NVIDIA's Latest Blowout Earnings: What They Mean for the Future of AI Dear Reader, I remember it like it was yesterday. My son was an engineering student at Stanford when one of their research teams debuted an autonomous race car named Shelley. As a self-professed car guy, my interest was immediately piqued. It was a modified Audi TTS – a beautiful machine with perfect handling. The students even upgraded it with ceramic brakes since they fade slower and are easier to program.  But what really caught my attention wasn’t the car. It was what powered it. This self-driving project was made possible by semiconductor chips from NVIDIA Corporation (NVDA). Maybe you’ve heard of ‘em. I say that tongue-in-cheek, of course, because practically the whole world knows NVIDIA by now. My introduction to NVIDIA could have happened to anyone. It was one of life’s happy coincidences. But after 40-plus years in this business, I’ve learned that keeping your eyes and ears open is key if you want to be a great investor. You never know when an opportunity is right in front of you. By that same token, NVIDIA didn’t become the household name it is today because of self-driving cars. Instead, it took advantage of another happy coincidence – one that changed the future of computing. Back in 2012, a PhD student named Alex Krizhevsky used NVIDIA’s graphics processing units (GPUs) to train a deep neural network called AlexNet. This model didn’t require a single line of traditional programming. It taught itself to recognize images. And when it crushed the competition in the ImageNet challenge, it proved that GPUs were far superior to CPUs (central processing units) for AI workloads. That’s when everything changed. Practically overnight, NVIDIA’s chips became must-haves for AI. The AI Revolution was on. Fast forward to today, and NVIDIA remains at the heart of the AI Revolution. But after such a historic run, investors had one big question ahead of its latest earnings report, which was released yesterday: Can the company keep up the momentum? Because this time, the stakes were a little different... - The rise of DeepSeek, a Chinese AI firm, has raised concerns about competition and the need for high-powered chips. (I discussed what happened – and why DeepSeek isn’t a threat – in this article.)

- Investors are growing concerned about Big Tech’s AI spending habits.

- Production delays in NVIDIA’s new Blackwell chip had some investors on edge.

- And as Big Tech companies look to make their own AI chips for internal use, Wall Street was watching closely.

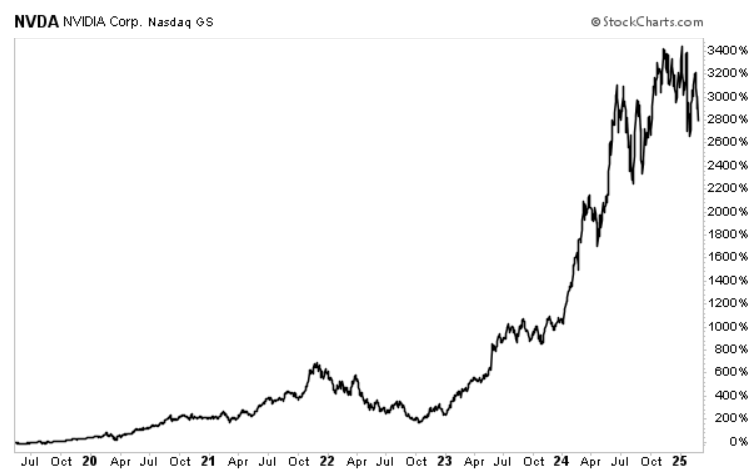

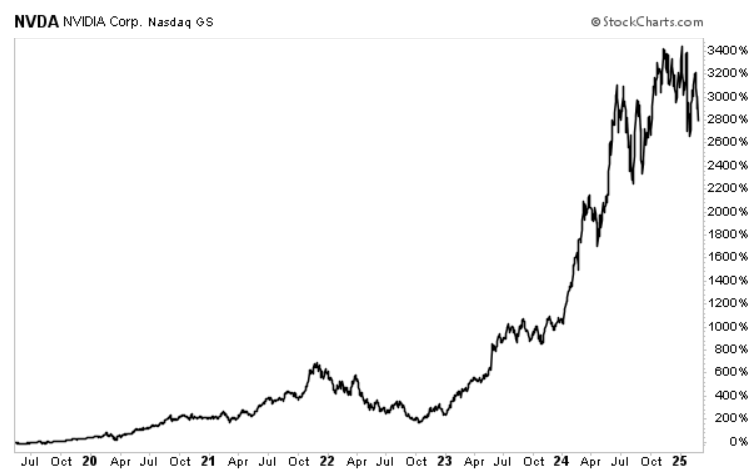

So, in today’s Market 360, let’s break down NVIDIA’s latest results. We’ll dive into what they mean for the AI Revolution, and more importantly – how you can take advantage of the next stage of AI investing… even if you missed the first wave. Tale of the Tape NVIDIA achieved record results in its fourth quarter and fiscal year 2025. Fourth-quarter revenue soared 78% year-over-year to $39.3 billion, topping estimates for $38.16 billion. Fourth-quarter data center revenue accounted for $35.6 billion, which was up 93% from the same quarter a year ago. Fourth-quarter earnings jumped 71% year-over-year to $0.89 per share, which also beat estimates for $0.85. For fiscal year 2025, NVIDIA reported revenue of $130.5 billion, or 114% annual revenue growth. Earnings clocked in at $2.99 per share, or 130% annual growth. These results also bested analysts’ estimates for full-year revenue of $129.28 billion and earnings of $2.95 per share, respectively. Also notable, NVIDIA revealed that the Blackwell chip accounted for $11 billion in the fourth quarter, or 28% of revenue. Company management stated it was “the fastest product ramp in our company’s history.” Looking forward to the first quarter in fiscal year 2026, NVIDIA expects revenue of about $43 billion. That would represent roughly 65% year-over-year revenue growth. My Key Takeaways So, once again, the company’s data center division proved to be the primary growth engine, led by the new Blackwell chip – which accounted for 50% of data center revenue. What this tells me is that demand for the latest and greatest AI-powered computing has to offer remains at an all-time high – despite recent concerns about DeepSeek or Big Tech’s AI spending. As I’ve mentioned previously, these concerns were largely overblown. The reality is that DeepSeek has proven to have major concerns with its reliability and data security. And we can’t seem to go a week without seeing fresh news about Big Tech’s plans to spend billions on additional data centers for AI. Company management also addressed new ways of running AI, like DeepSeek’s R1 model, which reportedly uses reasoning rather than inferencing. CEO Jensen Huang said this is not a threat, saying the next generation of AI algorithms could need millions of times more computing capacity. What’s more, he addressed the potential threat of chips being designed in-house by Big Tech companies like Alphabet Inc. (GOOG), Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN). Just because the chip is designed doesn't mean it gets deployed. And you've seen this over and over again. There are a lot of chips that get built, but when the time comes, a business decision has to be made… our technology is not only more advanced, more performance, it has much, much better software capability and very importantly, our ability to deploy is lightning fast. I should also add that sales of chips for self-driving cars and robots are beginning to take off. The company reported $570 million in automotive sales during the quarter. That may be a tiny fraction of the pie, but that slice is getting bigger – it represents a 103% rise year-over-year. | Recommended Link | | | | In the middle of this week’s volatility, an ultra-rare pattern has emerged in the markets that has only appeared three times going back 125 years. Last time this pattern appeared, backtests show it triggered certain tech stocks to soar thousands of percent over time… while devastating millions of Americans who failed to prepare. If you’re looking for answers on where the market’s really headed next, don't miss our urgent briefing tonight, at 8pm ET. Click here to automatically secure your spot. |  | | Wall Street's Reaction Now, NVIDIA shares rose by roughly 3.5% on Wednesday prior to the earnings release. But in Thursday’s trading, the stock really took it on the chin, falling more than 5%. So, what triggered the selloff? There seems to be some disappointment around the fact that NVIDIA’s margins declined slightly, down to 73% from 76% in the previous year. The company also forecasted margins of 71% for the current quarter. Since the Blackwell chips are even more complex (and expensive to make) than previous versions, this makes sense. But Wall Street fixated on the slight margin decline and forward guidance despite the company’s continued dominance. So, while the company successfully batted down a laundry list of concerns (DeepSeek, AI spending, Blackwell delays, rising competition), Wall Street still found a reason to sell after earnings. I don’t want you to be too concerned by this. NVIDIA’s initial action in the wake of earnings is usually not reflective of the long-term picture. | Recommended Link | | | | The world’s wealthiest insiders are sounding the alarm. Billionaires from Buffett to Zuckerberg are dumping shares of Big Tech stocks at a record pace, in a move that could cause trillions to drain out from under everyday investors. Fortunately, there's a way to protect your portfolio BEFORE the worst damage is done – allowing you to profit massively throughout the panic. Click here to find out how. |  | | The Next Revolution Is on the Horizon And the long-term picture is this… The AI Revolution is the biggest technological disruption of our lifetime. Few companies have benefited more than NVIDIA. I’ve had my fair share of winners over the years, and I can’t think of a single one that was as monopolistic as NVIDIA. I am on record saying that NVIDIA is the Stock of the Decade. You may know that we’ve held it in my Growth Investor service since 2019. And since then, we’re up by nearly 3,000% on my recommendation. And I don’t have any plans to sell.  However... You should always be thinking about what’s coming next... The folks at NVIDIA know this. In fact, they’re already preparing for it. That’s why I filmed a special presentation to discuss the next technological revolution on the horizon. Let me be clear, folks. If you missed the boat on NVIDIA, you’re going to want to hear about this. Because while NVIDIA is fully aware of what’s going on, the biggest gains will likely come from smaller firms on the cutting edge. These are the ones that could become the next NVIDIA. Go here to get the details now. Because by the time the mainstream public hears about it, the “easy” money will have already been made. Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق