What’s Going on With Super Micro Computer? Dear Reader, Sometimes the best performers don’t meet expectations. But that doesn’t take away from the fact that they’re still considered one of the best there is. The recent Olympics are a perfect example of this. In the last week of the Paris Summer Olympics, gymnast Simone Biles was scheduled to compete in the balance beam final. The weight of the world was on her shoulders with everyone expecting her to grab another gold medal for the United States (she had already won gold in every competition she competed in, including the team final, the individual all-around and the vault.) While her routine on the balance beam started off well, halfway through she fell. Any fall from the balance beam takes away one full point from a gymnast’s final score, which includes execution and difficulty level. She finished tied for fifth overall with teammate Suni Lee and failed to make the podium, shocking the world. While it was disappointing that Simone didn’t win a medal for the balance beam, there was something far better to celebrate in the bigger picture. She left Paris with three gold medals and one silver medal for the floor exercise final. These medals made her the most decorated gymnast in history with a total of 11 Olympic medals and 30 World Championship medals. That is a stunning accomplishment. Super Micro Computer, Inc. (SMCI) experienced similar scrutiny when its earnings came out earlier this month. Prior to its most recent earnings report, the company had been on a roll. It was one of the clear market leaders and was delivering incredible returns to investors. But in this latest release, the company slipped. Since then, I received many questions in my inbox about SMCI. This question sums up the majority of the inquiries I received: "SMCI missed earnings for the second quarter, and a lot of the big players stepped away from the stock last month. Are you confident it is wise to hold further?"

The fact is while SMCI did post softer-than-expected quarterly results, they were still fantastic. So, in today’s Market 360, I’ll explain what’s happened with SMCI this month and why I think it’s still a great buy. Then, I’ll share more about where you can find fundamentally superior stocks like Super Micro Computer. Here’s What Happened

After the closing bell on August 6, SMCI announced results for its fourth quarter in fiscal year 2024. Sales jumped 143.6% year-over-year to $5.31 billion, which topped estimates for $5.3 billion. However, fourth-quarter earnings were $6.25 per share, falling short of estimates for $8.07 per share. Due to earnings missing estimates, shares of the company fell 20% the next day. But there is one part of SMCI’s earnings that shows it still has tremendous strength. For its first quarter in fiscal year 2025, Super Micro Computer expects total sales between $6.0 billion and $7.0 billion and earnings per share between $6.69 and $8.27. This forecast was above analysts’ estimates, so earnings estimates have been revised higher over the past month. The current consensus estimate now calls for earnings of $7.64 per share and revenue of $6.54 billion, which represents 122.7% year-over-year earnings growth and 216.7% year-over-year revenue growth. While it’s disappointing that SMCI missed analysts’ earnings expectations, I encourage you to remember that the company still has accelerating earnings and revenue momentum.

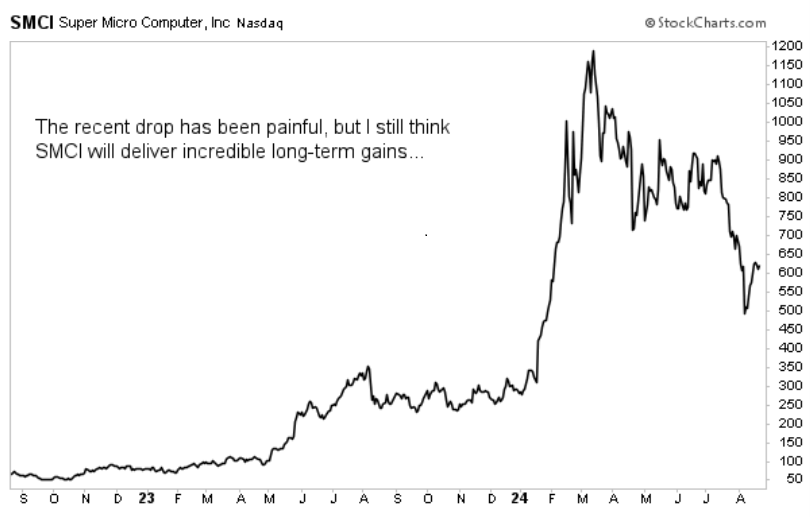

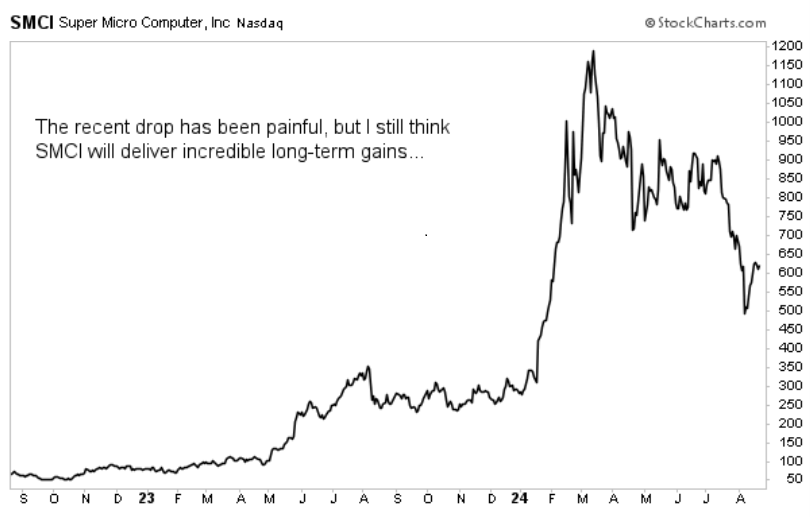

The fact is SMCI continues to dominate the liquid-cooled artificial intelligence solutions that enable data centers to function not only faster but also more efficiently. So, demand remains robust, which was clear in the company’s guidance. As you can see in the chart below, SMCI’s sharp 20% drop was simply profit-taking, which is why the stock is already bouncing back. It is up 24% from its post-earnings low of $488.88.  The Bottom Line

I should also add that SMCI recently announced a 10-for-1 stock split. The stock split is set to take place in October, with the new split-adjusted prices effective on October 1. In other words, current shareholders will receive an additional nine shares for every SMCI share owned. Splitting a stock helps to make shares more accessible and affordable to new investors, making them more likely to buy. In other words, a stock will often bounce higher after a split! Case in point: NVIDIA Corporation (NVDA). NVIDIA enacted a 10-for-1 stock split after the market closed on Monday, June 10. And by Friday, June 14, NVDA’s shares were up 8%. The fact is SMCI is still a solid buy, as it continues to have strong forecasted earnings and revenue growth, positive analyst revisions and persistent institutional buying pressure. I recommended Super Micro Computer to my Accelerated Profits subscribers in June 2022, and we are now sitting on a more than 1,000% gain. And I suspect even more gains for this stock are on the horizon. But it’s not the only fundamentally superior stock we feature in Accelerated Profits. The fact is our portfolio is chock-full of these companies. On top of that, earnings season has rewarded many of my Accelerated Profits stocks. So far, 39 of my Accelerated Profits stocks have released results for the latest quarter, with 28 of them exceeding analysts’ expectations. The average earnings surprise is a stunning 27%. Click here to become a member of Accelerated Profits today. (Already an Accelerated Profits subscriber? Click here to log in to the members-only website.) Sincerely, |

.png)

.png)

No comments:

Post a Comment