million barrels to roughly 13 million. “We’re not going to have the explosive growth that we’ve seen,” Richard Dealy, who oversees Exxon Mobil’s Permian operations, said. At least in the short term, a glut of new supply is going to be tough to come by. Now, longer-term, Trump’s plans to scrap environmental regulations should promote new capital flowing into the sector; and that should increase output, putting downward pressure on prices. But energy executives will be cautious about cannonballing into new, expensive projects this time around. And so, to alleviate prices in the short-term, where can Trump look? The Middle East. From the WSJ: [Trump’s advisers] say his best lever to bring down prices might be to persuade the Organization of the Petroleum Exporting Countries and Saudi Arabia, the group’s de facto leader, to add more barrels to the market. But Saudi Arabia has told former U.S. officials that it also is unwilling to augment global oil supplies, say people familiar with the matter. Some of those former officials have shared the message with Trump’s team. Oil trades at $73 per barrel as I write, not $94 a barrel like a few years ago. This has already eaten away at Saudi Arabia’s profit margins. Why would they support lower prices other than trying to gain more market share? Of course, Trump doesn’t want them gaining greater share. He wants that going to the U.S. energy complex. So, the incentive structure doesn’t lend itself to complete Saudi cooperation. Put all this together and it’s unlikely that “drill, baby, drill,” or Trump’s OPEC lobbying will result in significantly lower oil prices anytime soon. We like the energy trade over the coming quarters/years Stocks in the energy sector have significantly lower valuations than most other corners of the market. Many of the top-tier companies pay healthy dividends. And yet, eventually, we believe that Trump will succeed in enticing Big Oil to ramp up output, which will be necessary to support AI growth (in previous Digests, we’ve covered how DeepSeek’s lower-cost AI technology is likely to result in more demand for energy, not less, thanks to Jevons Paradox). I’ll add that legendary investor Louis Navellier just recommended a blue-chip oilfield services company to his Growth Investor subscribers. Oilfield services providers are in a good position today. They don’t need higher energy price to boost their bottom lines; rather, they just need more companies operating in the oil patch, requiring the goods/services provided by these oilfield services leaders. As always, Louis isn’t investing based on what he hopes will happen (in this case, Trump’s policies resulting in a wave of new drilling). He’s looking to fundamental strength to drive his recommendation. And that’s what this new recommendation has. From Louis: Total fourth-quarter revenue rose 8% year-over-year to $7.36 billion. Fourth-quarter adjusted earnings jumped 37% year-over-year to $0.70 per share, up from $0.51 per share in the same quarter a year ago. Analysts expected adjusted earnings of $0.63 per share… And over the past five years, [this company] has increased its dividend by more than 16%. You can learn more as a Growth Investor subscriber by clicking here. Bottom line: Keep your eye on the oil patch. It plays a big role in Trump’s overall plan. How a “stressed” consumer can point us toward market opportunities One of the most unexpected stories of the last two years has been the resilience of the U.S. consumer. Despite many metrics pointing toward a sharp decline in the economic health of the average American, a much-predicted consumer-based recession never materialized. Instead, shoppers continued opening their wallets. Now, this doesn’t mean that consumers have been unaffected. We’ve seen a shift in how they’re spending. Here’s MarketWatch on that note: Surveys continue to show that middle-income Americans are not feeling the benefits of a growing economy as they struggle with high prices for basic necessities like housing, transportation, healthcare, and child care… With consumer prices up 2.9% year on year in December — and new tariffs from the Trump administration widely to expected increase prices in the near future — middle-income households are feeling financially stressed and negative about their financial outlook, and many are cutting spending for 2025… Remember, the U.S. consumer is the primary workhorse of our economy, accounting for nearly 70% of our GDP. So, tracking what they’re spending money on – and how they’re spending money – can inform our investing decisions. This begs a question… Where do many “financially stressed” Americans prefer to shop? Congrats if you guessed Walmart. Given this preference, it shouldn’t surprise you that the retail giant just notched a new 52-week high yesterday as the broad market sold off in the wake of tariff fears. And as I write Tuesday, it’s on pace for a fresh all-time high. (Full disclosure: I own Walmart in my personal account.)

But not every company that targets financially strained Americans is a buy right now. Take Dollar General (DG). Its chart is going the opposite way as Walmart’s.

