Why April Was Supposed to be a Strong Month for the Market... Here’s What Happened Instead | | | Editor’s Note: Hi, folks. Before we get into our Market 360 for the day, I wanted to take a quick minute to highlight an exciting (and free) opportunity for you.

Yesterday, we handed the reins over to Jonathan Rose, a 20-year market veteran who has made over $10 million from trading over the course of his career. And his passion is sharing his knowledge of Wall Street with everyday investors by providing live education and trading analysis daily before the market opens.

We recently partnered with Jonathan to bring you the Masters in Trading Summit , which will take place next Wednesday, May 8, at 10 a.m. Eastern.

The best part? It is completely free to attend!

During the summit, Jonathan will be revealing the #1 indicator that helps market makers find trades that go up 90.3% of the time. This strategy works in bull markets, bear markets, and everything in between… and it could help you make gains of 197%, 317%, even 1,147% in 30 days or less.

You won't want to miss this! Go here to sign up now.

| |

Dear Reader,

Stocks ended the month of April in the same fashion that they started the month: lower.

The fact is, April did not live up to its reputation as being a seasonally strong month. Over the past four weeks, all of the major indices took investors on a rollercoaster ride that left many screaming in frustration and more than a little nauseous.

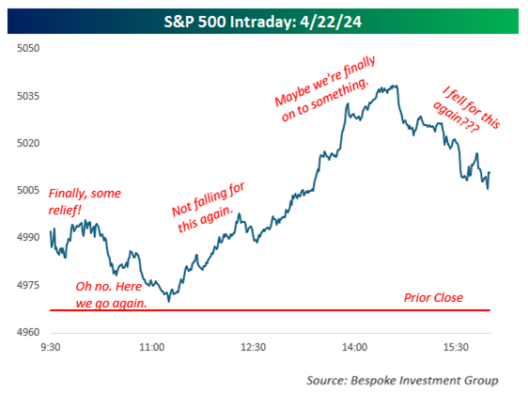

On some days, the S&P 500 would give folks hope, opening and trekking higher in early intra-day trading. But then these gains were more often than not erased in afternoon trading.

Our friends at Bespoke recently published a comical chart of how investors’ emotions have been jerked around in April, using intraday trading on Monday, April 22 as an example.  Given the herky-jerky trading, all of the major indices – S&P 500, Dow and NASDAQ – have declined more than 2% over the past four weeks. The good news is that the stock market finally broke its April losing streak, with the S&P 500 up 2.7% last week, even after last Thursday’s decline. Unfortunately, all the indices tumbled again and ended the month in the red. So, in today’s Market 360, I’ll share the main culprit for April’s weakness. Then I’ll share why I’m not worried about April missing the mark this year and how you can feel confident in your portfolio for the remainder of the year. Why Was April Uncharacteristically Weak? So, what was the primary culprit for the past month’s weakness? Well, folks, it’s simple… interest rates.

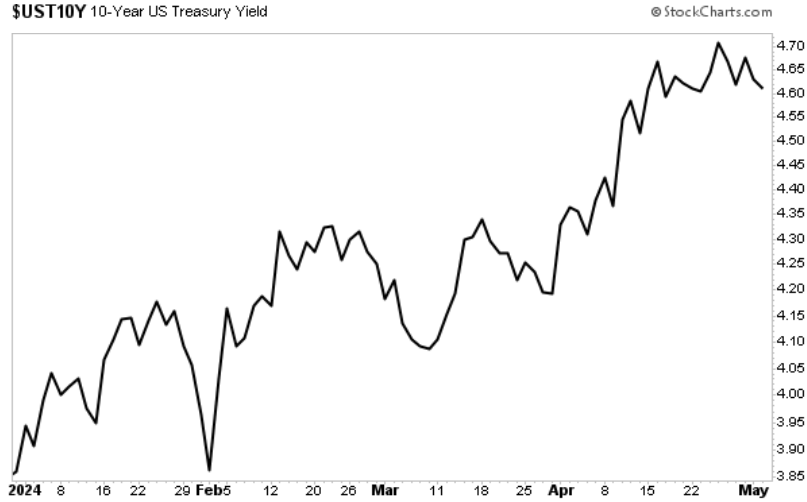

Treasury yields started to climb higher as soon as we flipped the calendar to April. The 10-year Treasury yield rose from 4.2% on March 29 to a high of 4.74% on April 25.  While Treasury auctions added to the climb last week, inflation was also a factor in the recent rise in Treasury yields. Consumer inflation continued to tick higher, with headline Consumer Price Index (CPI) and core CPI (excluding food and energy) up 0.4% in March. Ironically, the consumer inflation problems remain related to higher shelter costs (e.g., owners’ equivalent rent), as well as higher prices at the pump.

Federal Reserve Chair Jerome Powell recently confirmed that there has been a “lack of progress” on the inflation front. And that was clear in the latest Personal Consumption Expenditures (PCE) index report.

You may recall that core PCE, which excludes food and energy, is the Fed’s favorite inflation indicator. Well, core PCE rose 0.3% in March and was up 2.8% in the past 12 months. Economists expected a 0.3% month-to-month rise and a 2.7% year-over-year increase.

I should also add that last Thursday’s GDP report also revealed that headline PCE rose at a 3.4% annual pace in the first quarter, compared to a 1.8% annual pace in the fourth quarter. Core PCE, which excludes food and energy, increased at a 3.7% annual pace in the first quarter. That reading comes on the heels of two straight quarters of 2% annualized inflation. Economists had expected a 3.4% annual pace.

In other words, it will take more time for inflation to fall to the Fed’s 2% target level – and in turn, more time before the Fed commences with rate cuts.

The latter is what really threw investors into a tizzy in April, as many – myself included – anticipated that the Fed would cut key interest rates for the first time in June. The European Central Bank (ECB) and Bank of England (BOE) are both likely to cut key interest rates in June, and I expected it to be a coordinated global rate cut, with the Fed also slashing rates.

However, the Fed has now telegraphed that it will not likely cut key interest rates in June; rate cuts are now postponed until July or even later this year.

In fact, the latest Federal Reserve statement on Wednesday stated that there has been “a lack of further progress” on inflation declining to its 2% annual rate. But in its best doublespeak, the FOMC statement said the risks to achieving its employment and inflation goals have moved towards better balance over the past year.

To translate, the Fed thinks it is achieving its goal, which was deemed to be dovish.

Furthermore, they also said it will slow down its pace of quantitative tightening, which caused Treasury bond yields to decline. So, that at least was a positive statement and something to look forward to as we put the month of April behind us. Have No Fear, Earnings Season is Here Now, starting in May, investors’ attention should shift to quarterly earnings announcements, so I’m not worried about April's disappointment.

The fact is earnings are working, folks. Companies that are posting positive earnings surprises and provide strong forward-looking guidance have been rewarded – i.e., their shares have soared higher. Just take my Growth Investor stock Eli Lilly & Company (LLY), for example.

Shares of LLY shot higher on Tuesday morning following the company’s quarterly earnings beat and increased guidance. First-quarter earnings jumped 60% year-over-year to $2.34 billion, or $2.58 per share, up from $1.46 billion, or $1.62 per share, in the same quarter a year ago. Analysts expected first-quarter earnings of $2.46 per share. Not only that, but due to the success of LLY’s breakthrough weight loss and diabetes treatments, Eli Lilly also increased its full-year revenue guidance by $2.0 billion. The company now expects 2024 revenue between $42.4 billion and $43.6 billion, up from $34.12 billion in fiscal year 2023. Full-year earnings per share are forecast to be between $13.50 and $14.00.

Since adding LLY our Growth Investor Buy List in August 2023, we are up by nearly 35% - roughly double the S&P 500 during that time. And thanks to LLY’s superior fundamentals, I see no signs of that growth slowing down. How You Can Take Charge of Your Portfolio So, following the rocky month of April, you have a choice. You can can either react like a dog chasing its tail, or you can do what we’re doing at Growth Investor, which is wait for wave-after-wave of positive first-quarter sales, earnings and guidance to dropkick and drive stocks higher. If you’re like me, then you probably prefer the latter.

Now, I do recognize that it can be hard to find stocks that you can feel confident will post positive earnings results. That’s where my Growth Investor service can help. Our two buy lists (High-Growth Investments and Elite Dividend Payers) are chock-full of the crème de la crème in the market.

These are stocks that are poised to grow in any environment. In fact, right now, my average Growth Investor stock is characterized by 17.3% average sales growth and 135% average earnings growth – and posts an average 12.2% earnings surprise. As a result, I expect positive earnings surprises to continue to propel my Growth Investor stocks significantly higher in the upcoming weeks.

So, if you join me at Growth Investor, you’ll get immediate access to both of these Buy Lists today. Not only that, but you will also get access to my Monthly Issues, Weekly Updates, Special Market Podcasts – and much more.

Click here to sign up for Growth Investor now.

(Already a Growth Investor subscriber? Click here to log in to the members-only website now.)

Sincerely,

|

ليست هناك تعليقات:

إرسال تعليق