Are Amazon and Apple Good Buys After Earnings? Dear Reader, We are now more than halfway through earnings season, which means that six out of the seven Magnificent Seven companies have reported their earnings.

On April 26, I covered Alphabet Inc.’s (GOOG), Meta Platform, Inc.’s (META), Microsoft Corporation’s (MSFT) and Tesla, Inc.’s (TSLA) earnings. Here is a quick review of their results: - Alphabet: Reported $1.89 in earnings per share, beating analyst estimates of $1.50 per share. Revenue reached $80.54 billion, a 15.4% increase from the same quarter a year ago.

- Meta Platforms: Reported $4.71 in earnings per share, well above analysts’ expectations of $4.36 per share. Revenue increased to $36.46 billion, a 27% year-over-year jump.

- Microsoft: Reported $2.94 in earnings per share, representing 20% year-over-year earnings growth. Revenue climbed to $61.9 billion, surpassing analyst estimates of $60.8 billion.

- Tesla: Reported $0.45 earnings per share, short of analyst estimates of $0.50 earnings per share. Revenue fell 8.6% year-over-year to $21.30 billion.

Last week, two more Magnificent Seven companies announced their earnings: Amazon, Inc. (AMZN) and Apple Inc (AAPL).

So, in today’s Market 360, I’ll break down Amazon’s and Apple’s earnings reports and reveal if they’re good buys after earnings. I’ll also give a quick preview of the last member of the Magnificent Seven’s upcoming earnings – NVIDIA Corporation (NVDA). And then, I’ll wrap up with my prediction about the artificial intelligence market. I expect it will shock many of you... Let’s Break Down the Earnings Numbers Amazon.com, Inc. (AMZN) – Tuesday, April 30

The internet retail giant reported first-quarter earnings of $0.98 per share, topping analysts’ estimates for earnings of $0.83 per share. Revenue rose 12.5% year-over-year to $143.31 billion, up from revenue of $142.55 billion last year.

Its cloud computing segment, Amazon Web Services (AWS), increased sales by 17% year-over-year to $25.0 billion.

Amazon has also been jockeying for position in the AI space as it races to launch new AI-powered services to businesses and individual users. Company management said it expects spending to support the growth of AWS to “meaningfully” increase this year from nearly $50 billion in 2023.

AWS and NVIDIA extended their collaboration to make AWS the best place to run NVIDIA’s GPUs (graphics processing unit), which will help to unlock AWS’s AI capabilities. And in March, Amazon increased its investment in the AI startup Anthropic by another $2.75 billion. That brings its investment a total of $4 billion.

Amazon also increased its revenue guidance for next quarter, projecting between $144 billion and $149 billion in revenue. Shares of Amazon rallied more than 5% in the wake of the strong earnings results and positive revenue guidance. Apple Inc. (AAPL) – Thursday, May 2

Prior to Apple’s earnings, shares had fallen 10% this year, primarily due to the company’s iPhone sales tanking in Asian markets. So, investors were closely watching Apple’s results for its fiscal second quarter to look for signs of the company regaining momentum.

Apple’s second-quarter results exceeded analysts’ expectations. The company reported earnings of $1.53 per share on $90.75 billion in revenue. Analysts expected $1.50 per share in earnings on $90.1 billion in revenue. A bright spot for Apple was their services revenue. It hit $23.87 billion, a slight beat and also an all-time record. What’s more, Apple announced a monster buyback plan. Specifically, it plans to spend $110 billion on share repurchases, marking it the largest in US history. And to further reward investors, the company is raising its quarterly dividend for a 12th consecutive year. The board of directors declared a cash dividend of $0.25 per share, an increase of 4%. All shareholders of record on May 13 will receive the dividend on May 16.

The positive earnings report and new share buyback program boosted AAPL 7% higher on Friday, May 3.

Now, I should add that investors have been waiting on pins and needles to hear the company’s plans for AI. The tech giant has remained tight-lipped on the subject, causing investors to worry that Apple may be falling behind its tech rivals, such as Amazon and Google-parent Alphabet.

CEO Tim Cook partially addressed those concerns in the company’s conference call. Here’s what he said: We believe in the transformative power and promise of AI, and we believe we have advantages that will differentiate us in this new era including Apple's unique combination of seamless hardware, software, and services integration; groundbreaking Apple silicon with our industry leading neural engine; and our unwavering focus on privacy. On Tuesday, Apple gave investors a taste of this by unveiling its latest iPad Pros with the company’s all-new M4 processor. It has a new 16-core neural engine that is said to be more powerful than any neural processing unit out there. Apple quickly noted they have been adding the M4’s neural engines to its processors for years.

