Why You Should Keep This Powerful Tool in Your Back Pocket Dear Reader, When I was a student at Cal State Hayward, I was given an assignment to create a formula that could precisely track and mirror the S&P 500. I spent an unthinkable number of hours learning how to research market data. And when I ran the data, things took an unexpected turn...

My model showed that my returns beat the S&P 500!

It turns out that a select group of stocks had certain characteristics in common that led to them consistently outperforming the S&P 500. And that is how my Portfolio Grader was born!

Portfolio Grader uses a simple A to F grading system to give thousands of stocks a Total Grade based on two crucial characteristics. They can make all the difference when choosing a stock that can give you consistent gains.

In today’s Market 360, we’ll talk about how my Portfolio Grader works, how it helped me find a must-own market leader, and how you can use it to find more stocks with strong fundamentals to add to your portfolio. How It Works There are two characteristics I look for that determine the Total Grade. The first is strong fundamentals, which make up the Fundamental Grade.

Now, there are eight specific factors I look at that gauge a stock’s Fundamental Grade…

1. Sales Growth: This is just as it sounds, and it’s the hardest number to fake. Great companies continually look for ways to increase their month-to-month and year-to-year sales so they can expand and deliver big returns to their shareholders.

2. Operating Margin Growth : The margin shows the difference between production costs and retail prices. The wider the difference, the better! We want to see a company that’s able to expand its operating margins. They can raise prices without seeing their sales decline. On the flip side, if a company keeps having to reduce prices just to entice buyers, that’s not a good sign.

3. Earnings Growth: This determines whether a company has earned more money year-over-year. It is measured in earnings per share. It is the company’s earnings divided by the number of shares outstanding. I want to see continual, year-over-year growth.

4. Earnings Momentum: This tells me the rate of a company’s growth based on its earnings. If it’s going up, then you’ll likely see a bigger return on your investment.

5. Earnings Surprises: An earnings surprise is when a company beats analysts’ earnings estimates. It’s measured as a percentage and calculated as the difference between actual earnings and consensus estimates. If a company is consistently beating estimates, its share price can rise significantly.

6. Analyst Earnings Revisions: I like to see earnings estimates increased by Wall Street analysts. Upward revisions are not taken lightly and will only be done if they have superb confidence in those increases. Besides, if they choose to raise their revisions, then it’s likely that the stock will outperform those expectations.

7. Cash Flow: This measures the flow of cash earned and spent relative to its market value. It shows how much money a company has left over after paying for the costs of its business. The more cash they have, the better!

8. Return on Equity: This is the amount of profits a company generates with the money shareholders have invested. It tells me how efficiently a company is managing its resources. The second characteristic I look for is the amount of buying pressure, which makes up the Quantitative Grade.

Buying pressure is a fancy way of saying where the “smart money” is flowing. This “smart money” comes from large institutional investors, such as investment banks, hedge funds or cities, who invest in the stock. The more “smart money” coming in, the more momentum the stock has to rise.

The Fundamental Grade and Quantitative Grade make up the Total Grade. This grade gives you my current recommendation in the form of a letter grade, and you can see the breakdown below. - A=Strong Buy

- B=Buy

- C=Hold

- D=Sell

- F=Strong Sell

How to Use This Tool With Your Portfolio To find a stock’s grade, all you have to do is go to the Portfolio Grader, type in the stock and click Submit.

Not only can you do that, but Portfolio Grader can do exactly what it says: Grade your portfolio. Simply type in a combination of stocks and you will find the Total Portfolio Grade along with my Portfolio Review.

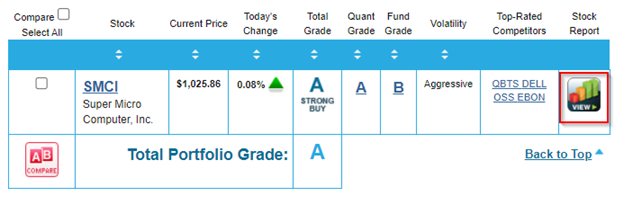

You can find a specific fundamental grade for a stock by clicking the “Stock Report” button shown below.  You will also find timely stock news and commentary, live stock quotes and a detailed view of my fundamental stock analysis.

You can even save your portfolio if you want to refer to it later! Just remember that you have to be logged in before you can save.

Portfolio Grader is updated weekly every Monday morning, so be sure to check in every week to see if any of your stock’s grades have changed. Finding Market Leaders Ahead of the Crowd Now that you know the ins and outs of my Portfolio Grader, you’re probably wondering if it’s going to give you results.

Well, it can.

For example, in my premium Growth Investor service, it led me to one of the highest-performing stocks in our High-Growth Buy List – Novo Nordisk A/S (NVO).

Novo Nordisk is a biotechnology company that develops treatments for weight loss, diabetes and other chronic illnesses. You may have heard of Ozempic, one of their diabetes treatments, or Wegovy – a similar treatment that is being used for weight loss.

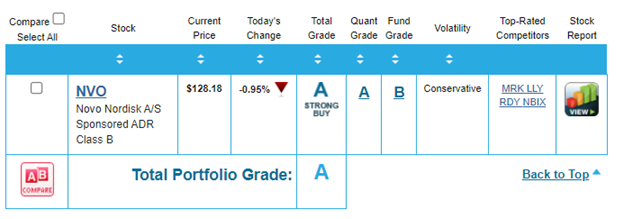

I first recommended NVO to my Growth Investor subscribers in late January of 2023. At the time, fourth-quarter earnings were forecast to grow 18.3% year-over-year to $0.84 per share, up from previous estimates for $0.77 per share. It also had a Quantitative Grade of an A and a Fundamental Grade of C, with a Total Grade of A.

When their earnings came out on February 1, 2023, I was impressed. Diabetes and obesity care sales rose 29% year-over-year while rare disease sales climbed 7% year-over-year. Ozempic sales increased 45% year-over-year. NVO continued to impress throughout 2023. But when NVO’s earnings for fiscal year 2023 were released on January 31 this year, they smashed them out of the park. Total fourth-quarter sales increased 31% year-over-year, with obesity care sales jumping 38% year-over-year. The company reported fourth-quarter earnings of $3.17 billion, or $0.71 per share, and total sales of $9.51 billion. Analysts expected earnings of $0.65 per share on $8.81 billion, so they posted a 9.2% earnings surprise.

Over at Growth Investor , I have boasted that NVO is one of the top market leaders. And that is evidenced by its superior fundamentals and persistent institutional buying pressure. Right now, we’re up by about 90% on NVO – crushing the S&P 500’s roughly 30% gain during that time.  So, should we expect even more gains ahead?

Well, according to Portfolio Grader, yes! It currently has a Quantitative Grade of A and a Fundamental Grade of B as well as a Total Grade of A.  Based on NVO’s stellar recent performance, as well as its superior fundamentals and institutional buying pressure, I consider it a must-own stock for any growth-oriented portfolio.

The reality is that I could give you example after example of how my Portfolio Grader can give you results like this. But instead, I encourage you to try it yourself! It’s free to use and it distills all of the factors I previously mentioned into an intuitive, easy-to-understand format.

Now, I should mention that if you would like to take it a step further and have my own personal picks delivered straight to you, then you can find NVO and other fundamentally superior stocks like it in my Growth Investor service.

Our Buy Lists contain the crème de la crème from all of the stocks in my database. So, if you want to find companies that have superior fundamentals and persistent institutional buying pressure, I encourage you to learn more about my Growth Investor service now!

(Already a Growth Investor subscriber? Click here to access the members-only website.) Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Novo Nordisk A/S (NVO) and Super Micro Computer, Inc. (SMCI) |

ليست هناك تعليقات:

إرسال تعليق