Inflation Is Fizzling Fast - Here's What That Means for Investors Dear Reader, There was a lot of economic data for investors to digest this week.

The latest consumer and wholesale inflation reports – the Consumer Price Index (CPI) and Producer Price Index (PPI) – as well as the most recent retail sales report were announced. And all showed the impact of the Federal Reserve’s tightening policy.

Consumers, though, are in a poor mood. Increased rates have weighed on Americans’ willingness to open their wallets, and that was apparent in the retail sales report.

So, in today’s Market 360, let’s make sense of the latest economic data reports and what investors should do now.

Let’s dive into the details… Consumer Price Index (CPI) The Consumer Price Index report for October was released on Tuesday – and it was phenomenal.

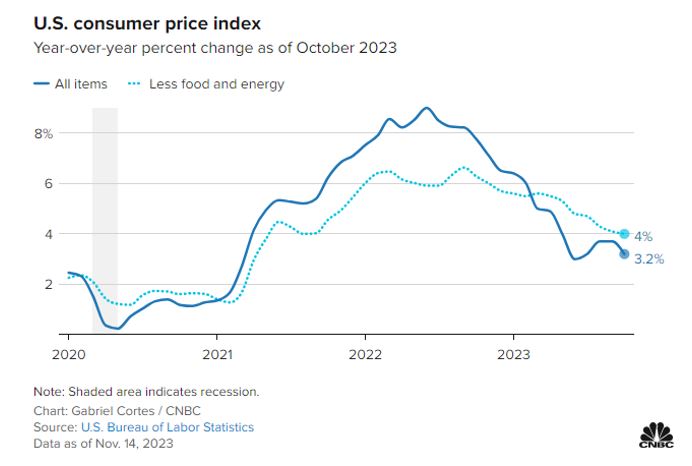

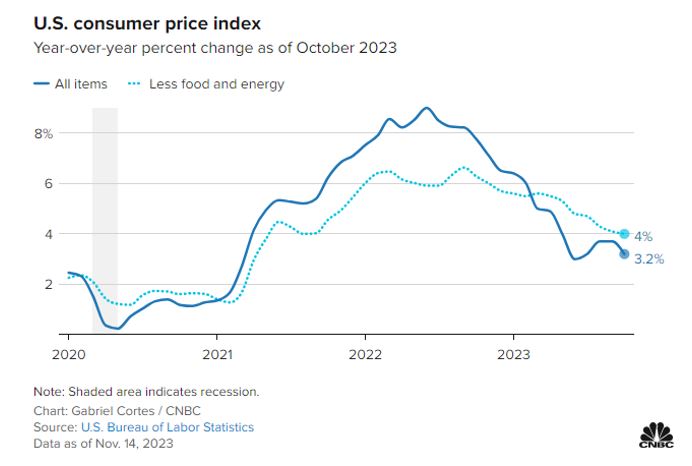

The latest CPI report showed that headline inflation was flat in October and up 3.2% in the past 12 months. As you can see in the chart below, consumer inflation is on the decline…

Core CPI, which excludes food and energy, rose 0.2% month-over-month and 4% in the past 12 months. This was also below economists’ estimates for core CPI to rise 0.3% in October and 4.1% in the past 12 months. Food prices rose 0.3% in October and energy prices declined 2.5%, led by a 5% decline in gasoline prices. Also notable is that used vehicles dropped 0.8% in October and declined by 7.1% in the past 12 months. I should also add that Owners’ Equivalent Rent (OER) rose only 0.3% in October, down from 0.6% in September, which is encouraging.

The bottom line: Consumer inflation is cooling – and that’s great news. Producer Price Index (PPI) The Producer Price Index report for October was released Wednesday morning.

It showed that wholesale inflation declined 0.5% in October, and is up 1.3% in the past 12 months, well below estimates for a 0.1% increase. Core PPI, which excludes food, energy and trade, rose 0.1% in October and was up 3% in the past 12 months. Wholesale gasoline prices declined 15.3% in October and accounted for over 80% of the October PPI decline.

Also, wholesale service costs were unchanged after rising for six months, so service inflation is cooling. The fact that wholesale inflation continues to cool off quickly bodes well for lower consumer prices in the upcoming months. October Retail Sales Report The other big news on Wednesday was that the Commerce Department announced the retail sales report for October.

The report showed that retail sales declined 0.1%, down from a 0.9% increase in September. Economists anticipated a drop of 0.3%, so it came in better than expected.

Seven out of 13 categories reported that sales declined, led by furniture, vehicle, and gas station sales. Grocery store sales rose 0.7% in October, so higher food prices might have boosted that figure. The bright spot in the report was health and beauty care spending. It rose 1.1% in October.

In the past 12 months, retail sales have risen 2.5% and are failing to keep pace with inflation, so no wonder consumer sentiment has turned sour! What This Means for Investors Overall, the CPI and PPI reports were much softer than economists had expected. So, the latest inflation reports are great news and indicative that inflation continues to moderate all around the world. Consumer spending clearly slowed down, and when you couple that with a deceleration in inflation, it means one very important thing: The Fed can cut interest rates.

You may recall that the Fed has a 2% inflation target, and the latest inflation data brings it closer to the Fed’s 2% level. I should also add that Treasury yields all along the yield curve declined sharply and also fell in the wake of the inflation reports… and that’s very bullish.

As of this writing, the two-year, 10-year and 30-year Treasury yields are now below 5%. In comparison, the federal funds rate stands at 5.25% - 5.50%. The Fed does not like to fight market rates, which means it will need to lower interest rates to get back in line with market rates.

(To get my interest rate forecast for next year, click here to become a member of Growth Investor. I share my prediction in today’s Growth Investor Monthly Issue for December. The issue will be released this evening.) So, what does this mean for investors?

It means it’s time to buy stocks!

I anticipate declining interest rates to boost stock prices next year. We got a sneak peek of this when Treasury yields dropped in the wake of the CPI report; the S&P 500 and Dow soared more than 1%, while the NASDAQ surged more than 2%!

So, we could be in for an explosive 2024, and you don’t want to miss out on the potential rally. If you have cash to invest, the last week of December is going to be the time to jump in feet first.

Of course, you don’t want to invest in any stock… you want to focus on those with superior fundamentals.

As important as a decline in interest rates will be to drive stocks higher, the upcoming earnings season announcements will play a critical role in the broader market’s potential rise, too. The fact of the matter is earnings results for the next three quarters will be stunning, due to favorable year-over-year earnings comparisons.

Now, if you’re not sure where to find the crème de la crème of fundamentally superior stocks, then consider my Growth Investor service. My Growth Investor stocks are characterized by 3.5 times more sales growth and a whopping 41.8 times more earnings growth than the S&P 500. Also, my Growth Investor stocks only trade at 14.1 times median fiscal 2024 earnings, and my average Growth Investor stock has had its earnings revised 7.6% higher in the past three months. So, I anticipate wave-after-wave of positive earnings surprises in the New Year, too!

To help best position my Growth Investor Buy Lists for next year, I am adding three fundamentally superior stocks in today’s Growth Investor Monthly Issue for December. So, join me at Growth Investor today so you can read the issue as soon as it’s published.

Once you become a Growth Investor member, you’ll also have full access to my latest Top Stocks, past Monthly Issues, Weekly Updates, Special Market Podcasts, and much more.

Click here for more details.

(Already a Growth Investor subscriber? Go here to log in to the members-only website.) Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق