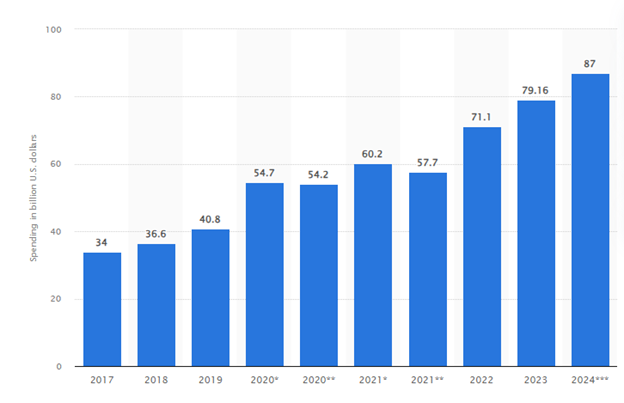

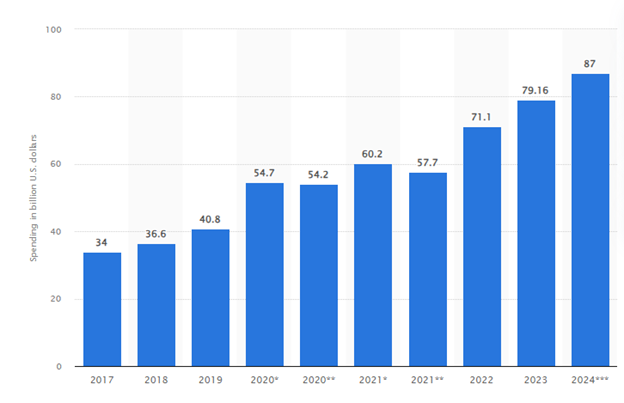

The Small Cybersecurity Company Winning Big in the Cybersecurity Space Dear Reader, Over the past week, two big-name companies revealed that they were targets of massive cyberattacks. Last Friday, July 12, AT&T Inc. (T) announced that it had suffered a 2022 security breach and approximately 109 million client accounts were impacted. Company management noted in a press release: Based on our investigation, the compromised data includes files containing AT&T records of calls and texts of nearly all of AT&T's cellular customers, customers of mobile virtual network operators (MVNOs) using AT&T's wireless network, as well as AT&T's landline customers who interacted with those cellular numbers between May 1, 2022 - October 31, 2022. The compromised data also includes records from January 2, 2023, for a very small number of customers. The records identify the telephone numbers an AT&T or MVNO cellular number interacted with during these periods. For a subset of records, one or more cell site identification number(s) associated with the interactions are also included. Then on Monday, July 15, The Wall Street Journal reported that “hacktivist” group Nullbulge breached and stole 1.1 terabytes of data from The Walt Disney Company’s (DIS) Slack channels. Nullbulge leaked private information from almost 10,000 Slack channels regarding Disney’s ad campaigns, studio technology and interview candidates. Nullbulge focuses on exposing potential corporate malpractices. So, their reasoning for targeting the entertainment giant was “due to how it handles artist contracts, its approach to AI, and its [sic] pretty blatant disregard for the consumer.” So, in today’s Market 360, we’ll talk about the increase in cybersecurity attacks in the past few years, the steep price businesses have to pay to recover and how this boosts the cybersecurity market. I’ll also share the small-cap cybersecurity stock that is poised to benefit from this growth. And I’ll explain the system I used to find it as well as how you can find stocks that are set to soar, too. And today, CrowdStrike Holdings, Inc. (CRWD), one of the largest cybersecurity companies in the world, triggered the “largest IT outage in history” due to a software update snafu. Airlines were forced to ground flights, while banks, telecoms, foreign stock exchanges and other media companies were impacted by the outage. Although the incident was not a cyberattack, it shows how serious an impact a major outage can have around the world. The Growing Need for Cybersecurity The fact of the matter is the risks of cyberattacks are rising. According to Forbes Advisor, last year there were 2,365 cyberattacks, with 343,338,964 people impacted. In addition, data breaches jumped 72% from 2021 to 2023. WatchGuard also notes that a cyberattack occurred every 39 seconds in 2023. A study from Morgan Lewis found that the global cost of a cyberattack was $4.45 million, up 2.25% from $4.35 million in 2022. The estimated price tag for cyberattacks on a global scale was $8 trillion in 2023. Unfortunately, cyberattacks will only get more expensive in 2024 and beyond. So far, there have been more than 20 serious cyberattacks and data breaches. According to Cybersecurity Ventures, the cost of a cyberattack worldwide is supposed to hit $9.5 trillion this year. This equates to $793 billion per month, $182.5 billion per week, $26 billion per day, $1 billion an hour, $18 billion per minute and $302,000 per second. Yikes! With cyberattacks expected to increase, companies are preparing for battle by spending more money on cybersecurity to keep them at bay. According to Statista, global spending on cybersecurity clocked in at $80 billion in 2023. In 2024, global spending should be north of $87 billion.  Source: Statista As a result of companies opening up their pocketbooks, the cybersecurity market will rise. Also according to Statista, the global cybersecurity market is forecast to hit $185.7 billion, with security services accounting for $97.3 billion. In the U.S., it is expected to reach $116.2 billion by 2029, with an average spend per employee of $469.50 in 2024. The bottom line: There is incredible growth in the cybersecurity space. As investors, this means that there’s a lot of money to be made on the legal side of the table. Your Next Best Small-Cap Cybersecurity Play The cybersecurity company I like is Alarum Technologies Ltd (ALAR). For the past 10-plus years, Alarum Technologies, an Israeli-based cybersecurity company, has focused primarily on providing cybersecurity and privacy solutions to consumers and enterprises. The company’s services are offered through three businesses: - NetNut: The company’s Enterprise Internet Access business.

