Is Amazon a Buy After a Record-Breaking Prime Day? Dear Reader, Have you ever heard the expression “Christmas in July”? The saying was first used back in 1933, at a girls’ camp called Keystone Camp in North Carolina. The camp would have two days of carolers, a Christmas tree, fake snow, and, of course, gift-giving. It kept the tradition going every July thereafter, and the phrase has evolved to mean any summertime event that evokes Christmastime.  Source: Southern Living

But this isn’t the only two-day holiday that happens in July. There is also Amazon Prime Day.

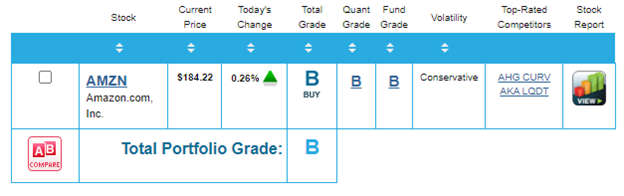

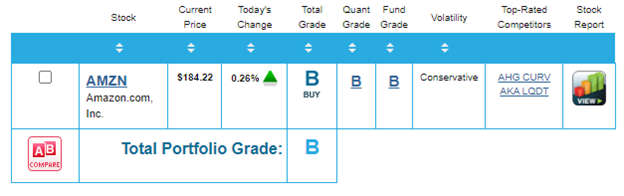

Amazon.com, Inc. (AMZN) held its first Prime Day back in 2015 to celebrate the company’s 20th birthday – and it was a huge success. In fact, more shoppers bought from Amazon on its inaugural Prime Day than they did on Black Friday the year before. Since then, the extravaganza expanded into a two-day event. Prime shoppers have scored deals on arts and crafts, bedding, backpacks, laptops, baby care, beauty products, and wireless technology. Christmas in July, indeed! This year’s Prime Day – held on Tuesday, July 15, and Wednesday, July 16 – marked the event’s 10th anniversary and was another record-breaking one for Amazon. So, in today’s Market 360, let’s dig into the Prime Day numbers. We’ll also discuss how Amazon stock historically responds after Prime Day, and we’ll see if it followed precedent this year. We’ll consider why Amazon may be a good long-term investment but not a great short-term buy, and I’ll share where you can find stocks that I expect to make big, short-term moves. Let’s get started. The Numbers Are In… Analysts’ expectations were high for this year’s Prime Day holiday. Sales were forecasted to be nearly $14 billion, almost $2 billion above the $12.7 billion in sales in 2023. Tuesday Prime Day sales were anticipated to increase 11.3% year-over-year to $7.1 billion and Wednesday Prime Day sales were estimated to rise 9.2% year-over-year to $6.9 billion, according to Adobe Analytics. This year, Prime Day knocked it out of the park. Prime Day sales hit a record $14.2 billion – an 11.8% increase from a year ago. Company management cheered the news in a press release Thursday morning: Prime Day 2024 was Amazon’s biggest Prime Day shopping event ever, with record sales and more items sold during the two-day event than any previous Prime Day event. During the 48-hour shopping event, Prime members globally saved billions on deals across every category. With Amazon’s vast selection at some of the lowest prices of the year so far, millions more Prime members shopped the two-day shopping event compared to Prime Day 2023. The opportunity to save big meant a record-breaking number of customers signed up for Prime in the three weeks leading up to Prime Day, with millions of new members worldwide. According to Numerator, a company that tracks online purchases, the average order on Prime Day 2024 was $57.97, compared to $56.64 in 2023. The average cost per item was $28.06. You can see some of the top Prime Day purchases below…  A "Prime" Opportunity to Buy Amazon Stock? Prime Day is historically good for Amazon stock. According to The Dow Jones Market Data, the day after the event, AMZN usually trends higher. It increases an average of 0.2%, an average 1.7% the following week and an average 4.3% the following month. That's not the case this year. Shares of Amazon slipped more than 2% on Thursday, though it’s worth mentioning that some of this weakness was likely related to the broader market selloff. The S&P 500 fell 0.8%, the NASDAQ dipped 0.7%, while the Dow dropped 1.3%. So, does the weakness represent a good opportunity following Amazon’s successful Prime Day? Well, according to my Portfolio Grader, that would be a yes. As you can see in the chart below, the stock holds a B-rating.  Amazon also earns a B-rating for its Quantitative and Fundamental Grades, which tells us that both institutional buying pressure and fundamentals are solid as well. Of course, the B-rating for Amazon’s Fundamental Grade isn’t surprising when you consider expectations for its second-quarter earnings report in August. Currently, the consensus estimate is for earnings of $1.02 per share on $148.5 billion in revenue. That represents 56.9% year-over-year earnings growth and 10.5% year-over-year revenue growth. In other words, Amazon is a good long-term buy. Finding the Big, Short-Term Movers However, if you’re looking for big short-term gains, I don’t expect you’ll find that with Amazon right now. The stock is up about 21% this year, barely outpacing the NASDAQ’s 18% gain and the S&P 500’s 15% return, though it has nearly tripled the Dow’s 7% rise. I also don’t see enough signs that Amazon is about to experience a “Flash Trend,” which is when a stock’s gains appear in short, quick moves. The fact is the eight “precursors” – sales growth, earnings growth and the like – my quantitative stock-picking system uses that indicate a Flash Trend is on its way in the very near term have not fully lined up for Amazon. Now, if you are looking for massive gains in a short period of time, then you’re in luck. My quantitative system recently targeted four stocks that are set to experience Flash Trends. In each of these companies, we see all eight precursors aligned in the prime position. I believe any of these stocks have the potential to hand you 100% gains in the next six months. To learn more about Flash Trends and how to access these recommendations, click here. Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق