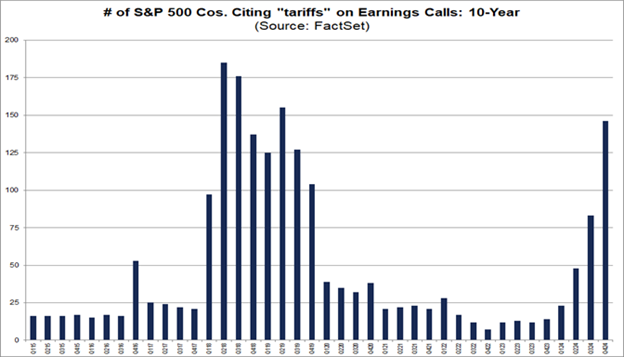

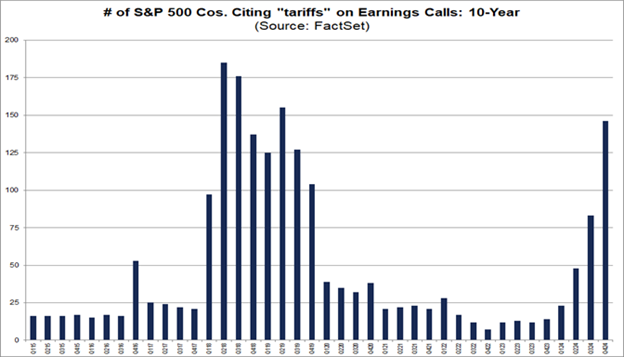

Consumers Are Worried – But This AI Shift Is Just Starting Dear Reader, In August 2021, Americans were on edge. The Delta variant of COVID-19 had arrived. This caused consumers to panic a bit, and it showed in the data. The Conference Board’s Consumer Confidence Index fell to 113.8, down from 125.1 in July. That was a steep 9% drop in one month. Now, it’s happening again – but for very different reasons. This morning, the Conference Board’s Consumer Confidence Index for February showed a reading of 98.3. That’s down from January’s 105 reading, and economists were looking for a reading of 102.5. Not only that, but it was the third-straight monthly decline for the index. This is its biggest drop since August 2021. This didn’t come out of nowhere, either. On Friday, the University of Michigan’s Consumer Sentiment Survey also plunged. The February reading came in at 64.7, down almost 10% from January’s 71.7. This also marked a 15-month low. The last time the consumer sentiment survey was this low was in October 2023, when people were grappling with the October 7 terrorist attacks by Hamas in Israel, the U.S.’s ballooning budget deficit and elevated Treasury yields and interest rates. Now, the reasons for the drop in consumer confidence and sentiment this time around are different. Some of the current consumer pessimism could be weather-related. But the main driver we are seeing this time around is due to tariff threats. The Conference Board noted today that “there was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019.” The truth is Americans are still feeling the sting of high prices. Even though inflation has cooled from its 2022 peak, it’s still sticking around. Gas, groceries, rent – they’re all more expensive than they were a year ago. Tariffs threaten to raise the prices of imported goods and reduce consumer demand. So, consumers are on edge that these tariffs might unravel the progress made in bringing inflation down recently. We already knew that S&P 500 companies are concerned. According to FactSet, more S&P 500 companies are citing “tariff” or “tariffs” on quarterly earnings calls than at any point since Q2 2019.  But it was Walmart Inc.’s (WMT) earnings report last week really raised the first major red flag that consumers were concerned about tariffs. So, in today’s Market 360, we’ll take a closer look at Walmart’s earnings and what the company management had to say about tariffs. I’ll also share the important details that investors are overlooking. Not only do they bode well for Walmart’s future, but they highlight a huge shift in companies’ approach to artificial intelligence. I’ll explain what’s shifting… and how you can profit from it. Let’s get started. | Recommended Link | | | | Investing legend Louis Navellier warned us about the stock market crash of 1987... the 2000 dot-com crash… Enron’s collapse… and the 2008 financial crisis crash. He also predicted the rise of a host of iconic stocks… including Google, Apple, Amazon, Netflix, Facebook, and Nvidia. Today, he’s stepping forward to make history yet again… with a critical market forecast he’s calling: “My biggest prediction in 47 years…” Click here to see it. |  | | Why Walmart Disappointed On Thursday, February 20, Walmart announced results for the fourth quarter and fiscal year of 2025. Earnings rose 10% year-over-year to $0.66 per share, besting expectations for $0.65 per share by 1.5%. Meanwhile, revenue increased 4.1% to $180.6 billion, in line with analysts’ estimates. Walmart continued to invest heavily in its online platform, helping drive a 20% increase in U.S. e-commerce sales. The company also reported that advertising revenue surged 29%. Still, these numbers weren’t enough for skittish traders, and shares of Walmart stumbled 6.5% last Thursday. And that’s because the company issued a lighter-than-expected forecast for sales. Specifically, the company said it expects net sales to increase 3% to 4%. That’s on the lower end of what analysts were expecting. The company also forecasted full-year adjusted earnings per share of $2.50 to $2.60, below the $2.77 consensus estimate. “We’re one month into the year,” Walmart Chief Financial Officer John David Rainey said in prepared investor call remarks. “So, I think it’s prudent to have an outlook that is somewhat measured… we don’t want to get ahead of ourselves.” As I mentioned earlier, tariff worries are likely the source of the tepid forecast. Walmart is the sixth-largest shipper in the world, as measured by number of shipments, and half of that comes from China. The Alliance for American Manufacturing estimates that as much as 80% of Walmart’s merchandise segment has ties to the country. That makes Walmart unusually exposed to tariffs on imported Chinese goods, which have already risen 10% since Donald Trump took office. Now, while most people were focused on the weak outlook for Walmart, many overlooked some of the statements that CEO Doug McMillion made that will have a far greater impact on the company’s bottom line over the long run. I’m talking about Walmart’s efforts with artificial intelligence. How Walmart Is Applying AI During the earnings call, McMillon revealed how the company plans to accelerate its entire business with AI. He first shared a new AI agent for its merchants to help “get to the root cause of issues related to things like out of stocks or overstocks with more accuracy and speed.” He also highlighted tools for coding assistance that are now available for developers on Walmart’s tech team that will “help streamline deployments and deliver code faster with fewer bugs.” McMillon said these tools helped to save an estimated 4 million developer hours last year. | Recommended Link | | | | Is this recent market drop a speed bump, or just the beginning of even worse market conditions? On February 27th, we’re revealing the full story behind today’s markets - and we’re not relying on emotions or doom-and-gloom headlines. We’re presenting cold, hard data. So what does the data say? Those that don’t prepare could get crushed. Those that take the right steps may never worry about shaky markets again. Don’t miss out – secure your spot for Thursday’s big event. |  | |

