Chevron and Exxon Earnings Are in... Are they Good Buys? Dear Reader, This earnings season has started out a little erratic, thanks to unusual Wall Street behavior after big tech companies released their earnings reports.

Case in point: Netflix, Inc. (NFLX) and Tesla, Inc. (TSLA).

Last Thursday, Netflix reported earnings of $5.28 per share on revenue of $9.37 billion, which topped analysts’ estimates for earnings of $4.52 per share and revenue of $9.28. They also reported substantial subscriber growth, doubling the consensus analyst estimate. However, they announced that they will no longer be reporting this metric in the first quarter of 2025 and provided a softer guidance for second-quarter revenue. Shares of NFLX fell 8% this week following the news.

On Tuesday, Tesla reported first-quarter earnings of $0.45 per share on revenue of $21.3 billion. This is just shy of analyst estimates of $0.52 per share in earnings and revenue of $22.3 billion. Despite the earnings and revenue “miss,” Tesla shares jumped 12% after announcing they would accelerate production of more affordable electric vehicles.

It’s a sign of what I like to call the “tail wagging the dog.” In other words, Wall Street is showing knee-jerk reactions to companies that don’t top earnings and sales estimates but report positive, forward-looking guidance.

This is especially true for technology stocks. Frankly, tech investors can be a bit impulsive and worry too much. And this is why it’s important to diversify with stocks that are an oasis amidst the chaos.

In other words, you want to own stocks that “zig” when other stocks are “zagging.”

In this case, I’m talking about energy stocks.

As I discussed in last week’s Market 360, energy stocks are surging due to rising oil prices from ongoing geopolitical tensions and OPEC+ production cuts.

Last week, Israel launched missile strikes against Iran in response to an Iranian attack on April 14. Mexico also recently slashed its crude oil exports, causing fears of crude oil prices reaching $100 per barrel.

So it is clear to me that the factors I cited earlier are still very much in play. For that reason, I think investors will continue to seek shelter among energy stocks. And as earnings season continues, I am expecting stocks with superior fundamentals to outperform, especially in the energy sector.

Now, energy giants Chevron Corporation (CVX) and Exxon Mobil Corporation (XOM) reported their earnings. So, in today’s Market 360, let’s take a look at how they did and if I still consider them good buys. I’ll also share how you can access two of my brand-new energy recommendations that could benefit from this strength in the energy sector. Chevron Corporation (CVX)

Chevron reported first-quarter results yesterday morning. Earnings were $2.93 per share on revenue of $48.72 billion. This beat the consensus estimate of $2.87 per share in earnings and sales of $48.42 billion. However, that’s down from earnings of $3.46 per share and revenue of $50.79 billion in the same quarter a year ago.

Chevron management noted that U.S. production was up 35% from a year ago. Meanwhile, Chevron's deal to buy Hess Corporation (HES) for $53 billion is progressing slowly. The company made an offer to buy the smaller energy explorer in October 2023, to gain exposure to oil fields in Guyana. The South American country’s offshore deposits are the largest discovery in the Western Hemisphere in decades – said to contain around 11 billion barrels.

The deal is currently under regulatory review and being challenged by Exxon Mobil. Exxon argues that since it leads the consortium developing the offshore field, it has the right to bid for Hess’s Guyana assets.

Exxon Mobil Corporation (XOM)

Exxon Mobil’s first-quarter earnings came in weaker than expected yesterday morning. The company reported earnings of $2.06 per share on revenue of $83.08 billion. That’s an improvement compared to the fourth quarter of last, but down from $2.83 per share in earnings and $83.08 billion in revenue in the first quarter of 2023. The consensus estimate called for earnings of $2.20 per share in earnings on $78.35 billion in revenue.

Shares of XOM finished Friday lower by about 2.8% in the wake of the earnings news. The company noted that earnings from oil and natural gas production slipped 14% in the quarter due to lower natural gas prices. Its refining earnings dropped 67%, while its chemicals business earnings more than doubled, and production in Guyana jumped to 600,000 barrels of oil equivalent per day.

I should note that Exxon is in the process of closing a $60 billion deal for Pioneer Natural Resources. The deal is expected to close in a few weeks and will cement the company's exposure to the Permian basin, eventually doubling its output in the top U.S. shale field.

Exxon also continues to develop Guyana’s record oil find at a speedy pace. One of its latest fields came online in a mere two months compared to an industry average of 15. Eventually, Exxon hopes to produce 1.3 million barrels a day by 2027. Are CVX and XOM Good Buys? While earnings for CVX and XOM were a mixed bag, do I still think they’re good buys?

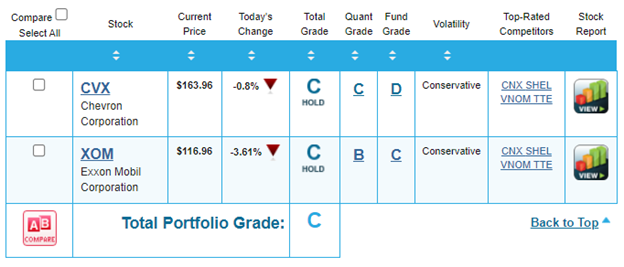

To answer this, let’s see what my Portfolio Grader has to say.

Both stocks currently sport a Total Grade of “C,” making them a “hold.” Now, I should note that this does not mean I don’t like these companies. They can be an important cornerstone for any portfolio. It’s just that if you’re looking for the best growth opportunities right now, you may want to look elsewhere.

I’ll be keeping a close eye on these companies. I expect they will prosper when seasonal demand ramps up in the spring and summer. But I recently pointed my Growth Investor subscribers to two stocks that I like even better... One is a master limited partnership (MLP) that focuses primarily on energy infrastructure assets. It will report earnings in a few days, and analysts have revised estimates higher over the past three months, which bodes well for a quarterly earnings surprise. It has also consistently raised dividends for the past two years.

The other is a Texas-based crude oil and natural gas exploration company with operations in West and North Africa and Western Canada. For the first quarter, which will be reported in mid-May, the current consensus estimate calls for 257.1% year-over-year earnings growth and 4.4% year-over-year revenue growth!

Both stocks boast an overall grade of “A” in Portfolio Grader, making them “strong buys.” In other words, they sport superior fundamentals and institutional buying pressure.

In times of uncertainty, our best defense is a strong offense. And that means you need to make sure your portfolio is full of fundamentally superior stocks. That’s why I recently added these two energy companies to my Elite Dividend Payers Buy List.

By the way, our Growth Investor Buy Lists are full of fundamentally superior stocks. So, I encourage you to learn more about Growth Investor at this link now.

You’ll learn about my latest research, as well as how to get your hands on these recommendations as well as all of my latest picks and reports.

(Already a Growth Investor subscriber? Click here to access the members-only website.) Sincerely, |

| Louis Navellier

Editor, Market 360

P.S. Not sure how to handle today’s market? Well, how about trading it regardless of which direction it’s headed?

Better still, how about trading it with the guidance of a 20-year market veteran who walks you through trades on a daily basis? And if all this was free, that would be great, too.

Well, that’s what you get with Jonathan Rose’s Masters in Trading: Live.

It’s a free livestream at 11 a.m. Eastern, offered each day the market is open. Jonathan talks about market action, highlights potential trade setups, and issues a “Trade of the Day.”

By the way, these livestreams are short – usually about 15 minutes. And it’s a fantastic way to see the markets through the eyes of an expert. So, even if you don’t make any trades, you’ll come away as a more informed investor.

To check out Jonathan’s livestream, just click here.

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Exxon Mobil Corporation (XOM) |

ليست هناك تعليقات:

إرسال تعليق