3 Market Highs and Lows of 2023 Dear Reader, Well, it’s that time of year, folks.

This is when we all want to look back at what went right and wrong. And then, of course, we look forward to the New Year and what might be in store for us.

So, in today’s Market 360, let’s talk about the best and worst of the market this year. I’ll also give you a glimpse at what I expect in the New Year. Hint: Investors should be pretty excited.

But first, let’s take a look at three highs and lows of 2023. High #1: The Year of AI I think we can all agree that the AI rally was a major highlight of the year.

The surge of stocks like NVIDIA Corporation (NVDA) and other AI-related plays has been impressive. There’s no doubt about that. Over at Growth Investor, it’s been our best-performing stock by far.

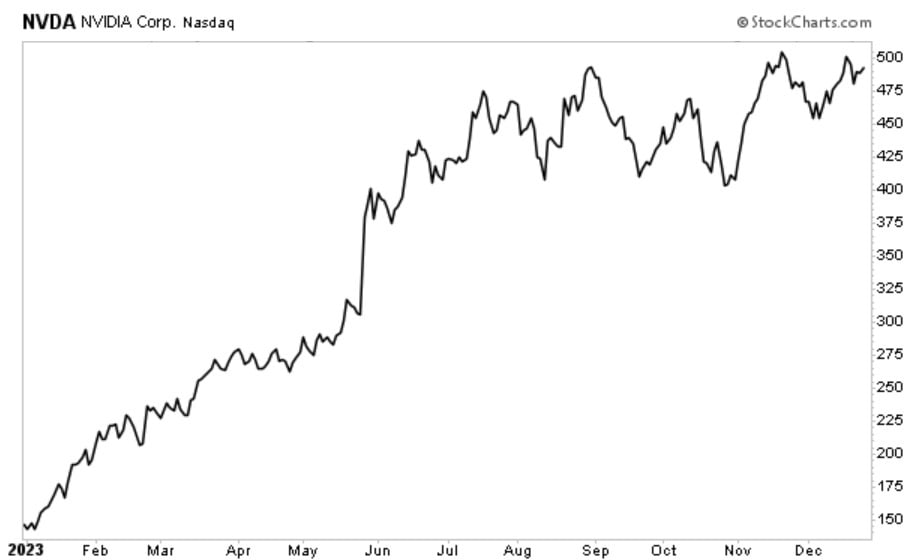

But just to put that into some context, let’s take a look at NVDA’s chart this year...  It’s up more than 237% year-to-date. But here’s the thing, folks. Sales are still forecasted to grow 231.3%. Earnings are forecasted to grow 410%. It has positive analyst revisions.

I’m just stunned by NVIDIA. For a company that size to have this kind of sales and earnings growth is unbelievable. It is the AI leader. It makes the best chips. The competition is coming, but right now, it’s NVIDIA’s world to dominate. High #2: U.S. Energy Dominance There were other highlights, though. The fact that the U.S. is now the largest and most dominant energy producer in the world is a big deal.

We’re the Saudi Arabia of natural gas. We’re exporting liquified natural gas (LNG) everywhere. We’re exporting 4.8 million barrels of crude oil per day. We have record production.

A lot of this is due to horizontal drilling. They drill farther than ever before when they drill horizontally. So, despite the Biden administration’s restrictions on drilling on federal land, oil production is just incredible.

But the other thing we dominate is refining. We have more refiners than anyone else in the world.

One of the biggest developments from this is the collapsing trade deficit, which will boost GDP growth. Thanks to energy exports, our trade deficit continues to shrink, and that’s going to go straight to GDP growth.

The point is we’re just becoming very dominant in the energy sector. Our energy stocks are actually growth stocks because they’re producing more.

But I think that was a big, big deal in 2023. There are still plenty of reasons to be bullish on energy right now, though. So, I’m very excited about when worldwide demand picks up in the spring. High #3: An Early January Effect A third thing I want to highlight in 2023 was the early “January Effect.”

We had an impressive small-cap rally in late May and early June during the end of the re-alignment of the Russell 2000 index. But the market rally in November was real.

The fact is the breadth and power of the stock market has improved dramatically over the past two months, with financials, industrials and real estate leading the market higher – not just the “magnificent seven” group of Big Tech stocks.

What this tells me is that the rally is real, and we’re going to have a much broader market rally in 2024. In fact, I fully expect stocks to continue to “melt up” in January when trading volume improves; our own Growth Investor stocks could surge 15% or more in January alone. Get ready. Low #1: No Fed Cuts, Despite Falling Market Rates So, what were the lows for the year?

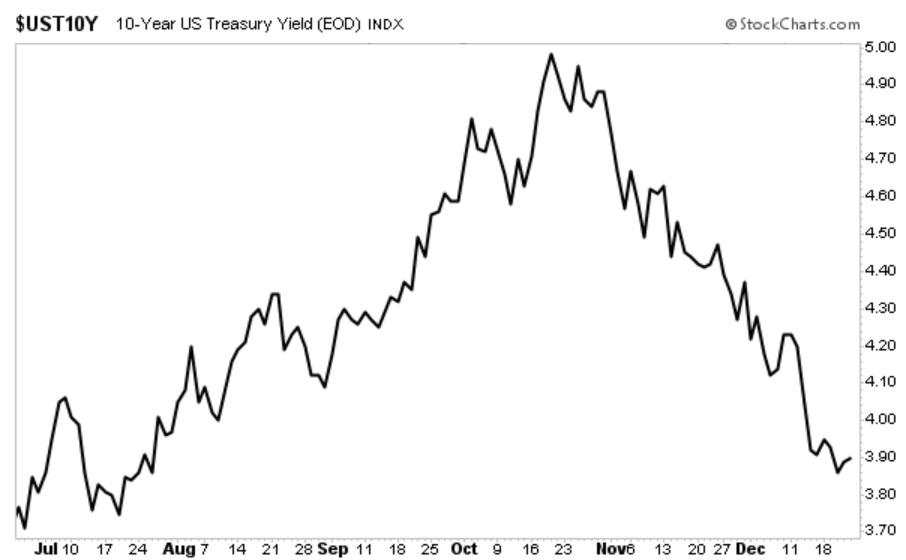

Well, one low was the fact that the Fed hasn’t cut rates yet – even though market rates have collapsed.

The 10-year Treasury yield peaked at 4.99% back on October 19 and was sitting around 4.25% prior to the Fed’s December meeting. Following the Fed statement and Fed Chair Jerome Powell’s comments, the 10-year Treasury yield dipped below 4.0% for the first time since late July. The 10-year Treasury yield now sits at about 3.89% as I write this.  That’s a full percentage point, folks. This is a dramatic decline in Treasury yields.

The point is that the Fed can never fight market rates. They’re going to have to cut to catch up.

They admitted this after the latest FOMC statement when they released their “dot plot.” They’re expecting 6-7 rate cuts in the next two years. Frankly, I think they ought to accelerate and make most of those cuts next year.

The bond market really held the stock market hostage, but we don’t have to worry about that now because we have this incredible bond rally underway Low #2: Inflation Silliness Now, there’s one last thing I wanted to talk about before we get to some stocks.

The Fed has a 2% inflation target. We’re already there if you look back at six months of data instead of a full year.

The monthly Consumer Price Index (CPI) increases from December 2022 to May 2023 were 0.40%, 0.41%, 0.45%, 0.38%, 0.41% and 0.44%, respectively. Once these large monthly gains are removed from the 12-month CPI calculation, the monthly gains only range from 0.18% to 0.32%.

So, what’s going to happen in the next six months is this... we’ll see about four-tenths of a percent of inflation come off every month for six continuous months. And then, we’ll hit 2%.

The truth of the matter is that we’re already at 2% inflation in the last six months. The Fed is doing the right thing, ending its tightening phase before it throws the U.S. economy into a recession. So, I think this obsession with annual inflation gets a little silly from time to time. But that’s where we’re at. Low #3: China Slowdown Another low was that we are importing deflation from China.

The country’s National Bureau of Statistics recently reported that consumer prices declined 0.5% in November. That marked the second-straight month of deflation. I should also add that China’s consumer prices have dropped 0.5% in the past 12 months and fallen at the fastest pace in three years.

The reality is that China is going to shrink dramatically because of that one-baby policy they had. They are going to be really struggling as an economic power. Unless they pull a Japan and figure out how to make their society more productive, they are going to have a hard time. Looking Ahead to 2024... So, what’s going to happen next year? Well, I’m going to talk about some of my predictions for 2023 in Thursday’s Market 360 issue. So, we’ll save the details for another day.

But this recent strength should carry over into the New Year, and I expect a blowout year in 2024. It’s going to be a lot of fun, folks.

In the meantime, one of the best ways to position yourself for profits next year is to harness the power of AI for your portfolio.

To take advantage, all you have to do is apply my “Billion Dollar Tech Blueprint.”

Let me be clear. I firmly believe that the AI boom we’re witnessing will be the biggest opportunity of the next decade. The AI boom we saw this year is just getting started, and you don’t want to miss out on what’s coming.

That’s why I created this urgent message to share how my time-tested “Billion Dollar Tech Blueprint” can turbocharge your portfolio and position you to make the most money possible from the AI Revolution.

Click here to watch it now. |

| Louis Navellier

Editor, Market 360 The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) |

ليست هناك تعليقات:

إرسال تعليق