Tesla Hits the Brakes... Time to Buy? Dear Reader, There is one sector of the market that’s been in the headlines a lot recently… but not for positive reasons.

While this sector has experienced significant growth in the past, it has recently faced some significant headwinds. And now, investors are wondering what the future holds.

I’m talking about electric vehicles (EVs).

The EV sector as a whole is hitting a bit of a rough patch. And one company in particular is feeling the effects.

This past Tuesday, Tesla, Inc. (TSLA) announced its total vehicle deliveries for the first quarter of 2024, and the numbers weren’t great. Since Tesla has been the EV leader up to this point, this has some investors worried.

The list of problems at Tesla (and with EVs) is growing. And many investors are wondering if now is a good time to buy the stock – or whether to stay away. So, in today’s Market 360, let’s examine the latest Tesla numbers and the struggles the company has been facing. Then, I’ll share whether I think it’s a buy right now – and if there are other EV stocks you should consider. Tesla’s Growing List of Challenges Tesla’s list of challenges has been mounting for a while now.

In the second half of 2023, as EV sales began to slow, it became clear that there was an industrywide inventory glut. Carmakers were too aggressive in ramping up production. The reality is that many early adopters had already bought EVs, while mainstream prospective buyers struggled with high prices and high interest rates, making them unaffordable.

So, many EV makers began to slash their prices and offer incentives.

What’s more, the cold stretches in the U.S. and Europe this winter season have left a bad impression on a lot of the public. The fact is the batteries in electric vehicles don’t like cold weather. The cold affects the range of an EV and also the charging time. So, during these cold blasts, EVs were being left abandoned at charging stations when they were unable to hold a charge.

That’s not a good look for automakers when you're trying to encourage mass adoption.

For Tesla specifically, the company began facing stiff competition in China last year from several rival Chinese firms, including BYD, Li Auto, Inc. (LI), and Xiaomi. As a result, as Bloomberg reports, Tesla’s market share dropped from 10.5% to around 6.7% in 2023. Now this year, the company has slashed production of its Model 3 and Model Y at its Shanghai plant.

Then, in the first quarter of 2024, Tesla's problems only got worse. The company was forced to suspend operations at the German Gigafactory after Houthi militants attacked ships in the Red Sea and disrupted Tesla’s supply of components for production. Then, in March, an alleged arson attack by environmental activists cut the power to the same factory, causing another delay in production.

Meanwhile, Tesla’s newest model – the Cybertruck – debuted to mixed reviews in December last year, and is only selling in small numbers. The company also implemented a number of discounts and incentives to try to spur sales, so analysts and investors were eager to see the delivery numbers for the first quarter. Q1 Delivery Numbers Unfortunately, Tesla announced a dramatic decline in vehicle deliveries in the first quarter.

The company delivered 386,810 vehicles in the first quarter, well below analysts’ expectations of 449,080. That’s quite a big miss, and it marked an 8.5% annual drop in deliveries.

But the deliveries weren’t the only number Tesla reported on Tuesday. The company also shared its total production numbers, noting that it produced 433,371 vehicles during the first quarter, a decline of 1.7% from a year ago.

Now, this is a prime example of what interest rates do to certain industries. People like to finance their cars and as rates go higher and higher, it hurts. The other thing that’s really hurting sales is all the price cuts.

This is because if you lease an electric vehicle and it has no residual value, it doesn’t really matter. But if you buy, and all of a sudden vehicles are cheaper, that’s not good when you try to resell or trade in. This becomes even more of a problem as battery technology gets better. But unfortunately, that is where we are at.

You see, used EVs are like old cell phones. They have value, but it’s not very good. The longer you use the phone, the less efficient the device and the battery becomes. And just like with your old iPhone, when you go to trade it in, don’t be surprised when the value isn’t very much, because there’s always a newer model with better technology and a better battery.

The whole EV story is pretty simple. In my view, the industry needs to transition to iron phosphate batteries as soon as possible, as they have a longer life than lithium ion. Not to mention that they work in the cold weather which, as I said above, is a big negative factor on the industry right now.

The sooner the industry does that, the sooner it’ll regroup. And Tesla needs to introduce its Model 2 sooner rather than later if it hopes to continue competing with other EV companies. The cheaper model (reported to be $25,000 or less) is expected to go into production in 2025.

The reality is consumers want less expensive EVs. And the Chinese automakers are coming after the other automakers in Europe and North America, as they can reportedly build an EV for about a third less than other manufacturers. So, not only will the Model 2 cost less, but it is rumored to have a revolutionary design and production process that will slash costs, allowing it to compete. Is Now the Time to Buy? According to my Portfolio Grader, the answer is no.

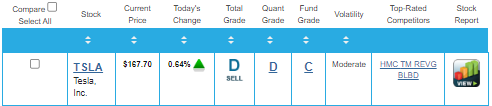

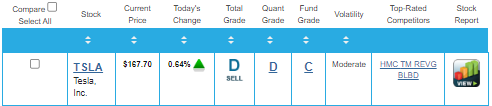

As you can see in the chart below, the stock currently holds a D-rating, making it a “Sell”. The stock has held this rating for the majority of the year so far.  But just because Tesla isn’t a buy doesn’t mean that every EV company is in the same boat. In fact, I can think of at least one EV company I like that I believed was worth recommending to my Accelerated Profits subscribers in October 2023: Li Auto.

On Monday, Li Auto announced a nice uptick in March deliveries. The company reported deliveries of 28,984 vehicles last month, representing a 39.2% year-over-year increase. Given the strong March deliveries, Li Auto achieved total vehicle deliveries of 80,400 in the first quarter, or a 52.9% year-over-year increase.

Li Auto also noted that with the first-quarter deliveries, the company’s cumulative deliveries now exceed the milestone of 700,000. The company has delivered a total of 713,764 vehicles.

So, Tesla now has some serious competition.

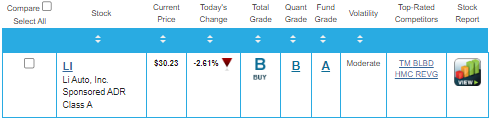

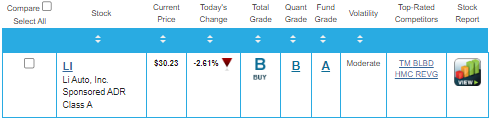

Now, if we look at the Portfolio Grader report card for LI, the stock has a B-rating making it a “Buy”.  Clearly, this is a better bet when it comes to investing in an electric vehicle company. And there are a handful of reasons this company is a better choice.

First, Li Auto sources the majority of its batteries from Contemporary Amperex Technology Co Limited, or CATL, the world's biggest EV battery maker. This allows Li to get better pricing for the batteries. Another advantage for Li is its pricing. Right now, the 2024 Li L7 Air has a starting price of $42,000 which is currently cheaper than Tesla’s Model Y, which goes for around $44,990. The bottom line is Li Auto is focusing on the high end of the market, scaling its production to help cut costs and then using those savings to win market share.

So, while I think investors should stay away from Tesla, I do believe now is a good time to buy certain EV companies that have superior fundamentals and will continue to boast strong earnings and sales growth along with persistent institutional buying pressure.

Li Auto fits the bill. But this is also true of any sector – you want to make sure you own the crème de la crème of any industry, and my Accelerated Profits Buy List is chock-full of stocks like this.

In fact, our Buy List is up a whopping 17% so far this year, which has more than quadruple the Dow’s 3% gain and more than double the S&P 500’s 9% rise. With results like that, I am confident that our Accelerated Profits stocks should continue to rally strongly.

Now, one of the reasons I’m so confident is because the system I use in Accelerated Profits harnesses the power of financial superintelligence to help me pinpoint companies that are primed to post strong earnings results – sending their stocks soaring as a result.

I call this income generator the Quantum Cash project. And it is nothing short of one of my greatest professional achievements.

At its core, Quantum Cash uses a series of AI algorithms to constantly scout massive amounts of data, looking for patterns. Many of these patterns are nonlinear, meaning you’re not going to be able to see them with the naked eye. But the more data you feed it, the more patterns it can spot.

To learn more about my Quantum Cash system and how I incorporate it into Accelerated Profits, click here.

(Already an Accelerated Profits member? Click here to log in to the members-only website now.) Sincerely, |

.png)

.png)