Inflation and Retail Sales Reports Are Out – Here’s What You Need to Know Dear Reader, Christmas is less than a week away, and we are nearing the end of the holiday shopping season.

Now, the official start to the holiday shopping season has long been Black Friday. This term was coined back in the 1980s when, after an entire year of operating at a loss (“in the red”), stores would allegedly earn a profit (“went into the black”) on the day after Thanksgiving. They found that holiday shoppers would spend a lot of money on discounted merchandise.

Then, in 2005, as online shopping became more popular, retailers added Cyber Monday. Since then, Cyber Monday has evolved into the biggest day for online shopping sales every year. In 2005, sales totaled $484 million and have surged nearly 2,461% since then.

This year, Cyber Monday sales surged 9.6% to $12.4 billion, according to Adobe. Black Friday sales were also strong, rising 7.5% year-over-year to $9.8 billion.

This is a great first peek at the health of the consumer. But based on this year’s Black Friday and Cyber Monday sales, we can only tell that consumers will open their wallets if the items are discounted.

However, retail sales reports give us much more insight into the health of the consumer and the impact of inflationary pressures.

The November retail sales report was released last Thursday, so, in today’s Market 360, we’re going to dive into the details of the report and what they tell us about the consumer. The latest inflation reports – Producer Price Index (PPI) and Consumer Price Index (CPI) – were also released last week, so we’ll take a closer look at those, too. And then, I’ll share a catalyst that could impact inflation next year. Hint: It is not the Federal Reserve.

Let’s dig in…

The November Retail Sales Report Retail sales rose 0.3% in November, which was substantially better than economists’ consensus estimate of a 0.1% decline. Excluding vehicles and gas, retail sales rose a much more impressive 0.6% in November. October retail sales were also revised lower to a 0.2% increase. In the past 12 months, retail sales have risen 4.1%.

Looking a little closer at the details… - Spending at bars and restaurants surged 1.6%

- Electronics and appliance stores declined 1.1%

- Gas prices dropped 2.9%

- Online retail sales increased 1%

Those numbers are amazing, and they show that consumers are spending. And because retail sales are now up 4.1% in the past 12 months, they’re also higher than inflation. This is exactly what we want to happen. Now, speaking of inflation… let’s see what we learned from the PPI and CPI reports. Producer Price Index PPI, or wholesale inflation, gives us a glimpse into the prices that producers pay for goods before they reach the consumer. For that reason, they’re considered a valuable leading indicator.

The Labor Department announced last Wednesday morning that PPI was unchanged for November and rose 0.9% in the past 12 months. Core PPI, which excludes food, energy and trade, rose 0.1% in November and 2.5% in the past 12 months.

Wholesale food costs rose 0.6%, and energy prices declined 1.2% in November. Interestingly, wholesale service costs rose 0.2%, while whole good costs rose 0.1%. In October, wholesale service costs rose 0.1%, while whole good costs declined 0.8%. So, these key components rose a bit in November.

Overall, the PPI report was positive, but we have to keep an eye on wholesale service and good costs for further improvement.

