What We Learned From the March FOMC Meeting Dear Reader, For college basketball fans, this is the best time of the year.

Since Sunday, teams have been taking their shot at play-in games for the right to make it to the official March Madness tournament bracket.

Never mind the fact that they’ll be one of the lowest seeds and will likely have to face off against a powerhouse team. There’s always hope.

As of today, all the brackets are locked in and the first round is underway. All fans can do now is sit back and watch. Of course, many hope the “little guy” emerges as the winner – after all, Americans love a good underdog story.

Meanwhile, investors are experiencing a bit of March Madness of their own, as the market digests the latest news from this week’s Federal Reserve Open Market Committee (FOMC) meeting.

The FOMC meetings have long been highly anticipated events by investors, but even more so in recent years after the Fed began raising key interest rates to tamp down inflation. From March 2022 to July 2023, the Fed raised rates 11 times. And since the Fed’s last rate hike in July 2023, it has maintained the federal funds rate at a range of 5.25%-5.50%.

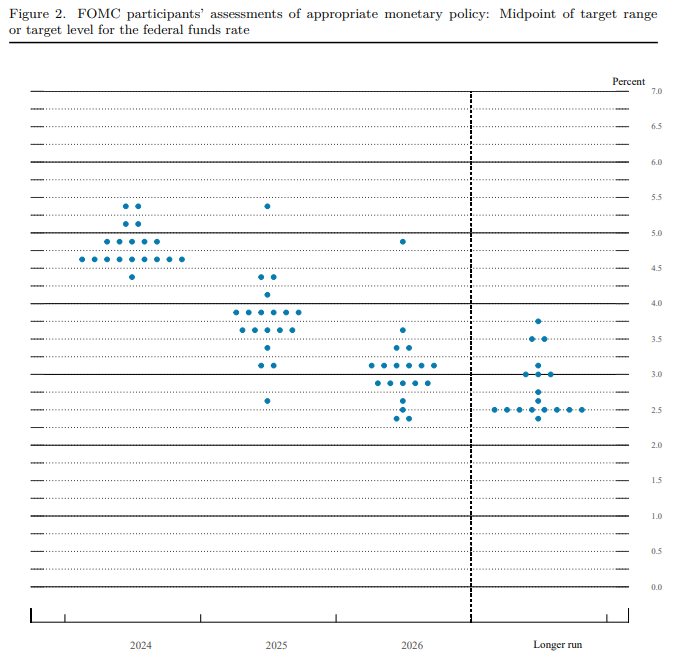

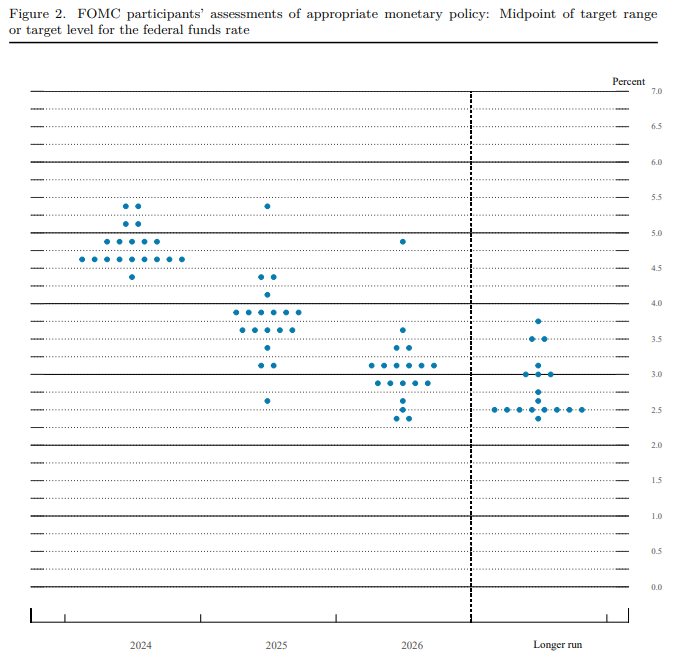

Now, at the December FOMC meeting, the Fed revealed in its “dot plot” survey that it expected three rate cuts in 2024 and another three to four rate cuts in 2025. That’s six to seven rate cuts over the next two years, bringing the federal funds rate to between 3.5% and 3.75%.

So, at the beginning of this year, investors were eager to see rate cuts. They were betting that we would have as many as six, starting in March. But Fed Chair Jerome Powell has consistently said that the Fed wants to see inflation moving “substantially” to their 2% annual inflation target before cutting rates.

However, once inflation data for 2024 began rolling in, it became clear that inflation is still running a little hot. Case in point: The Consumer Price Index (CPI) and Producer Price Index (PPI) readings for February both ticked higher and were above economists’ forecasts. In fact, PPI and core PPI, which excludes food, energy and trade margins, both doubled economists’ expectations. Naturally, all eyes were on the Fed this week when it wrapped up its March FOMC meeting. Not only would we learn the Fed’s interest rate decision, but its latest dot plot survey would be released. This would tell investors if the Fed still planned on three rate cuts… or if it would reduce that number given the spike in both consumer and wholesale inflation.

So, in today’s Market 360, we’ll review the Fed’s latest rate decision, the details of the FOMC statement, as well as what the dot plot tells us. I’ll also share when I expect the Fed to cut rates… and what that means for investors when they finally do. The Federal Reserve Stands Pat First, I should mention that key interest rates remained unchanged. The federal funds rate will stay at 5.25%-5.50%. The FOMC statement was also mostly unchanged from February. It stated that “Jobs have remained strong,” compared to “Job gains have moderated since early last year but remain strong” in the February FOMC statement.

More interesting, however, is that there were no changes to the dot plot for this quarter, either. The Fed still plans on cutting key interest rates three times this year, though the Fed anticipates three additional rate cuts in 2025 instead of four. You can see the dot plot below.  Source: Federal Reserve I should also add that the Fed raised its GDP projections for 2024 – despite the fact that inflation has backed up a little. The central bank now expects GDP growth of 2.1%, up from previous projections for GDP growth of 1.4% in December. When to Expect the First Rate Cut I believe the first rate cut will be in June. And one reason is because of what Christine Lagarde, the president of the European Central Bank (ECB), said during a speech in Frankfurt, Germany, on Wednesday. Lagarde stated that “by June we will have a new set of projections that will confirm whether the inflation path we foresaw in our March forecast remains valid.”

So, it looks like the major central banks – the Federal Reserve, ECB and the Bank of England – are planning to cut rates at the same time. In other words, come June, we will see worldwide rate cuts. By coordinating their rate cuts, the central banks should be able to keep the currencies in sync. Prepare for a Massive Market Rally This is great news for investors because rate cuts set the market up for a massive rally.

The reality is there’s about $8.8 trillion in cash sitting on the sidelines – a record high. So, when the Fed does cut rates, much of this cash should flood back into the stock market. That’s because investors will realize that not only is there less risk to investing in stocks, but also more money to be made than in their savings accounts, money markets or Treasury bonds.

But this money isn’t going to pour into just any stock – I expect a lot of it is going to flood into a few select artificial intelligence stocks…

The truth is there are plenty of AI stocks out there – but not every AI stock is created equally. So, instead of blindly throwing your money at any company with “AI” tacked to the end of its name, you need to make sure that they also have superior fundamentals.

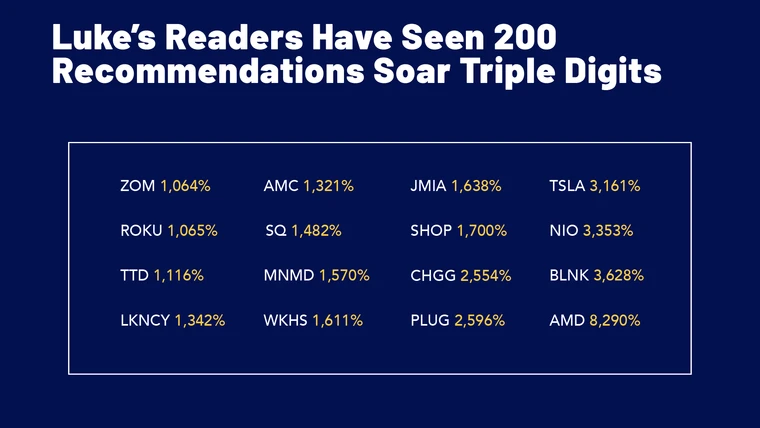

There are five stocks in particular that I expect to lead the charge as AI explodes – all of which I recommend in my Breakthrough Stocks service. If you become a member of Breakthrough Stocks now, I’ll send you the names in my brand-new special report: 5 Small-Cap Gems for the 2024 A.I. Boom. These are five companies that are properly incorporating AI into their businesses or stand to directly profit from AI.

And just as there will be big AI winners, there will also be real losers – and I list three stocks that are directly in the crosshairs of AI in another new report – The A.I. Landmines: 3 Stocks to Avoid in the Age of A.I. These companies could get left behind as they wait too long to incorporate AI into their businesses. Given their popularity, there’s a good chance you have at least one of these ticking time bombs in your account.

Join me at Breakthrough Stocks now and I’ll send you this report as well. You’ll also have full access to my Breakthrough Stocks Portfolio, all my Weekly Updates, Monthly Issues, Special Reports, Special Market Podcasts – and much more.

Click here for full details .

(Already a Breakthrough Stocks member? Click here to log in to the members-only website now.) Sincerely, |

.png)

.png)