Now, Walmart has already been using AI to help reduce costs and boost margins. The company’s 5.2% sales growth came with a 9.4% increase in adjusted operating income, powered by higher-margin businesses like membership, third-party selling, and advertising – all businesses helped by Walmart’s AI-powered website. It is also using its Walmart+ subscription service to help understand its shoppers. This monthly subscription service, like Amazon Prime, offers bonuses like free shipping, streaming services, returns-from-home, and fuel savings. With this platform, Walmart can track shoppers’ spending habits and create better recommendations for future buys. In other words, Walmart is finally ready for an e-commerce fight with Amazon. These innovations are critical for Walmart. After 50 years of expansion, the company is finally reaching the end of its physical growth runway. Analysts expect store count to remain at 4,600 through 2027, which means future expansion will have to come from an expansion of online and omnichannel offerings. In addition, Walmart is benefiting from its recent investments in supply-chain automation. The company was an early user of warehouse robots and opened five automated distribution centers for fresh food earlier in 2024. AI: The Ultimate Survival of the Fittest I bring all this up because you might not think of Walmart when you think about AI. But mark my words... In the not-too-distant future, every company will be involved with AI to one degree or another. And those that don’t will go the way of the Dodo bird. Walmart gets this, and so do a handful of AI Appliers, the companies that apply AI to better optimize their businesses. The fact is, the early adopters of AI are already becoming more efficient and profitable. And we’re only at the beginning stages of this process. Right now, more and more “non-tech” businesses, like Walmart, are hard at work applying AI to increase revenue, make smarter capital allocation decisions and reduce costs. Others are simply burying their heads in the proverbial sand. As this mass adoption phase of AI plays out, we’ll begin to see a massive market rupture take place. Those that master AI and employ fewer and fewer people and have very low-cost structures but generate huge amounts of revenue… And companies that go out of business. I want you to be on the right side of this, and that’s why I put together an urgent message. Click here to watch now. Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق