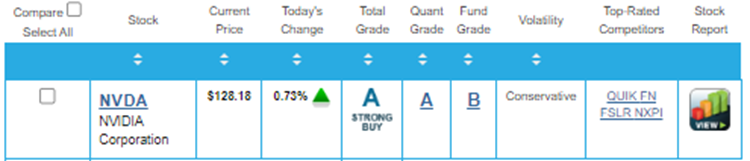

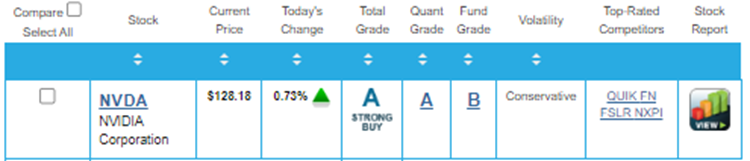

The Apple of the Market’s Eye Announces Earnings Next Week… Here’s What You Can Expect Dear Reader, The summer is drawing to a close, and that means one thing… school is back in session. Students have begun to load up their backpacks and return to classrooms while the lazy sun-soaked days give way to structure and routine. And as they say goodbye to sweet summertime, Wall Street is also saying goodbye to its own season: earnings season. Much like summer, the earnings season offers a brief period of clarity and excitement. It gives investors a window into how companies performed during the quarter and sets the tone for the market's next phase. Likewise, both transitions – whether in classrooms or on Wall Street – signal the importance of moving from reflection to action. For students, it's about moving from the freedom of summer to the structure and goals of a new academic year. For investors, it's about shifting from digesting quarterly reports to assessing long-term strategies based on what they have learned. And just as teachers and students begin setting the agenda for the months ahead, investors use the insights from earnings season to adjust their outlook and prepare for what's next in the market. But before we can fully put earnings season behind us, we do have the grand finale scheduled for this upcoming Wednesday, August 28. And there is one stock in particular, the star student of the markets, that will wrap up the season. I'm talking about NVIDIA Corporation (NVDA). So, in today's Market 360, let's take a look at what investors are expecting from the company's earnings report next week. Then I'll share the important shift NVIDIA is making as a company, and how you can profit from it. Expectations for NVIDIA's Earnings NVIDIA has a history of hitting it out of the park quarter after quarter. The company continues to experience intense demand for its artificial intelligence chips, posting positive earnings surprises of 9.8%, 11.4%, 18.7%, and 29.4% in the past four quarters, respectively. Given this track record of positive earnings surprises and the overall AI craze, expectations for this quarter are beyond high. For its second quarter in fiscal year 2025, analysts forecast earnings to surge 137% year-over-year to $0.64 per share. They expect revenue to soar 111.6% year-over-year to $28.59 billion. The analyst community is raising the bar, too, having upped earnings estimates by 7.6% over the past three months. Now, I should note that a recent report stated that NVIDIA's next-generation Blackwell chip could be delayed by at least three months. While originally slated to launch around October, a recently discovered flaw threw a wrench in that plan. According to AI Business, "manufacturer Taiwan Semiconductor Manufacturing Company (TSMC) uncovered the reported design flaw, which affects the processor die connecting two Blackwell graphic processing units (GPUs) on a single board. Given this, the company has allegedly decided to delay shipments and revamp the design of the chips." While customers and partners alike have indirectly confirmed this news, NVIDIA has yet to make a statement. So investors will be looking for an update on Wednesday in the company's earnings report. Looking at the Report Card Clearly, based on these expectations, NVIDIA is slated to be the star student this earnings season. In fact, its earnings should push the S&P 500's earnings growth rate up to over 11% for this quarter, the strongest number in two years. But does the company's report card reflect its numbers? Well, if you look below, my Portfolio Grader gives the company an "A" for its Total Grade.  Likewise, NVIDIA's Quantitative Grade is also an "A" and holds a "B"-rating for its Fundamental Grade. This tells us it is a stock with superior fundamentals that is also backed by persistent buying pressure, i.e., money is still flowing into the stock. It is safe to say that NVIDIA is still the apple of the market's eye with this report card. And if I could give its CEO, Jensen Huang, a grade as well, he would get a resounding A+. Not only does he foster a work environment where creativity and experimentation are encouraged, but the culture of innovation he has built keeps NVIDIA one step ahead of its competitors at all times.

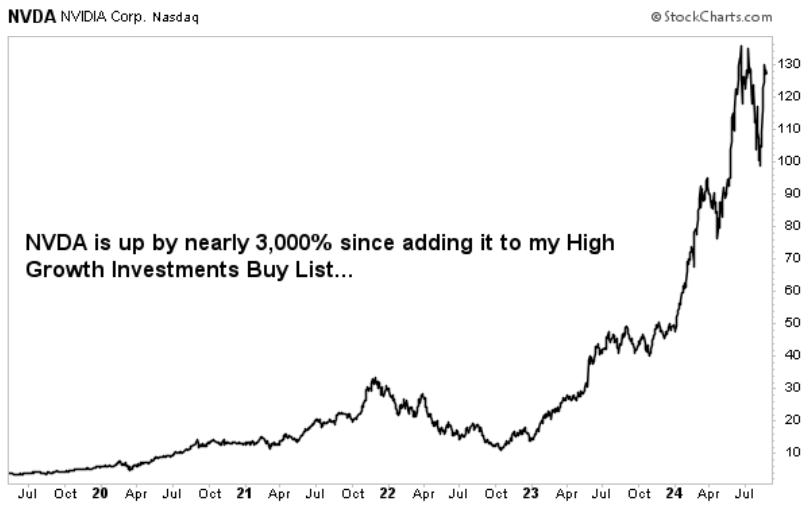

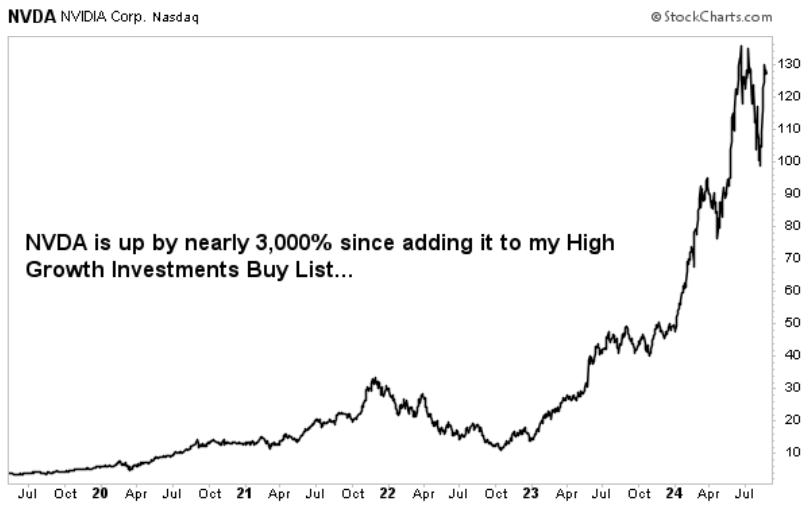

I should also add that, for the year so far, shares of NVDA are up 161%. And in my Growth Investor service, we are up by nearly 3,000% since adding it to one of our Buy Lists in 2019.  Now, when you look at its size, NVIDIA is sitting at a $3.14 trillion market cap – just behind the market leader Apple, Inc. (AAPL). But don't let that size fool you... there is still plenty of growth ahead. In my opinion, NVDA will be over $200 per share in 2025. That's partly thanks to a huge shift the company has been making recently... How to Profit from AI Innovation For decades, NVIDIA focused solely on microchips. But more recently, data centers have quietly become a larger and larger share of their revenue. For example, in the company's first quarter of fiscal 2025, data center revenue hit $22.6 billion. That's up by 23% from its fourth quarter 2024 and a whopping 427% from a year ago. I should also add that Huang calls these hyperscale data centers "AI Factories." He also noted that "the next industrial revolution has begun," and it started with these data centers. Now, the hyperscale data center industry is worth nearly $50 billion a year, and it's expected to grow 20% year-over-year for the next decade. However, there's just one problem... The data center industry is facing a shortage of power. And without enough electricity, data center buildings will screech to a halt and the growth of the AI industry could be severely stunted. That's where the presidential election comes in. I predict that if Donald Trump wins the election, he will fix the power shortage by signing an emergency executive order on energy. This, in turn, would usher in a Second Wave of the AI Boom. Plus, there's a new set of AI stocks that could take off on or before November 5. So, as the election draws near, you'll want to be prepared. Because these AI stocks are on the verge of massive gains. Click here to learn more about what the Second Wave of the AI Boom is and how you can profit from it. (Already a Growth Investor subscriber? Click here to log in to the members-only website.) Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق