| |||

الأحد، 17 أبريل 2022

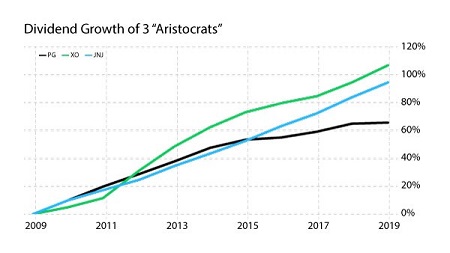

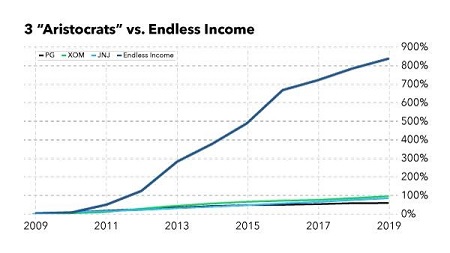

You’ll Never Look at Dividend Stocks the Same Way

الاشتراك في:

تعليقات الرسالة (Atom)

Missed the Boat? This Is Your Second Chance!

Decode Hidden Signals to Explode Massive Cash Now! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

Job Alert Shop Clinical Support Supervisor Senior Engine Programmer Junior Accountant/Bookkeeper ...

-

Job Alert Shop Insurance Defense Attorney- Metairie Master Trend Forex Trading System….Getting Started ...

-

Bill O'Reilly has trusted one expert for investment advice for over 20 years... Alexander Green. Now, Alex is revealing Tr...

ليست هناك تعليقات:

إرسال تعليق