The reality, however, is that what investors really want to know are the company’s plans for AI as it relates to the iPhone. And we may only know whether Apple has gotten its mojo back for sure when the company holds is Worldwide Developer Conference in June. That’s traditionally one of the windows in which Apple makes big product announcements. Are Amazon and Apple Still Good Buys? Now that we’ve reviewed their earnings, the big question is this: Are they still good buys?

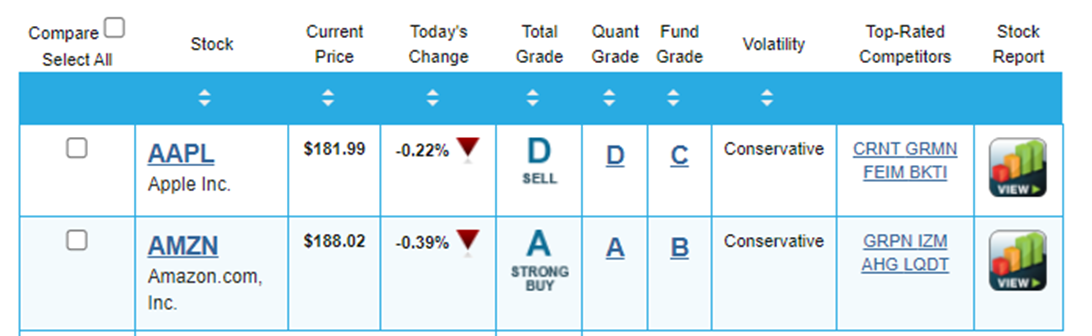

Let’s take a look at what my Portfolio Grader has to say…  As you can see, Apple receives a D-rating for its Total Grade, making the stock a “Sell.” The reality is that institutional buying pressure is weak, as evidenced by the D-rating Apple holds for its Quantitative Grade. It’s C-rating for its Fundamental Grade is also a little lacking.

Amazon, on the other hand, earns an A-rating for its Total Grade, making it a “Buy.” And given that it also has an A-rating for its Quantitative Grade, this tells us that institutional buying pressure is strong. In other words, money is still flowing into the stock. NVIDIA’s Earnings Preview Since we’re talking about the Magnificent Seven stocks today, I’d be remiss if I didn’t mention NVIDIA. The company is scheduled to report its first-quarter results on Wednesday, May 22. The consensus estimate is for earnings of $5.16 per share on $22.78 billion in revenue. That represents an earnings growth rate of 426.5% and 249.6 % revenue growth.

In other words, analysts are expecting yet another stunning set of results from NVIDIA’s quarterly earnings. You may recall that in the wake of the previous quarter’s impressive results, which beat analyst estimates, shares jumped 16% the next day.

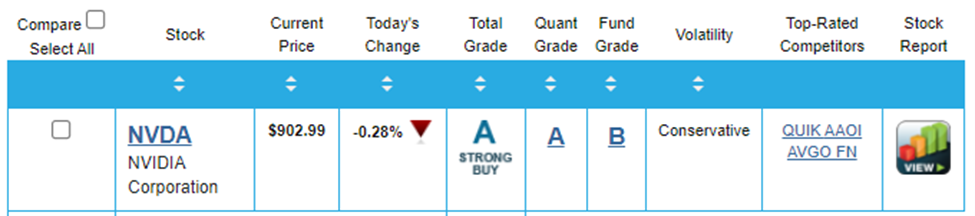

So, is NVIDIA a good buy before earnings?

As you can see below, my Portfolio Grader says “yes,” given its A-rating for both its Total Grade and Quantitative Grade.  My Bearish AI Prediction The fact of the matter is NVIDIA dominates the AI industry, so it’s no surprise that it continues to boast stunning fundamentals (and clearly has the best fundamentals out of all the Magnificent Seven stocks). And thanks to those fundamentals, I am confident that NVIDIA will one day become a $1,000 stock as AI continues to innovate and the AI industry grows.

However, given the hype surrounding AI, I am also deeply worried that folks are falling into the same trap they fell into during the dot-com boom of the 1990s.

Back in the 1990s, Wall Street and the mainstream media pushed the idea that the Internet was such a game-changing technology that the old rules about valuing stocks had to be thrown out the window.

We’re seeing the same situation play out with AI. So, I predict that the speculative frenzy around AI is going to come crashing down just like every frenzy before it. And when that crash happens… folks invested in the wrong AI stocks will be left holding the bag.

I don’t want you to be caught off guard when this crash happens. That’s why I’m issuing an urgent warning about the AI “losers,” that won’t survive – and how you can find the AI trophy stocks (like NVIDIA) that can become the cornerstone of your portfolio for the next decade.

Go here to learn more about my shocking bearish AI prediction right now.

(Already a Growth Investor subscriber? Click here to access the members-only website.) Sincerely, |

ليست هناك تعليقات:

إرسال تعليق