Why? Like Walmart, Dollar General serves budget-conscious consumers, but there are some key differences in their strategies. And one of the biggest is Walmart’s successful implementation of AI. Walmart isn’t just outperforming today because of cash-strapped American consumers – it’s leveraging AI in ways that boost its bottom line Let’s rewind to this past summer. On Walmart’s post-earnings call, CEO Doug McMillon said that the company was finding “tangible ways” to leverage generative AI to improve customer, member, and employee experiences. From McMillon: Without the use of generative AI, this work would have required nearly 100 times the current head count to complete in the same amount of time and for associates picking online orders, showing them high-quality images of product packages helps them quickly find what they're looking for. While Dollar General has made efforts to implement AI, the company is miles behind Walmart when it comes to applying AI to supply chain and logistics, checkout automation, personalized shopping ads, employee management, and drone and delivery robotics to name a few. Bottom line: The effective use of AI is helping drive an enormous difference in fundamental performance between these two companies. And this underscores a point that our technology expert, Luke Lango is stressing today… | Recommended Link | | | | According to my proprietary quant crypto algorithm, President Trump’s first 100 days in office will be mission critical for the crypto market. Most people could be blindsided and be completely left behind. But if you know what coins to invest in, you could actually make more money in Trump’s first 100 days in office than in his entire four year term… Which is why this Thursday at 10 am ET, I’m hosting a special event to give you all the details. Including the details on three coins I just found with my proprietary algorithm that could soar in Trump’s first 100 days. It’s called The Great American Crypto Project. Click here to instantly save your seat. |  | | Invest in the companies that are effectively implementing AI today In the first phase of AI – the “buildout” phase – companies spent billions upon billions of dollars to create new AI datacenters, buy new AI chips, build new AI fabrication plants (fabs), and more. The AI Builder stocks – or the companies building those data centers, selling those chips, running those fabs, etc. – were the big winners. This is still happening to some degree. But phase two is the application phase – or the AI Applier Boom. This is when companies spend billions upon billions of dollars to develop new AI applications on top of the new AI infrastructure. In this phase, where we are today, AI Applier stocks are the big winners. Walmart is an example. Luke is urging his readers to buy top-tier AI Appliers, as this where he predicts the biggest winners of the AI Boom will emerge – even more so after the DeepSeek breakthrough last week. From Luke: The biggest takeaway [from DeepSeek’s emergence] is an accelerated shift from AI Builder stocks toward AI Applier stocks. That’s because the breakthrough simultaneously (somewhat) commoditizes AI hardware and democratizes AI software. By partially commoditizing AI hardware, the DeepSeek breakthrough may lead to some premium AI hardware providers – like Nvidia – losing some pricing and margin power, though demand will remain robust, leading to good (but not great) AI Builder stock performance. Meanwhile, by democratizing AI software, the DeepSeek breakthrough will lead to more AI software creation and deployment, leading to very strong AI Applier stock performance. Therefore, we remain fully bullish on the AI trade in 2025 but would like to continue to emphasize a shift in focus toward AI Applier stocks over AI Builder stocks. For more on the AI Applier stocks that Luke is recommending to his Innovation Investor subscribers, click here to learn more about joining him. And if you missed it, last week, in the wake of the DeepSeek news, our experts Louis Navellier, Eric Fry, and Luke Lango just sat down with our Editor-in-Chief and fellow Digest writer, Luis Hernandez, for a roundtable discussion. Part of what they discussed was this handoff of AI leadership from AI Builders to AI appliers. It was a fantastic discussion which will help you understand the forces driving today’s investment markets. Click here (or press the play button on the image below) for more on the action steps they’re recommending today.

By the way, in December, Louis, Eric, and Luke created their AI Revolution Portfolio. This is a “best of the best” collection of AI stocks based on our experts’ respective approaches to picking market winners. The portfolio represents what Louis, Eric, and Luke believe are the best ways to profit from the AI revolution over the next 12-26 months. They discuss this in the video above, but if you’d like more information, click here. Wrapping up… - So far, China’s tariff counterpunch isn’t awful.

- What’s happening in the oil patch today is complex, but we’re still long top-tier fossil fuel plays, as is Louis Navellier.

- The U.S. consumer is still alive, but his/her spending patterns are changing. Make sure you’re investing accordingly.

- Walmart – a beneficiary of changing spending patterns – is outperforming also because of its use of AI.

- This type of “AI Applier” is going to outperform the “AI Builders” looking forward.

We’ll keep you updated on all this and more here in the Digest. Have a good evening, Jeff Remsburg |

ليست هناك تعليقات:

إرسال تعليق