The ‘Shiny Ball Syndrome’ Trap In AI Investing Is Real. Here’s How to Avoid It. | Editor’s Note: The stock market will be closed on Monday, June 19, for the Juneteenth holiday. The InvestorPlace offices and customer service department will also be closed on Monday. We hope you enjoy the long weekend! | | | Dear Reader, The printing press, Mars rovers and the internet are seemingly random examples of what humankind can create, but they are united by one characteristic: They were born out of human ingenuity.

We have the incredible power to envision an idea, sketch out a plan and experiment until that idea becomes a reality.

But this rational part of our brains is yoked to another, sometimes less logical aspect of human consciousness: our emotions.

And too often, investors let that emotional side run the show.

When there’s an exciting investing sector – like artificial intelligence (AI) – people can fall victim to “shiny ball syndrome.” It’s where investors start disregarding their risk tolerance and abandoning their investment strategies to chase what’s “shiny” and new.

We’re seeing this happen right now for a lot of reasons, including the fear of missing out (FOMO), an urge to find that golden-ticket investment that can erase losses from 2022 and the fact that relatively unknown AI stocks seem “inexpensive” compared to more established companies working on AI projects.

Emotions come with the territory of being human. This impulse to jump into the “next big thing” is understandable.

However, you can’t let emotions impact your reasoning and push you into buying shares of a company that has a limited or nonexistent track record of success. You don’t want to fall into the trap of “shiny and new” AI stocks.

The reality is the AI frenzy is creating an environment where a “rising tide is lifting all boats.” In other words, AI and AI-related companies are climbing higher, even though they don’t have the fundamentals to back up their share prices.

And when the AI frenzy dies down and Wall Street refocuses on the fundamentals, the companies with weak fundamentals (or are too new to have a real history) will fall and ultimately leave investors holding the bag.

I tell you this to keep you on your guard, not to scare you off from AI investing entirely. Because for scrupulous investors, there is a big opportunity to make money by investing in and with AI.

While the company we’re about to discuss in today’s Market 360 is not one of my official recommendations, it does rate well in Portfolio Grader (it currently holds a B-rating) and is a good play on the AI space.

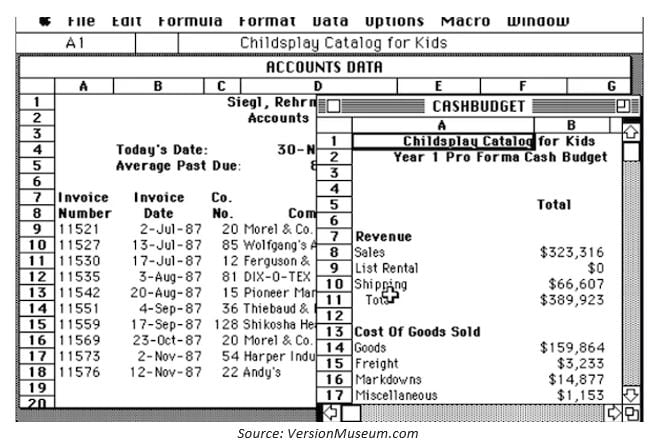

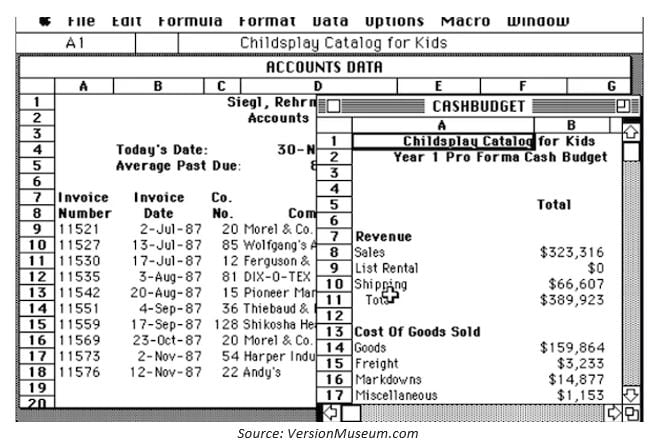

In fact, since 1985, the company has been a key innovator in creating automated technology that helps people be more productive, and it just announced an “AI makeover” for its flagship product… More Than A Spreadsheet – Excel Was An Early AI Super Tool When Microsoft Corp. (MSFT) released Excel in 1985 for Apple’s Macintosh computer, it was a game-changing moment for anyone who had previously been stuck keeping track of sales, organizing budgets, or crunching numbers to create future projections by hand in some kind of written ledger.

Two years later, Microsoft released – the first version of Excel to run on its new Windows operating system.

The rest is history, with over 730,000 businesses using Excel in the United States alone.

Today, Excel’s time-saving and productivity-enhancing capabilities are often taken for granted, as it’s viewed as just a spreadsheet application.

But by taking a step back and thinking about what Excel was designed to do – taking inputted information and automatically organizing it through commands – we can see that Microsoft didn’t just launch a productivity tool – it launched an early AI super tool.

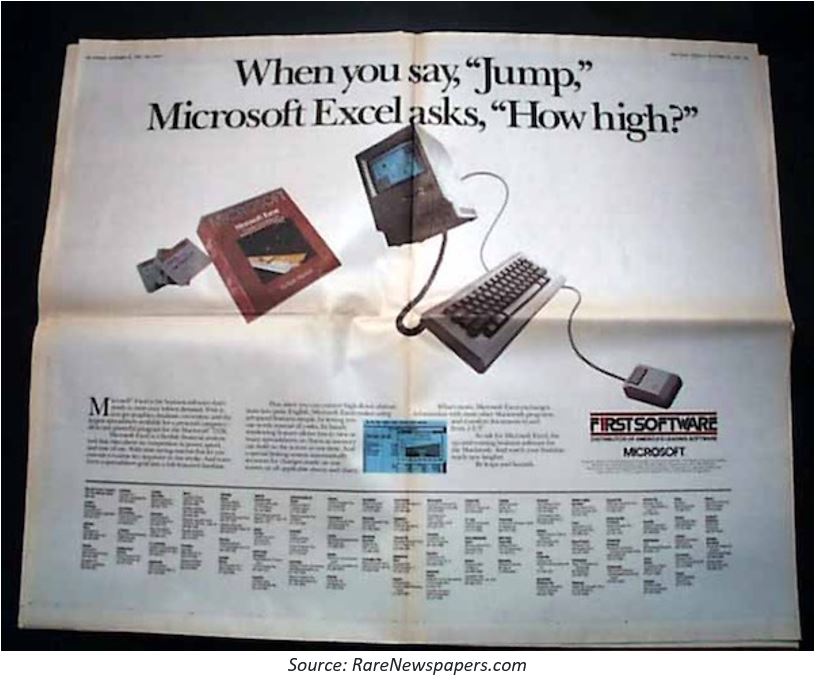

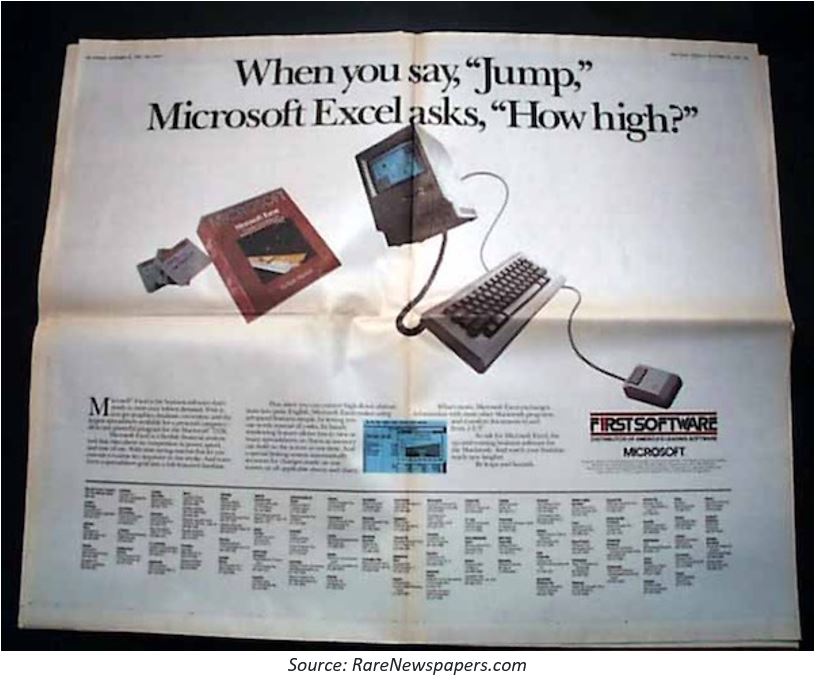

You can even see Microsoft hinting at this in its early ads:

The ad above is saying that if you input the commands and parameters you want for analyzing and organizing information, Excel will give you exactly what you asked for – automatically.

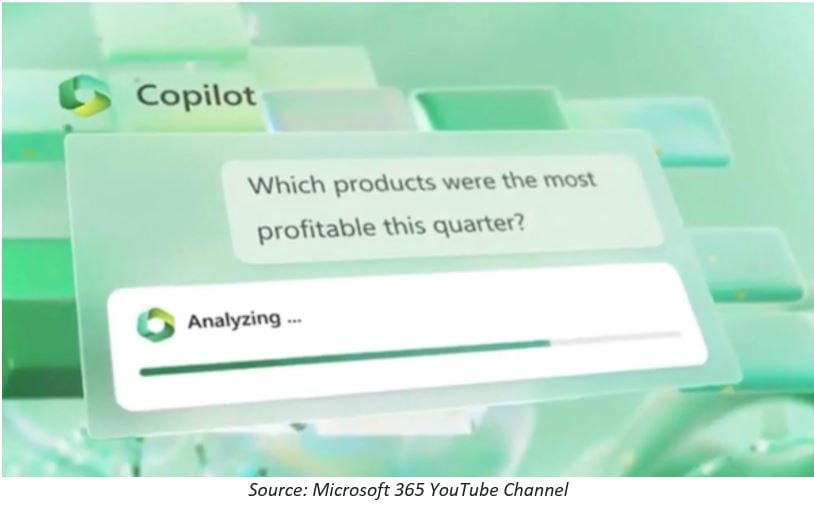

Now, 38 years after the app’s initial release, Microsoft CEO Satya Nadella is giving Excel and other suite apps and services an “AI makeover” for 2023. Unlocking Super-Productive Mode On March 16, Microsoft announced the launch of Copilot, an AI-powered enhancer for its Microsoft 365 suite of apps and services, which includes Excel, Word and PowerPoint.

Using Copilot in Excel, you won’t need to know the exact formula you should use for a particular scenario – you can simply ask Copilot questions and receive formula recommendations. Copilot will also share correlations it finds throughout the data you have and suggest what-if scenarios.

Say that you have all of your sales organized by quarter but that you sell hundreds or thousands of products.

Well, instead of having to dig through that information yourself, you can ask Copilot to do it for you.

Copilot will also be able to gather information from one document and use it to create content in another.

All of these features help remove some manual tasks and make it even easier to visualize, analyze and present data.

Microsoft says it is currently testing Copilot with just a handful of customers to receive feedback, but in the months ahead, it will be bringing Copilot to Excel, Word, PowerPoint, Outlook, Teams and more, at which point it will reveal pricing.

Early results from GitHub, a hosting service for software development that Microsoft acquired in 2018 for $7.5 billion, show that 88% of developers who are using GitHub Copilot say they are more productive and 77% say it helps them spend less time searching for information or examples.

Bottom line: It’s easy to fall into the trap of chasing what’s shiny and new, but a company with deep pockets like Microsoft not only has the ability to invest and build out AI, but also already has products in place that it can enhance with new AI developments.

Now, if you’re more interested in using special AI software to find stocks, then look no further than Project An-E. This is a system created by Keith Caplan, CEO of InvestorPlace partner company Tradesmith, and his team of 36 data scientists, software engineers, and investment analysts that has a strong predictive ability over the short term (about 30 days).

For more details on Project An-E, you’ll want to tune in for a special AI Predictive Project event next Tuesday, June 20, at 8 p.m. Eastern time. I will be sitting down with Keith to discuss Project An-E and how it can help make big returns in the stock market with little risk.

Click here now to register and reserve your spot for this live event. Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق