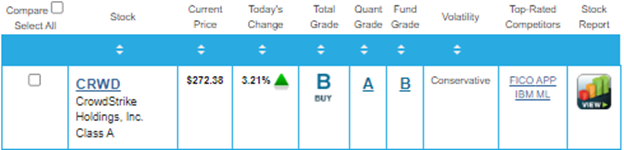

Why CrowdStrike Is a Great Buy… Despite Its Recent Software Snafu Dear Reader, Let’s take a quick trip back to February 28, 2017… Early that morning, an engineer for Amazon.com Inc.’s (AMZN) Web Services (AWS) was working to repair a billing issue for the company. Unfortunately, he mistyped a command and caused an outage that briefly “broke” the internet. This outage lasted several hours, causing blackouts or degraded performance. And it impacted big-name web companies like Coursera, Inc. (COUR), Slack, Expedia Group, Inc. (EXPE) and AWS’ own cloud health status dashboard. Not only that, but according to The Wall Street Journal, the outage “cost companies in the S&P 500 index $150 million.” Believe it or not, Amazon stock was left relatively unscathed. Shares of AMZN dipped slightly on the day of the outage and were back up the following week. Now, let’s fast-forward a bit to November 25, 2020… Here we find ourselves with another AWS outage. This outage was caused by Kinesis, a cloud-based service that collects, processes and analyzes large amounts of real-time video and data streams. AWS released a statement stating that “a relatively small addition to capacity” triggered the outage and that “the new capacity had caused all of the servers in the fleet to exceed the maximum number of threads allowed by an operating system configuration.” Companies such as Adobe Inc. (ADBE), Roku, Inc. (ROKU), Flickr, Coinbase Global, Inc. (COIN) and Glassdoor, as well as Capital Gazette, The Washington Post and The Philadelphia Inquirer, were all impacted. This time, shares of AMZN slipped nearly 2% on November 30, 2020, following the outage before rebounding. Let’s now fast-forward one final time to last Friday, July 19, 2024: The day CrowdStrike Holdings, Inc. (CRWD) triggered “the largest IT outage in history” because of a software update snafu. In today’s Market 360, I want to dig into the details of the outage and its repercussions. I’ll explain why I believe CrowdStrike is a good buy. And then, I’ll discuss why artificial intelligence could be even more destructive than CrowdStrike’s update… and how you can protect yourself from the fallout. CrowdStrike’s Software Snafu Early last Friday, a CrowdStrike software update crashed Microsoft Windows 365 operating systems which exists on most servers. Following this update, folks couldn’t log in after that mandatory system reboot. And most folks saw the “blue screen of death.” This triggered a global software crash that grounded major airlines, including American Airlines Group Inc. (AAL), Delta Air Lines, Inc. (DAL) and United Airlines Holdings, Inc. (UAL). The crash also impacted banks, trains and other businesses in a systematic cascade of software failures. Some of the other businesses that were hit included the London Stock Exchange news services and Sky News live television broadcasts. Now, CrowdStrike said that the software issue was not related to a cyberattack and that a “fix” has since been deployed. Microsoft Corporation (MSFT) has confirmed that the CrowdStrike fix is restoring Windows 365 systems worldwide and encouraged everyone to hurry up and get the upgrade. Microsoft is also blaming the European Union (EU) for forcing it to have an open operating system where it can’t enforce updates. Microsoft is asserting that had it not had an open operating system, the crash never would have happened because it would have tested the upgrade first. Following the outage on Friday, shares of CRWD fell 11%... and then plummeted another 13.5% on Monday. For the week, as of this writing, CRWD is down about 17%. Is CrowdStrike a Good Buy? Clearly, shares of CrowdStrike got hit harder than Amazon did during its outages. But AWS is notorious for crashes and outages while CrowdStrike is not. But the fact of the matter is CrowdStrike is still one of the biggest cybersecurity players out there. So, I do expect the stock to bounce back. I should also add that CRWD holds a B-rating in Portfolio Grader, making it a “Buy.”  As you can see in the chart above, CrowdStrike also earns a B-rating for its Fundamental Grade and an A-rating for its Quantitative Grade. This tells us that the stock is still backed by both institutional buying pressure and fundamentals remain solid. Even after the outage, the analyst community still expects strong earnings and sales for CrowdStrike’s second quarter. Earnings are forecasted to rise 33.8% year-over-year to $0.99 per share, up from earnings of $0.74 per share in the same quarter a year prior. Revenue is expected to increase 31.1% year-over-year to $958.94 million. I should also mention that CrowdStrike has a strong earnings surprise history, as it topped analysts’ earnings estimates in the past four quarters. Earnings estimates have been upped slightly over the past three months, so another earnings surprise could be in the cards. If the company does surprise, I expect the stock to bounce. It should also continue to benefit from the AI Revolution. Artificial intelligence relies on acquiring massive amounts of training data, which benefits large firms like CrowdStrike. These incumbents can “see” more threats thanks to their customer base, and so it creates a virtuous cycle. Larger companies create more powerful AI systems, which attracts more new users, and so on. It’s also important to note that one solution can get rolled out to every customer. Phase 2 of the AI Revolution Now, about a year ago, I teamed up with my InvestorPlace colleagues Eric Fry and Luke Lango to detail the different ways the AI Revolution would impact every aspect of the economy and stock market. In short, it would simultaneously create enormous wealth for a few of the “in the know” investors, while leaving everyone else behind. In other words, we predicted a growing chasm between the “haves” and “have-nots.” Fast-forward to today and everything we predicted has played out exactly as we said. We’re now entering a second phase of the AI Revolution, and we expect this phase to be just as profitable for some and destructive for others. So, we held a special roundtable just this morning to issue another urgent warning. We revealed the immediate steps you need to take if you want to save yourself from the destruction that’s about to unfold. We also shared how the move to Phase 2 of the AI Revolution could give you the chance to 10 times your money… or more! If you missed our AI briefing from this morning, click here now to catch a replay. Sincerely, | .png)

.png)

ليست هناك تعليقات:

إرسال تعليق