The Best Time for Stocks Is Coming Dear Reader, September was a tough month for the stock market. And it actually ended up being a little backwards…

The S&P 500 had more strength in the first half of the month and then declined sharply in the second half. Historically, the S&P 500 is stronger in the second half of the month after tax selling has eased and quarter-end window dressing heats up.

But this year, there were a lot of distractions for investors, especially in the latter half of September.

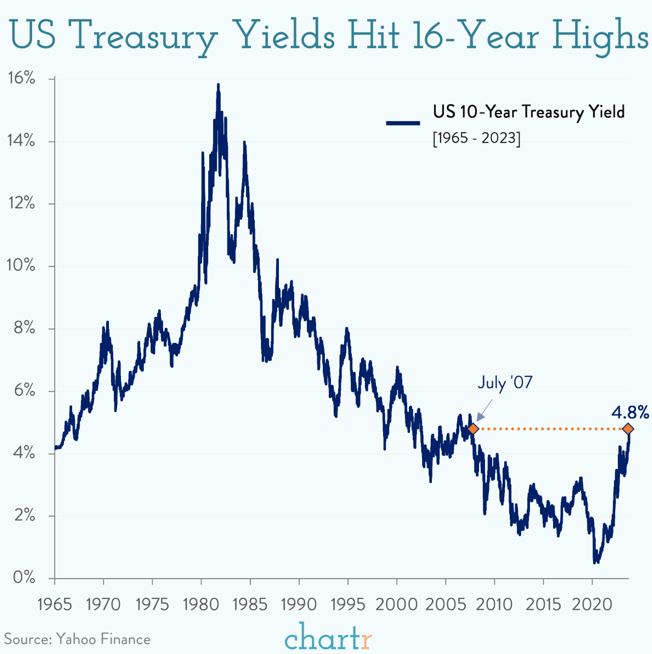

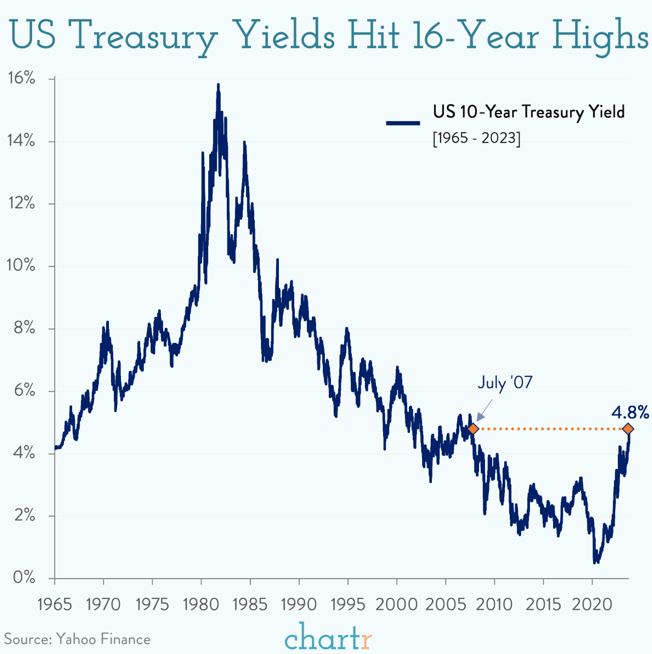

The biggest distraction last week, of course, was the potential for a federal government shutdown. Thankfully, the folks on Capitol Hill secured a last-minute deal on Saturday to avoid a shutdown. But that deal did little to ease investors’ fears, as it was basically a Band-Aid. The House and Senate now have 45 days for more budget negotiations. And as I’ve discussed in my Special Market Podcasts, these budget discussions have contributed to artificially high Treasury yields – the highest we’ve seen in 16 years.

In fact, the 10-year Treasury yield is now sitting at about 4.7%, and it is getting dangerously close to 5% across the entire yield curve. That’s a big problem, and many are concerned that high Treasury yields could push the U.S. economy into a recession...

In today’s Market 360, we’ll discuss what’s going on with the broader economy and which stocks I’m most excited about in the months ahead… Inflation Continues to Fall Overall, higher Treasury bond yields have masked the fact that key inflation components are cooling off.

The Commerce Department recently reported that the Federal Reserve’s favorite inflation indicator, namely the Personal Consumption Expenditure (PCE) index, rose only 0.1% in August and 3.5% in the past 12 months. The core PCE, which excludes food and energy, also rose 0.1% in August and 3.9% in the past year.

This is good news for the PCE, which includes less Owners’ Equivalent Rent (shelter costs) than the Consumer Price Index (CPI). If the PCE continues to cool off, the Fed will not have to raise key interest rates further.

The Commerce Department also reported that consumer spending rose 0.4% in August, down from 0.9% in July, so consumers are becoming more cautious.

The rest of the world is struggling with higher food and energy prices, so economic growth is slowing outside of North America.

The Atlanta Fed still expects the U.S. economy grew at a 4.9% annual pace in the third quarter, and it has cited the shrinking trade deficit and higher energy exports for its high forecast.

Just last week, the Commerce Department revealed that the trade deficit declined 7.3% in August. Imports dipped 1.3% to $253.1 billion, and exports surged 2.2% to $168.8 billion. Clearly, higher energy prices are helping shrink the trade deficit and boost GDP growth.

The good news for my Breakthrough Stocks subscribers is that we’ve benefited from the recent inflation, as my Breakthrough Stocks Buy List is chock-full of energy stocks that have risen with the higher energy prices. An Oasis Amidst the Chaos Amidst all this uncertainty, an investor’s best defense remains a strong offense of fundamentally superior stocks.

Despite the overall broader market weakness, my Breakthrough Stocks Buy List rose an average 2% over the past week. One reason why my Buy List stocks outperformed: the recent resurgence in energy stocks. Crude oil prices resumed their trek higher last week. Brent crude oil prices jumped above $97 per barrel, while WTI crude oil prices rose back to more than $93 per barrel.

While none of us are happy with prices at the pump right now – the average price of gasoline is around $4.00 per gallon nationally ($6.00 per gallon in California) – we can help offset higher gasoline and diesel prices by staying invested in strategic inflation plays. That’s why I have added multiple integrated energy companies, oil and natural gas companies, tanker stocks and coal stocks in the Breakthrough Stocks Buy List .

Looking forward, I anticipate that my Breakthrough Stocks will continue to emerge as an oasis and exhibit relative strength, thanks to improving sales growth and exploding earnings growth.

So, as the third-quarter earnings announcement season gets underway in mid-October, I expect another round of big earnings surprises from my Breakthrough Stocks . The average sales are forecasted to rise 18.6% and the average earnings are forecasted to rise 111.2%. I should also add that in the past three months, the analyst community has revised their consensus earnings estimate up 16.7%, which bodes well for more earnings surprises.

Plus, my Breakthrough Stocks trade at low forecasted price-to-earnings (PE) ratios (e.g., 4.7 times median forecasted earnings), so their upside potential is incredible.

So, I won’t be surprised if many of my Breakthrough Stocks surge 100% or more in the next several months!

In tomorrow’s Breakthrough Stocks monthly issue, I’ll cover all the reasons we should be happy going into the final months of the year… plus I’ll be adding two more fundamentally superior companies to the Buy List.

You can join me at Breakthrough Stocks – and receive the new issue as soon as it’s released – by clicking here.

(Already a reader? I’ll send the new Breakthrough Stocks issue directly to your inbox tomorrow. In the meantime, you can keep up with everything at the Breakthrough Stocks website here.) Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق