The Details of the ISM Report… And Why They Spooked Wall Street Dear Reader, All year Wall Street has been obsessed with the Federal Reserve and inflation. In order to tamp down inflation, the Fed has had to hike key interest rates. This is why investors follow every economic release closely, because the numbers could give a reason for the Fed not to raise key interest rates or even begin cutting them.

Given this, you can bet folks were focused on yesterday’s ISM Manufacturing report for August. And, unfortunately, the numbers spooked investors… despite that the report was good.

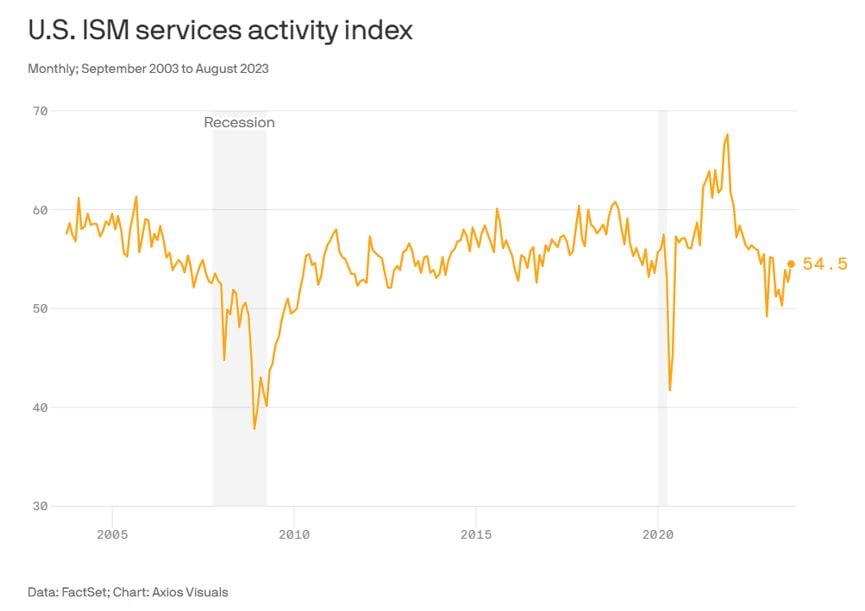

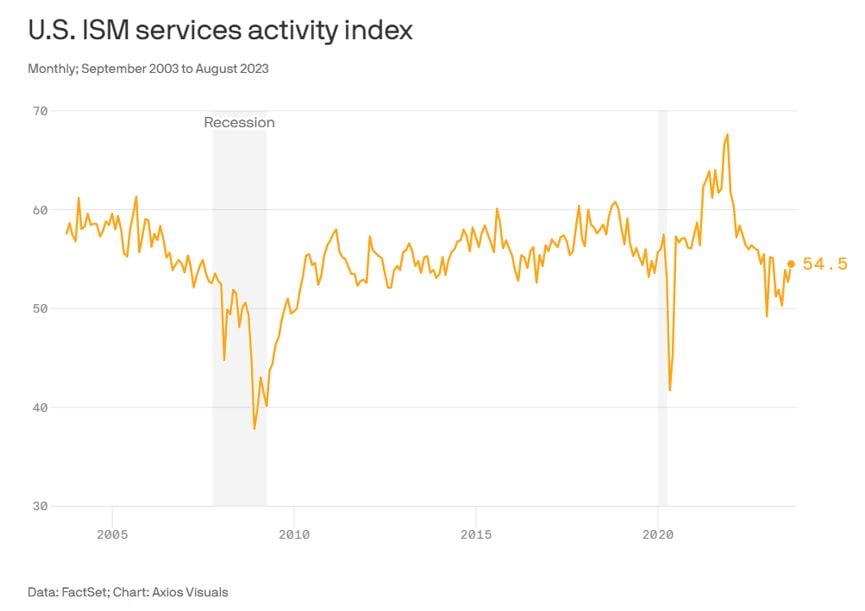

So, in today’s Market 360 , we’ll cover yesterday’s ISM Manufacturing report… why investors weren’t happy with it, as well as what it means for the economy – and stocks – as we head into the final months of the year. And then, I’ll share how to best position your portfolio to protect yourself from the market’s gyrations. The Details of the ISM Report The ISM reported yesterday that their service index rose to 54.5% in August. That's up from 52.7% in July.

This was a big surprise because economists weren't expecting a significant increase.

Furthermore, all the ISM components were really good. One example is the new orders component, which rose for the eighth-straight month. The business activity, inventory sentiment and prices components were also very strong, up 0.2%, 7.3% and 2.1% month-over-month, respectively.

All in, 13 of the 18 service industries that ISM surveyed reported growth in August. The five service industries that posted a decline were Agriculture, Forestry, Fishing & Hunting, Mining, Wholesale Trade, Healthcare & Social Assistance, and Management of Companies & Support Services.

This shows that we remain in a consumer-led economic recovery – and it’s what is driving our GDP growth right now. Currently, the Atlanta Fed expects GDP growth of 5.6% in the third quarter.

Investors weren’t happy with the growth, because they were worried that it would lead to higher prices, which would cause a spike in inflation and force the Fed to raise key interest rates again. Jobs Data Shows Weakness… Not Growth However, investors were happy with last week’s Job Openings and Labor Turnover Survey (JOLTS) and ADP reports that showed that jobs growth is slowing.

Last Tuesday, it was revealed that JOLTS declined 3.7% to 8.827 million jobs in July, compared to a revised 9.165 million in June. The JOLTS report was also well below economists’ consensus estimate of 9.465 million.

Then, ADP reported on Wednesday that 177,000 private payroll jobs were created in August, which was substantially below a revised 371,000 in July. This was the slowest monthly job growth in the leisure and hospitality sector (with 30,000 jobs created) since March 2022, according to ADP.

The good news is the manufacturing sector gained 12,000 jobs after two big months of job losses. Due to decelerating payroll growth, the Fed is expected to proceed cautiously.

And then on Friday, the Labor Department reported that 187,000 new payroll jobs were created in August, which was a bit better than economists’ consensus estimate of 170,000. However, the June and July payroll reports were revised lower by a cumulative 110,000 to 105,000 and 157,000, respectively.

In addition to the August payroll report, the Labor Department is also expected to dramatically reduce overall U.S. payroll growth in the past 12 months. This big payroll revision is anticipated to finally fix the bogus seasonal adjustments (like in January) as well as overstated manufacturing jobs (like in June and July) relative to ADP.

I am happy to see that the Labor Department is now much closer to ADP in the past three months, but this is why I do not trust the monthly payroll reports from the Labor Department. There are simply too many seasonal “fudge” factors.

What I do trust? Fundamentals. As investors digest the economic reports, the market is going to continue to oscillate. The best way to protect yourself and prepare for the future is to invest in fundamentally superior stocks, like the ones on my Growth Investor Buy List… Strong Fundamentals Will Be Rewarded Folks, as I’ve been saying, this is the seasonally weakest time of the year.

The fact is a lot of the recent selling is to pay quarterly taxes. Taxes are due on September 15 for a lot of people, and so they go in and sell a few things to pay them off.

At Growth Investor, I’m not worried. My Growth Investor Buy Lists are chock-full of fundamentally superior stocks anticipated to grow their sales and earnings. So, they will benefit from quarter-end window dressing in the second half of September. Essentially, quarter-end window dressing is when institutional investors make their clients’ portfolios “pretty” by scooping up fundamentally superior stocks.

And since my Growth Investor Buy Lists represent the crème de la crème, my stocks tend to shine and outperform during this time.

The bottom line: Don’t let Wall Street’s reactions to the recent economic data scare you. Instead focus on the fundamentals, because those will be what’s really important once we hit the second half of September.

To make sure you’re invested in the stocks that will likely be scooped up by institutional investors, be sure to take a look at my Growth Investor Buy Lists.

To join me at Growth Investor – and access my full Buy List today – simply click here.

(Already a Growth Investor subscriber? Go here to log into the members-only website.) Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق