Apple Bites Into AI… Does That Mean You Should Take a Bite Out of Apple Stock? Dear Reader, Apple Inc. (AAPL) kicked off this week with its annual Worldwide Developers Conference (WWDC) at Apple Park in California.

The WWDC is where developers can attend sessions throughout the weeklong event and meet with Apple engineers. Typically, this is a highly anticipated event, as Apple uses the WWDC to showcase new software and technologies in the macOS, iOS, iPadOS, watchOS and tvOS families, as well as other Apple software.

Now, what’s interesting about Apple is that although it’s part of the “Magnificent Seven” – Alphabet, Inc. (GOOG), Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA) and Tesla, Inc. (TSLA) – it’s the only one that hadn’t made its own generative AI.

Well, that finally changed on Monday, when Apple CEO Tim Cook revealed Apple Intelligence. So, in today’s Market 360, I’ll highlight a few of Apple Intelligence’s capabilities, and then I’ll share if Apple’s foray into AI makes the stock a buy right now. Introducing… Apple Intelligence Apple Intelligence, according to Apple, will build generative AI “into your iPhone, iPad, and Mac to help you write, express yourself, and get things done effortlessly.”

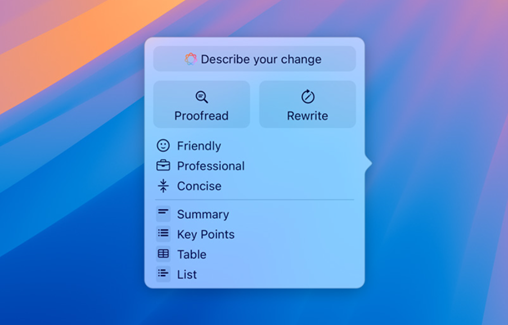

For example, Apple Intelligence will power a new feature called Writing Tools, shown below. With this tool, users can use AI to proofread, rewrite or summarize a text. They can also select a certain tone for their messages, including “friendly” and/or “professional.”  Source: Apple

Along with these new features, Apple Intelligence gets Siri an upgrade, or as Apple says, “superpowers.”

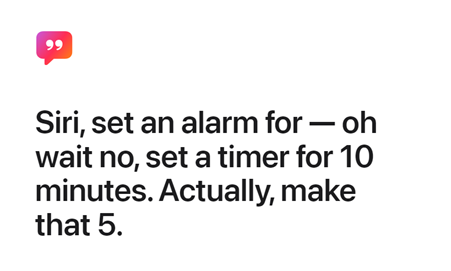

One of these superpowers includes voice-activated action across apps. For instance, if a user has drafted email that they want to send, all they have to do is ask Siri to send the email. The voice assistant knows which email is referenced, which app it’s in and sends it. Apple claims the user doesn’t have to lift a finger – literally. Siri will also have a richer understanding of language, allowing users to communicate more easily. As the image below shows, a clear, concise sentence is no longer needed to give Siri a command.  Source: Apple

Siri now understands directions, regardless of backtracking or interruptions. The voice assistant also remembers information from a previous request, providing a more natural conversation.

To support some of these AI capabilities, Apple also announced a partnership with OpenAI at the WWDC24 event. Any user requests that Apple Intelligence can’t field will be directed to ChatGPT, OpenAI’s well-known generative AI chatbot.

Apple is not paying OpenAI for the use of ChatGPT… but is providing Sam Altman’s company access to millions of new users.

Apple Intelligence will run on Apple Silicon, chipsets the company developed in-house for its own products. Additionally, the computer processing will be done on a user’s own device, rather than at a data center. Like Apple, many enterprises have been migrating huge portions of their processing infrastructure from offsite data centers back to their own premises. This type of local AI is known as “on-premises AI.” This change helps to ensure the privacy of personal information.

Apple Intelligence will be available in beta this fall, but the company’s rivals don’t need to worry – at least not yet. Apple products still have a limited capability and will take time to gain traction. What This Means for Apple Stock Interestingly, Wall Street’s reaction to Apple Intelligence was a little lackluster. Shares of Apple fell about 2% on Monday following the announcement.

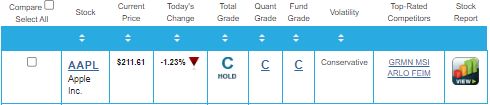

But given that the company is now fully in the generative AI game, does that mean you should buy the stock? Well, according to my Portfolio Grader… don’t buy it, but don’t sell it, either. As you can see below, Apple currently earns a C-rating, making it a "Hold."  The reality is Apple’s fundamentals just aren’t there. I may get more optimistic on the stock if the analyst community raises its earnings estimates, but right now they are largely unchanged. For the second quarter, the analyst community is forecasting 2.4% sales growth and 5.6% earnings growth. Personally, I think what will really propel Apple stock higher is its $2,499 folding iPhone, which is expected to be announced in September.

The truth of the matter is just because a company is involved in AI, doesn’t make it an automatic buy.

In fact, I recently predicted that an AI market bust is coming , similar to what happened during the dot-com bust. During this market shakeout, many of today’s high-flying AI stocks are going to crash and burn like countless internet stocks did back in 2000.

Just as Apple did this week, many companies are hyping up their AI all because they plug into ChatGPT. But what you don’t see is that many of these companies aren’t fundamentally superior picks. Without the earnings growth to propel stock prices higher, many of these companies are going to eventually crash back down to Earth. Some may even disappear forever.

On the flipside, there will be a handful of stocks that are not only going to survive this time but thrive in the years to come. And that’s why I’ve put together this urgent video to help you situate yourself on the right side of this bust.

In this special video , I offer the stock tickers I believe you should be avoiding at all costs during the AI meltdown as well as the ones that could turn into an everyday millionaire in relatively short order.

This research could be the difference between suffering huge losses or retiring far earlier than expected.

Click here to watch my urgent video now.

(Already a Growth Investor subscriber? Click here to log in to the members-only website now.) Sincerely, |

ليست هناك تعليقات:

إرسال تعليق