An Under-the-Radar Way to Profit from the AI Boom Editor’s Note: The stock market will be closed next Monday, May 27, for the Memorial Day holiday. The InvestorPlace offices and customer service department will also be closed next Monday. We hope you enjoy the long weekend! Dear Reader, AI has become a familiar term on Wall Street. By now, we know the buzz is so strong that any developing news on AI can make significant waves in the market.

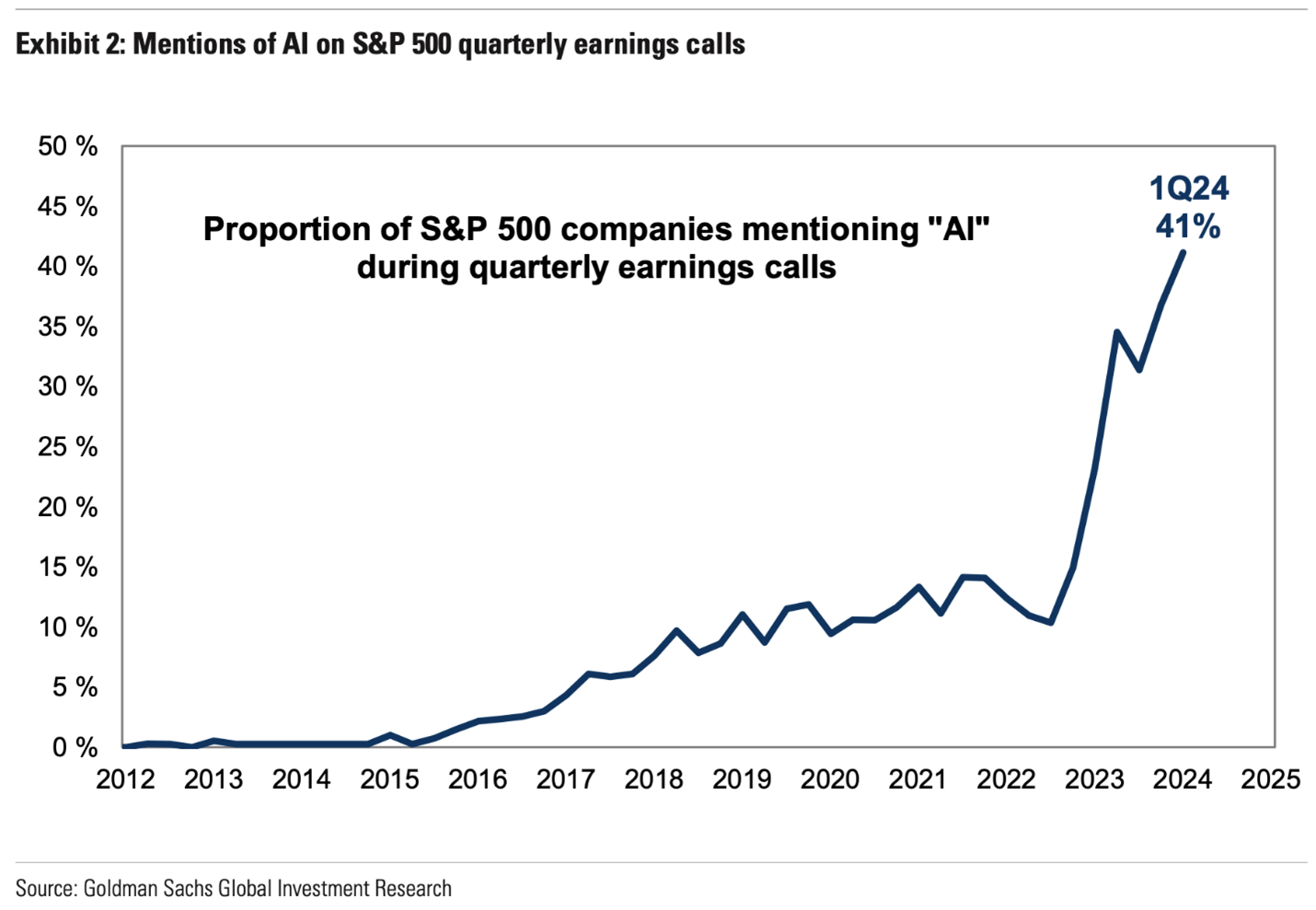

According to Goldman Sachs, 41% of S&P 500 companies mentioned the term “AI” during their fourth-quarter conference calls.  Interestingly, many of these companies aren’t even in the tech sector.

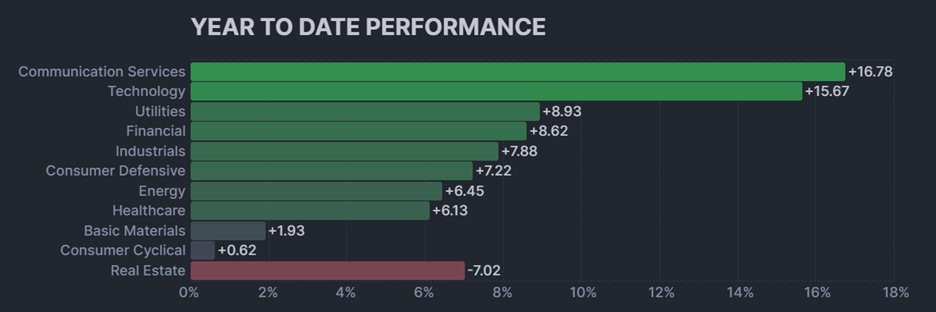

Instead, another sector is emerging as a critical component of the AI revolution that may surprise you. In fact, this sector has helped propel AI to being one of the best-performing sectors of the year.

I’m talking about the utility sector.  Source: finviz So, in today’s Market 360, I’ll explain how utilities are a great way to profit from the AI boom. I’ll explain how we’ve profited from this trend and share one particular stock that my Growth Investor subscribers have made a killing on in a very short amount of time. And finally, I’ll explain another way you can profit from the AI boom. The Real Opportunity in the AI Boom The fact is AI demands a lot of electricity.

A Wells Fargo research report indicated that U.S. electricity demand is set to grow nearly 20% by 2030 due to the AI boom. Additionally, data center electricity consumption is expected to triple and account for 7.5% of U.S. consumption by 2030.

The U.S. power grid is already stretched, and the reality is we do not have enough electricity to keep up with the increased demand for AI. Wall Street is starting to catch on to this fact, which is why the utility sector has been the best-performing sector in May so far. It’s also why most utility stocks have reached overbought, and even extremely overbought, status this year.

Personally, I believe our opportunity to profit from this lies in infrastructure. You want to own companies that are not only helping build infrastructure for data centers and the cloud, but also utilities.

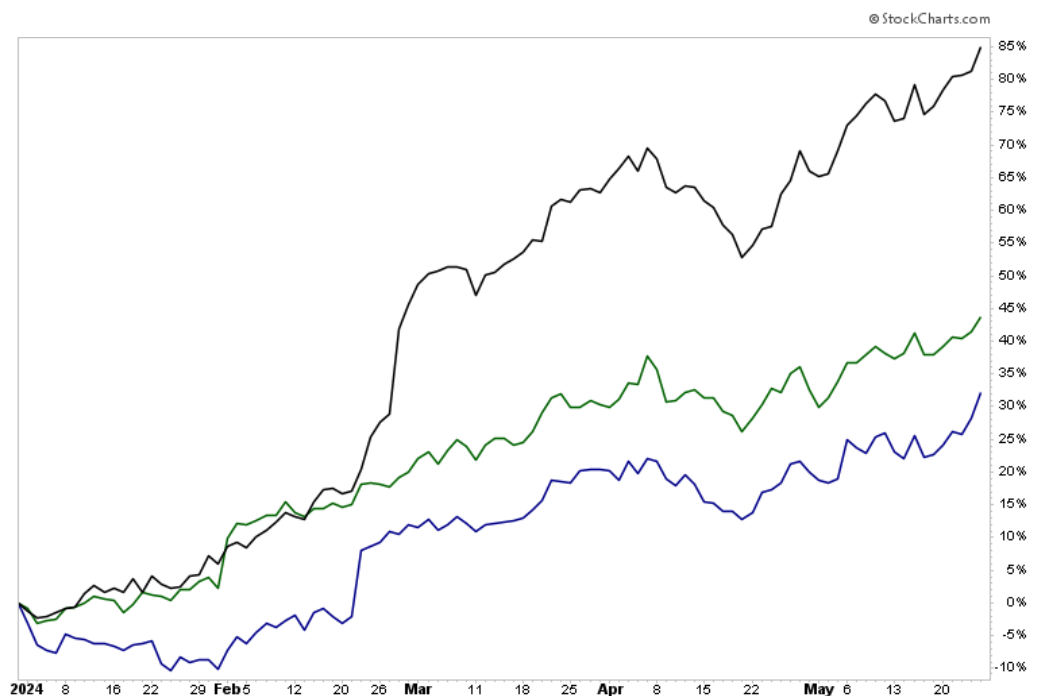

As a matter of fact, we already have three such companies in one of my Growth Investor Buy Lists.

Each one of these companies is experiencing strong demand for their solutions and services. They’re also posting wave-after-wave of positive earnings and increased outlooks. As a result, these three stocks have rallied strongly so far this year: 84%, 44% and 32%, respectively, as of this writing.  My favorite of this group is a company I recommended in August 2023.

It’s called EMCOR Group, Inc. (EME).

The company provides electrical and mechanical construction, energy and industrial infrastructure and building services. It also provides data center services, electrical maintenance, new construction, energy services and upgrades.

The company recently crushed estimates for earnings of $2.83 per share and revenue of $3.22 billion when it reported earnings of $4.17 per share and revenue of $3.43 billion.

Due to increased demand, the company recently upped its outlook for fiscal year 2024. It now expects 11.3% to 15.3% annual revenue growth and 16.5% to 24% annual earnings growth.

With the U.S. is looking to upgrade to more energy-efficient systems and onshore more chip production, EMCOR is directly benefitting.

That’s why my Growth Investor subscribers who followed the initial recommendation are up over 80% in roughly nine months. Thanks to the company’s superior fundamentals and the ongoing AI boom, I think more gains lie ahead... How to Prepare for the Next Wave of AI Now, EMCOR isn’t the only infrastructure company benefitting from the increasing demand for AI.

Like I said, there are two other companies that I shared with my Growth Investor subscribers that I expect to continue profiting from this trend, too.

The bottom line is there are other ways to profit from AI than the usual suspects. Other sectors are poised to benefit, including defense, energy and more.

In fact, I recently made a bold prediction about the upcoming presidential election and how it could spark a Second Wave of the AI boom...

I’ll tell you right now, some people aren’t going to like what I have to say. But that’s okay. My job isn’t to sugarcoat things – but to give you my honest analysis of the market and how to profit.

It all has to do with an executive order that I believe Donald Trump will issue as soon as he takes office. And it could hand massive gains to a small subset of AI stocks.

I say this because Trump issued an Executive Order in his previous presidency that laid the foundation for the current AI boom. It facilitated significant advancements, such as the world’s most powerful supercomputer and the success of ChatGPT, the famous AI chatbot developed by OpenAI.

So, as the election draws near, you’ll want to be prepared. That’s why I’ve flagged a handful of AI stocks that I believe could soar from Day One of Trump’s presidency – or even sooner. I also recently released three special reports to my Growth Investor subscribers that provide research on the companies that I believe are poised to profit from the AI Boom if Trump should get re-elected.

To learn how you can access these reports, click here.

(Already a Growth Investor subscriber? You can click here to access the members-only website.) Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

EMCOR Group, Inc. (EME) |

ليست هناك تعليقات:

إرسال تعليق