What You Need to Know About the Jackson Hole Conference Dear Reader, This past week in Jackson Hole, Wyoming, the Kansas City Federal Reserve held its 46th annual central banking conference.

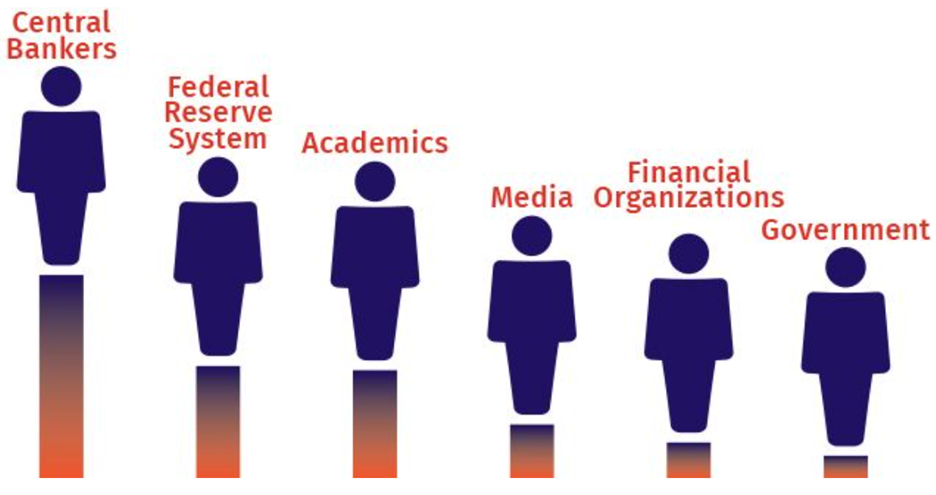

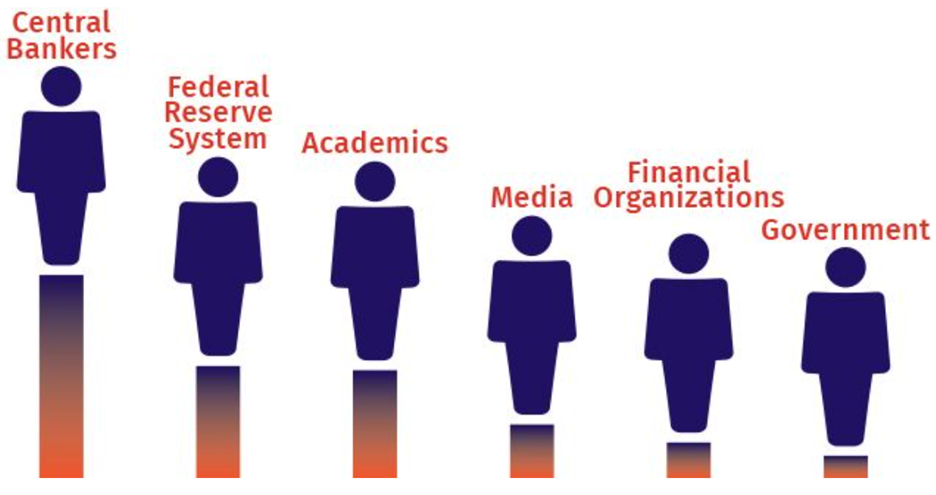

Each year, they host dozens of central bankers, policymakers, academics, U.S. government representatives, economists and media from all around the world to discuss issues of concern. The graphic below shows about how much of each group is invited to attend the conference.

Source: Kansas City Fed (https://www.kansascityfed.org/research/jackson-hole-economic-symposium/about-jackson-hole-economic-symposium/) Before each year’s conference is held, the Kansas City Fed decides a theme to focus on.

This year, the topic is “Structural Shifts in the Global Economy”.

The Kansas City Fed stated: This year’s theme will explore several significant, and potentially long-lasting, developments affecting the global economy. While the immediate disruption of the pandemic is fading, there likely will be long-lasting aftereffects for how economies are structured, both domestically and globally, as trade networks shift, and global financial flows react. Similarly, the policy response to the pandemic and its aftermath could have persistent effects as economies adjust to rapid shifts in the stance of monetary policy and a substantial increase in sovereign debt. Now, this conference is important as it aims to provide key insights to the current economic challenges facing the nation – and how the Federal Reserve should go about addressing them. Conferences in previous years have addressed concerns like inflation and economic uncertainty. It also offers clues on potential policy shifts that could be coming down the pipeline.

For instance, at last year’s conference, Federal Chairman Jerome Powell stated: Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy… restoring price stability will likely require maintaining a restrictive policy stance for some time. Following these comments, the S&P 500 dove more than 3% as investors began to fear a tightening of monetary policy.

In today’s Market 360, we’ll cover the important takeaways from the conference held this week. Then, I’ll share my latest critical message for investors. The Big Remarks at Jackson Hole Friday morning, Fed Chairman Jerome Powell kicked off the conference with opening remarks. And it was not what I was hoping for.

Powell led off by stating that the Fed’s job is to bring inflation down to their 2% goal and that they have tightened policy significantly over the past year.

He then proceeded to state the following: Although inflation has moved down from its peak – a welcome development – it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective. He also noted that the fight to lower inflation has put a strain of banks, saying, “Bank lending standards have tightened, and loan growth has slowed sharply.” Powell stated how this could dampen economic growth and was a worrying sign for the broader economy.

Essentially, he highlighted the uncertainties that are currently surrounding the economy and the difficulty for the Fed on how to respond to it.

I, just like much of Wall Street, was expecting Powell to suggest that the Fed could soon start to ease up on its inflation fight. But it looks like we are still not there yet, folks.

Now, overall Powell’s remarks are much more neutral this year compared to last year’s conference. Remember, last year Powell cautioned investors about the war on inflation. And as investors worried about a tightening of monetary policy, the markets acted accordingly with a drop.

But this year, Wall Street was more than happy with his remarks. Following his 13-minute speech yesterday, the S&P 500 was 0.4% higher and the Dow and NASDAQ gained 0.3%. The Fight’s Not Over The Jackson Hole conference showed that inflation is clearly a battle we are still fighting in the economy.

And just as the Fed is data dependent right now, it is essential that investors are also watching the data.

In fact, one of the biggest dividers between Wall Street pros who make millions, and everyday investors just scarping by… is data.

And that’s why I want to share this important message with you today.

I’m inviting you to take advantage of something much better , something that will position you for the biggest potential gains to come, across all corners of the market.

It’s called Platinum Growth Club.

This elite membership could give you the chance to add more money to your nest egg than you imagined possible. Platinum Growth Club gives my best readers VIP entry to everything I publish now, and in the future – and the chance to potentially make huge gains.

Today, I want to help you not only survive the current environment but channel any momentum into potential long-lasting wealth.

To learn more about my Platinum Growth Club, click here now. Sincerely, |

.png)

.png)

ليست هناك تعليقات:

إرسال تعليق