- Cyber Kick: Its Consumer Internet Access business.

- And TerraZone: An information security provider.

Through these three businesses, Alarum ensures that its customers have access to enhanced cyber security protection in order to identify and address threats quickly. The company provides threat intelligence, incident response, penetration testing, secure servers, advanced encryption software, protection against malware, VPN, email protection, brand protection and more! Record Earnings in May In May, Alarum announced another record quarter, as its technologies and solutions continue to attract new customers. First-quarter revenue jumped 47% year-over-year to a record $8.4 million, which crushed estimates for $7.38 million. NetNut accounted for the bulk of revenue, as it surged 139% year-over-year to $8.1 million. First-quarter earnings surged to $0.23 per ADS, up from a loss of $0.21 per ADS. Analysts expected earnings of $0.28 per ADS. For the second quarter, the analyst community expects Alarum to report earnings of $0.31 per share on revenue of $8.92 million, up from an earnings loss of $2.30 per share and revenue of $6.4 million. Earnings estimates have also been upped slightly over the past three months, so an earnings surprise could be in the cards. Now, ALAR has been on an incredible run in 2024 – surging more than 245% year-to-date. And I’m pleased to say that my Accelerated Profits subscribers have been able to enjoy the stock’s run. I recommended ALAR on January 2, 2024, and we’re up about 200% in seven months.  Within three weeks of my recommendation, the stock surged nearly 43%. So, on January 18, I told my subscribers to take advantage of the strength and collect one-third of our gains. Those who had invested $7,500 when I had first recommended ALAR would have claimed about a $3,500 return on their initial investment in just 16 days. Meanwhile, the S&P 500, Dow and NASDAQ are up 16.1%, 7% and 20.1%, respectively. Meanwhile, the First Trust NASDAQ Cybersecurity ETF (CIBR), which tracks cybersecurity stocks, is up 7.1%. How You Can Find Flash Trends So, how was I able to find Alarum before it took off? It all boils down to what I like to call “Flash Trends.” As I explained in Thursday’s Market 360, Flash Trends are when stocks make a series of sharp, fast moves up. They can be hard to pinpoint, but thanks to my proprietary stock-picking system, I’ve found a way to catch Flash Trends before they occur. After countless hours of research and crunching trillions of data points, I discovered that eight “precursors” – including positive earnings revisions and sales growth – that indicate a Flash Trend is on its way in the very near term. A precursor is a sign that an event is likely to happen in the future. Many events in life are often preceded by precursors. For example, family history and high cholesterol can be precursors to heart disease. In a less distressing example, the smell of ozone and pets acting weird can be precursors to a thunderstorm. Such precursors can also clue us into the likelihood of Flash Trends. To learn more about Flash Trends, watch my Flash Trend Event briefing here. In this briefing, I tell you everything you need to know about my quantitative system… those eight precursors… and more. I also share where you can find the four stocks my system targeted that are set to experience Flash Trends. In each of these companies, we see all eight precursors aligned in the prime position. I believe any of these stocks have the potential to hand you 100% gains in the next six months. You can find the Flash Trend Event briefing here. (Already an Accelerated Profits member? Click here to log in to the members-only website.) Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق