The Fed Leaves Interest Rates Unchanged – What Investors Need to Do Now Dear Reader, Earnings season was front and center in the first half of the week, with earnings results coming in fast and furious on Monday and Tuesday.

But the Federal Reserve stole all the attention on Wednesday.

Wednesday afternoon, the January Federal Open Market Committee (FOMC) statement was released. As expected, the Fed stood pat and left key interest rates unchanged at 5.25%-5.50%.

However, there were a few surprises in the statement. First, the Fed noted that it “judges that the risks to achieving its employment and inflation goals are moving into better balance.” However, it then went on to say that “the economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.”

But later in the statement, it said “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Translated from Fedspeak: The Fed is not going to cut key interest rates until inflation is officially at 2%. It also means that the first rate cut won’t likely be until April. And in case there was any doubt, Fed Chairman Jerome Powell confirmed this in his press conference. He said, “I don’t think it’s likely the Committee will reach a level of confidence by the time of the March meeting to identify March as the time to [cut rates].”

This was not what Wall Street wanted to hear. As a result, stocks sold off hard in afternoon trading – the S&P 500 fell 1.6%, the Dow slipped 0.8% and the NASDAQ fared the worst, falling 2.2%.

Now, I think the Fed better hurry up and cut key interest rates. The reality is we’re beginning to see signs of deflation in wholesale prices, and if the central bank isn’t careful, it could creep into consumer prices. I should also add that the Fed’s rates are above market rates at this point (the 10-year Treasury yield stands at about 3.86% as I write this). And, historically, the Fed never fights the bond market.

So why wait?

Powell said that he wanted to see “more good data” and a “continuation of the data we have been seeing” with inflation numbers.

While the market (and I) would love the Fed to lower rates sooner rather than later, I think there’s a lot of hope in this statement. Focus on Earnings Season Until we get a rate cuts, I think investors are better served if they focus on earnings season. The reality is there is a lot of money to be made this earnings season.

Case in point: Powell Industries, Inc. (POWL).

In case you’re wondering, Powell Industries has nothing to do with Jerome Powell. Rather, the company develops and manufactures equipment and systems for electrical infrastructure. These systems are used by petrochemical plants, as well as pulp and paper mills, oil and gas producers, utilities and transportation facilities.

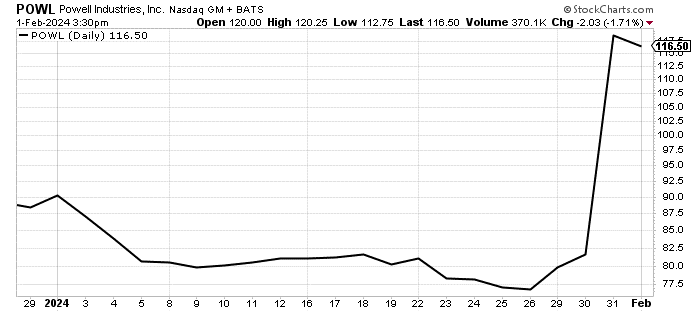

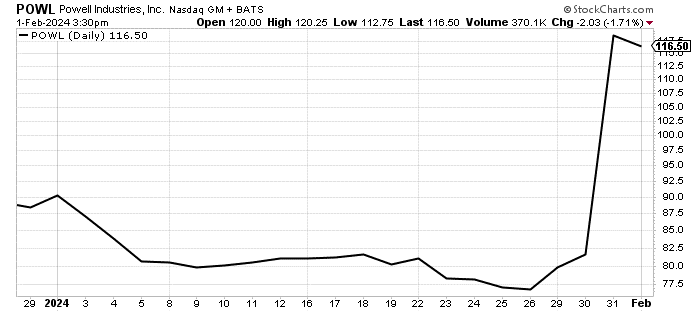

POWL is also a small-cap stock that’s flown mostly under Wall Street’s radar… until it posted phenomenal fourth-quarter earnings results Tuesday evening. First-quarter earnings surged 1,908.3% year-over-year to $24.1 million, or $1.98 per share, compared to $1.2 million, or $0.10 per share, in the first quarter of 2023. Analysts only expected earnings of $0.84 per share, so Powell Industries posted a whopping 135.7% earnings surprise. Company management noted that the first quarter is typically a slower period, but Powell Industries still reported $918 million in new orders. In turn, total revenue rose 53% year-over-year to $194.0 million in the first quarter of fiscal year 2024. That topped estimates for $182.04 million by 6.6%.

POWL skyrocketed more than 50% to a new record high on Wednesday following its blowout quarterly report.  POWL’s phenomenal results might have taken Wall Street by surprise, but I knew they were coming… and it’s all thanks to my Quantum Cash system.

At its core, Quantum Cash uses a series of AI algorithms to constantly scour massive amounts of data looking for patterns. Many of these patterns are nonlinear, meaning you’re not going to be able to see them with the naked eye. But the more data you feed it, the more patterns it can spot.

In the case of Powell Industries, my Quantum Cash system flagged the company back in December, well before the stock took off.

To learn more about my Quantum Cash system, click here and watch my brand-new presentation. During this presentation, I unveil my income strategy that’s tailor-made in the interest rate environment, as well as… - How I have been able to give readers the chance to collect three income plays a month, regardless of stagnating markets, or even market crashes.

- Why it’s the perfect income vehicle for people with smaller portfolios.

- And the revolutionary AI technology behind my Quantum Cash system.

Click here to watch this brand-new presentation now. Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Powell Industries, Inc. (POWL) |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق