A Big Week for Inflation and Economic Data... So, When Will the Fed Cut Rates? Dear Reader, This week, Wall Street had its eye on two key inflation reports as well as a critical piece of economic data.

I’m talking about the Producer Price Index (PPI), the Consumer Price Index (CPI) and the U.S. retail sales report for April, respectively.

On Tuesday, the PPI came in hot. The CPI, meanwhile, was better than expected – while the retail sales report was worse than expected.

The latter two reports drove bond yields lower (the 10-year Treasury yield fell to 4.36%), which fueled a stunning rally in stocks this week. Meanwhile the S&P 500 broke 5,300 for the first time and the Dow broke 40,000.

With the release of these inflation reports, the big question is when will the Federal Reserve start cutting key rates?

In today’s Market 360, I’ll answer that question as well as review the CPI and U.S. retail sales numbers. Then I will share insight into a new tech revolution currently taking place with a company that could be the next NVIDIA Corporation (NVDA). Breaking Down the Latest Numbers Now, in Tuesday’s Market 360, I broke down the results of the PPI. The PPI is considered to be a leading indicator of inflation. That’s because it tells us details about the prices producers are paying, which are then usually passed on to consumers.

Here’s a quick review: - Headline PPI increased 0.5% in April, above the 0.3% economists were expecting and up 2.2% in the past 12 months.

- Core PPI, excluding food, energy, and trade, climbed 0.4% last month and was up 3.1% in the past 12 months.

- Interestingly, March’s PPI was revised lower, from an initial reading of a 0.2% increase to a decrease of 0.1%.

- Energy inflation remains a problem at the wholesale goods level. If we strip out April’s energy data, then goods prices would only be up by 0.1% (instead of 0.4%).

The PPI news dampened the mood on Wall Street, but it wasn’t for long. Because the CPI was released Wednesday morning, and investors cheered. Consumer Price Index (CPI)

Headline CPI in April rose 0.3% over the previous month and 3.4% in the past year. Economists expected a 0.4% rise in April. That’s also down from a 0.4% monthly increase and a 3.5% annual pace in March.

Core CPI, which excludes food and energy, climbed 0.3% over the prior month and up 3.6% over last year. This was in line with economists’ expectations.

Looking closer at the details… - Rent and owners’ equivalent rent each rose 0.4% on a monthly basis, matching March’s rise.

- Gas prices rose 2.8% from March to April.

- The food index increased 2.2% in April over last year, with food prices falling flat from March to April.

Shelter costs were the biggest contributor to the inflation gain in April. If this number can come down, inflation will really dissipate and will push the Fed to cut key interest rates.

U.S. Retail Sales - Retail sales were flat in April, a sharp decline from the 0.6% increase in March. Economists were expecting a 0.4% increase, so this was a big surprise.

- Excluding auto and gas, retail sales declined 0.1% last month. This is lower than economists’ expectations of a 0.1% increase.

- Non-store retailers led the retail sales decline, falling 1.2% from the previous month.

These numbers fall in line with what I’ve been watching from both the University of Michigan and Conference Board measures of consumer confidence. The latest Conference Board report in April, for example, showed a reading of 97. That was a sharp drop from a revised 103.1 in March – and economists were expecting a reading of 104. That’s its lowest reading since July 2022 and the third-straight monthly decline.

In other words, American consumers are showing signs of fatigue. They’re cutting back on spending, partly due to high prices at the gas pump. When Bad News Is Good News Right now, we are in an environment where bad news is good news. Take the retail sales numbers, for example. The report was dismal, yet the market cheered. That’s because Wall Street desperately wants the Fed to hurry up and cut rates.

The European Central Bank and the Bank of England will be cutting rates in June, and both have telegraphed approximately three rate cuts this year. Now, our Fed was going to join them in a global-coordinated rate cut. But inflation, believe it or not, is running lower in Europe than it is here. And the answer to why has all got to do with shelter costs.

We’ve seen overbuilt markets like Austin, Texas, where the prices have cracked both on rents and homes. We’ve also seen other hot markets like Florida cooling off. But it’s just not showing up in the data just yet.

The truth is the Fed is dealing with some bad data right now. It’s going to take some time for them to get a clearer picture on where things stand. In fact, Fed Chair Jerome Powell pretty much acknowledged this on Tuesday, saying he thinks the Fed needs more than a quarter’s worth of data to really know for sure if inflation is steadily falling towards its 2% target.

If we take that at face value, then this means the Fed will need more than three inflation reports to feel confident enough to cut rates. That would push the timeline to September.

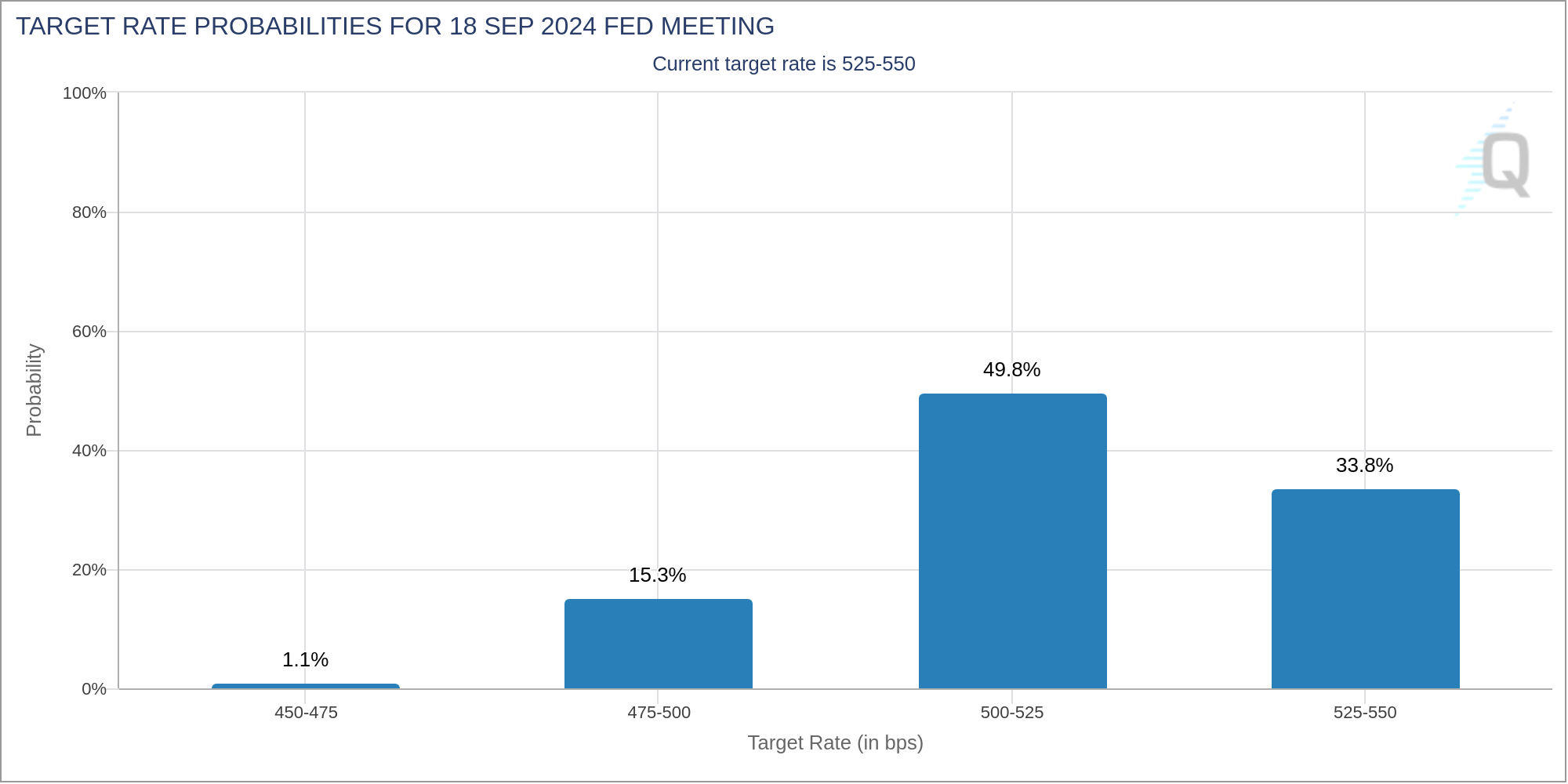

In fact, according to the CME FedWatch Tool, traders are predicting a 33.8% that rates will stay the same at the September meeting.  Personally, I think the first cut could be on July 31 – and then we could see another cut in September. The Best Defense is a Good Offense As I’ve said before, I don’t want you to worry too much about rate cuts.

Why? Because the best defense is a good offense of fundamentally superior stocks that will dropkick and drive your portfolio higher.

I’m talking about the kinds of stocks you’ll find in my Growth Investor service.

In fact, I recently told my readers about a new tech revolution that’s quietly happening behind the scenes.

It’s nearly ready for primetime – and when it is, it could overturn the dominance of AI stocks in the market. It’s called Quantum Computing-as-a-Service (QaaS).

Remember that phrase. You’re going to hear more about quantum computing (and QaaS) a lot more in the months and years to come.

QaaS is set to disrupt major industries like pharmaceutical, oil & gas, telecom, and more. And as you know, the time to get in on the market’s next big winners is before the crowd catches on.

That’s why I shared the name of a tiny company with my Growth Investor subscribers. Experts think could become the next NVIDIA...

Click here to learn how to gain access to this exclusive report now.

(Already a Growth Investor subscriber? Click here to log in to the members-only website.)

Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) |

ليست هناك تعليقات:

إرسال تعليق