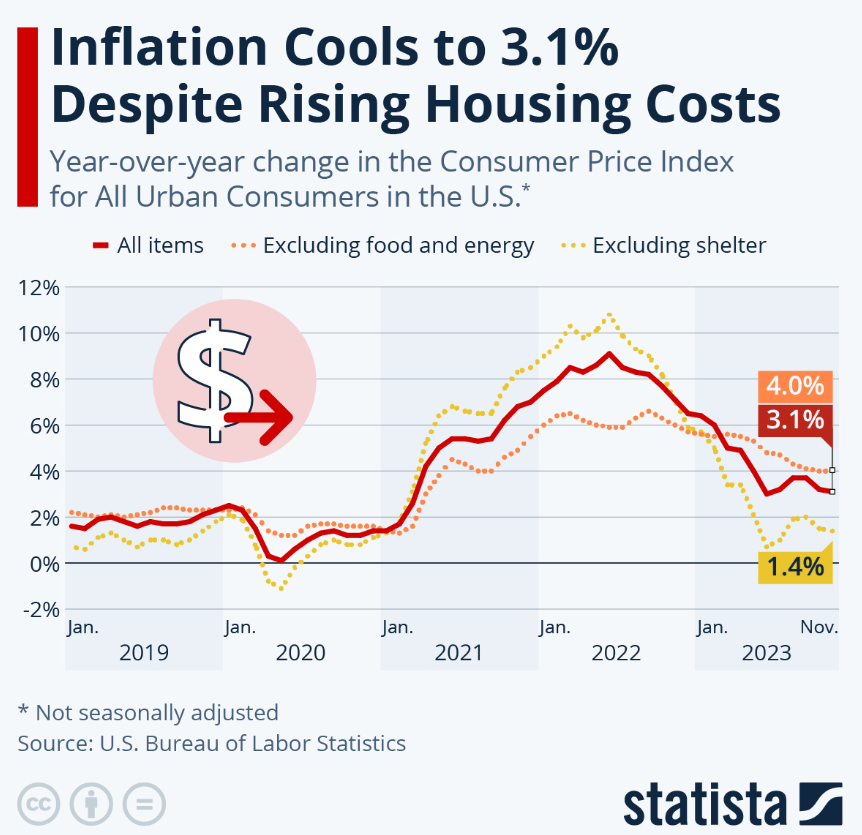

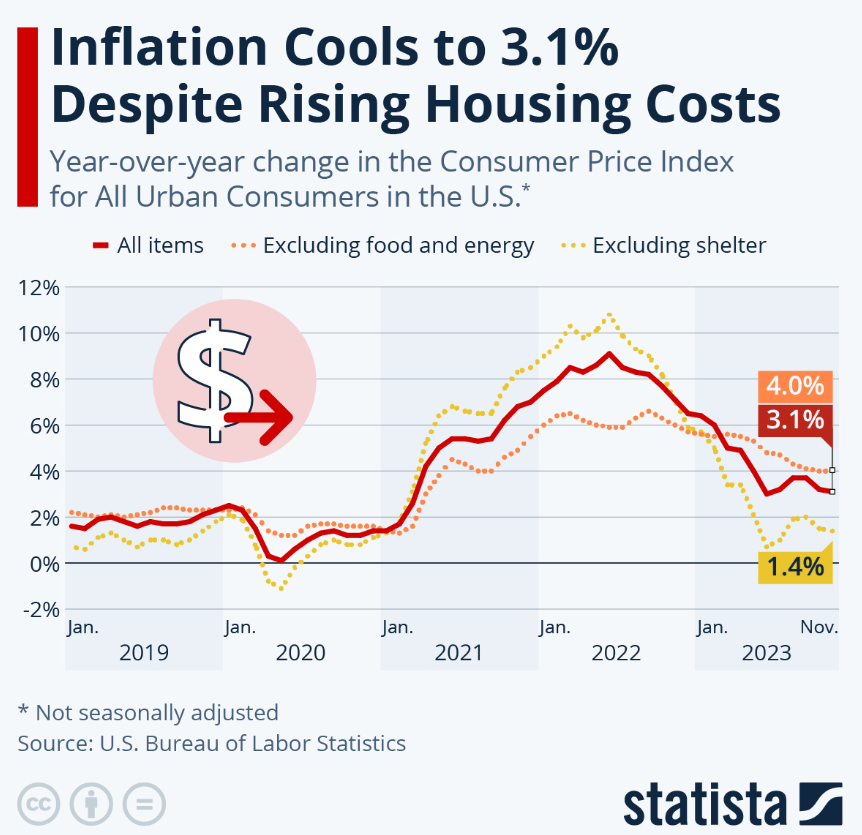

Consumer Price Index The Labor Department revealed last Tuesday that CPI, or consumer inflation, rose 0.1% in November and 3.1% over the past 12 months. Core CPI, which excludes food and energy, rose 0.3% in November and 4% in the past 12 months. As you can see in the chart below, consumer inflation is cooling down.  Food prices rose 0.2% and energy prices declined 2.3%, due largely to a 6% decline in gasoline prices. Natural gas/propane prices rose 2.8% in November due in part to cold weather. Owners’ Equivalent Rent (OER), or shelter costs, increased 0.4% in November and 5.5% in the past year.

Overall, the CPI was a bit disappointing. Economists were forecasting no change in November. And while the annual pace of inflation is decelerating, it is nowhere near the Federal Reserve’s 2% inflation target. So, the Fed will keep rates steady until inflation falls to 2%.

The bottom line: Inflation continues to cool on the wholesale and consumer levels, which bodes well for the consumer and the stock market. One Catalyst to Push Inflation Lower in 2024 I firmly believe inflation will continue to fall in 2024, but it won’t be just because of the Fed. There is another catalyst that could help bring inflation down...

I’m talking about artificial intelligence.

The reality is technology is and has always been a great weapon against inflation. It can boost productivity while lowering the cost of producing goods and services. As AI continues to evolve in the coming year, it will magnify this reality to levels we’ve never seen before.

My InvestorPlace colleagues Luke Lango, Eric Fry and I discussed how the AI boom could impact the U.S. economy and market at length during our Early Warning Summit 2024 event last week. (If you missed it, you can watch a replay here.)

Also, during the event we covered: - Our investing game plan for next year – including a strategy that could outperform the markets by 9X or more.

- Where you should – and where you shouldn’t – invest your money in the coming year.

- And three stocks we think could soar in 2024, regardless of what happens in the market.

|

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق