What Every Investor Needs to Do Before Election Day Dear Reader, If I were a screenwriter, I could not make up the 2024 presidential election scenario.

On the Right, we have former president Donald Trump. He was tried for impeachment twice in 2019, currently faces 91 indictments (four criminal) and has almost been removed from the ballot in several states.

On the Left, we have President Joe Biden, though some have serious concerns about his health and mental state. When Biden went to East Palestine, Ohio, in February – a year after a major train derailment there – he gave an awkward speech as he shuffled cue cards and then asked an aid “Why am I here?” East Palestine resident Rich McHugh said the photo-op of the president drinking local tap water was “performative” and “disgusting,” and then described it as the “final nail in the coffin.”

And then there’s Robert F. Kennedy Jr., nephew of President John F. Kennedy. Since RFK Jr. is running as an independent, the winning candidate won’t likely receive 50% of the overall vote, as Kennedy will probably take votes from both candidates.

So, we have three presidential candidates to choose from right now, but, come Election Day, I don’t expect Biden to be one of them. I predict he’ll drop out or be forced out and be replaced by California Governor Gavin Newsom at the Democratic National Convention in August. (My special guest at my upcoming Election Shock Summit – scheduled for Wednesday, April 10, at 8 p.m. Eastern time – agrees, though he has another prediction about what else could change the course of the presidential election… and the stock market. Click here to register for the event now.)

Newsom has more energy and is a better politician than Biden, so that’s why I believe there will be an abrupt substitution by the superdelegates at the DNC. Now, Newsom hasn’t directly challenged Biden; in fact, he’s previously said he’s not running for president and has publicly endorsed Biden.

However, his actions say otherwise. Newsom traveled to Israel right after Hamas attacked, traveled to China to meet with Chinese President Xi Jinping, and has even traveled across the South to court voters and community groups for local candidates in several Republican states, from Alabama to Missouri to Arkansas. But the reality is that for investors it doesn’t matter who goes up against Trump and Kennedy in November. In this article, let’s explore why that’s true.

Plus, I’ll show you the first step you need to take protect your portfolio during this chaotic year, regardless of what happens between now and November… An Age of Chaos – but Still Good for Stocks Presidential election years can be chaotic, but they are typically good for the stock market.

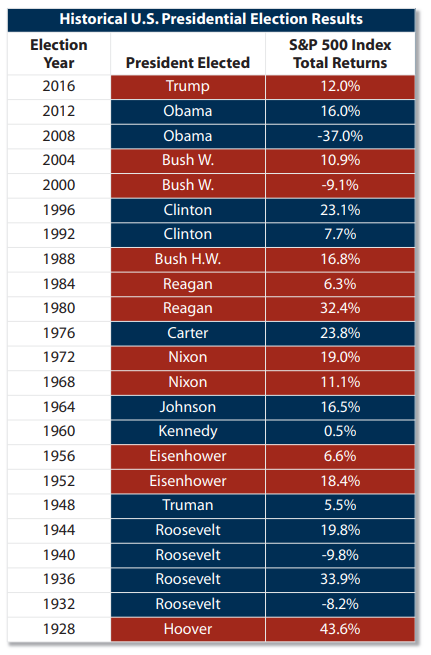

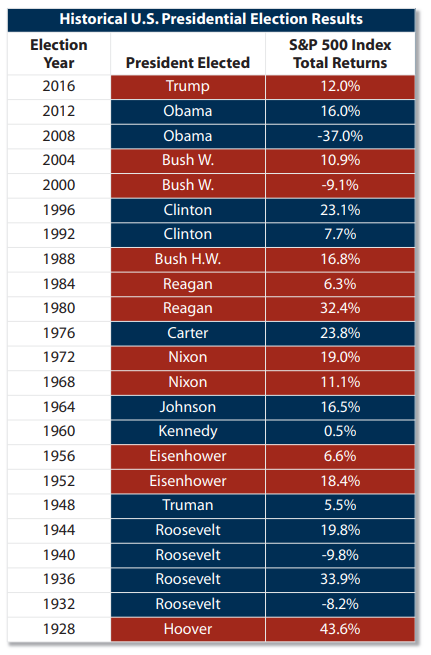

Between 1928 and 2016, there have been 23 presidential elections. According to First Trust, in 19 of the 23 election years, the S&P 500 has posted positive gains. When a Republican was elected, the average gain was 15.3%, and when a Democrat was elected, the average gain was 7.6%. For all presidential election years, the average S&P 500 gain was 11.28%.

You can see the individual market performance during the past 23 elections in the chart below.  Source: First Trust

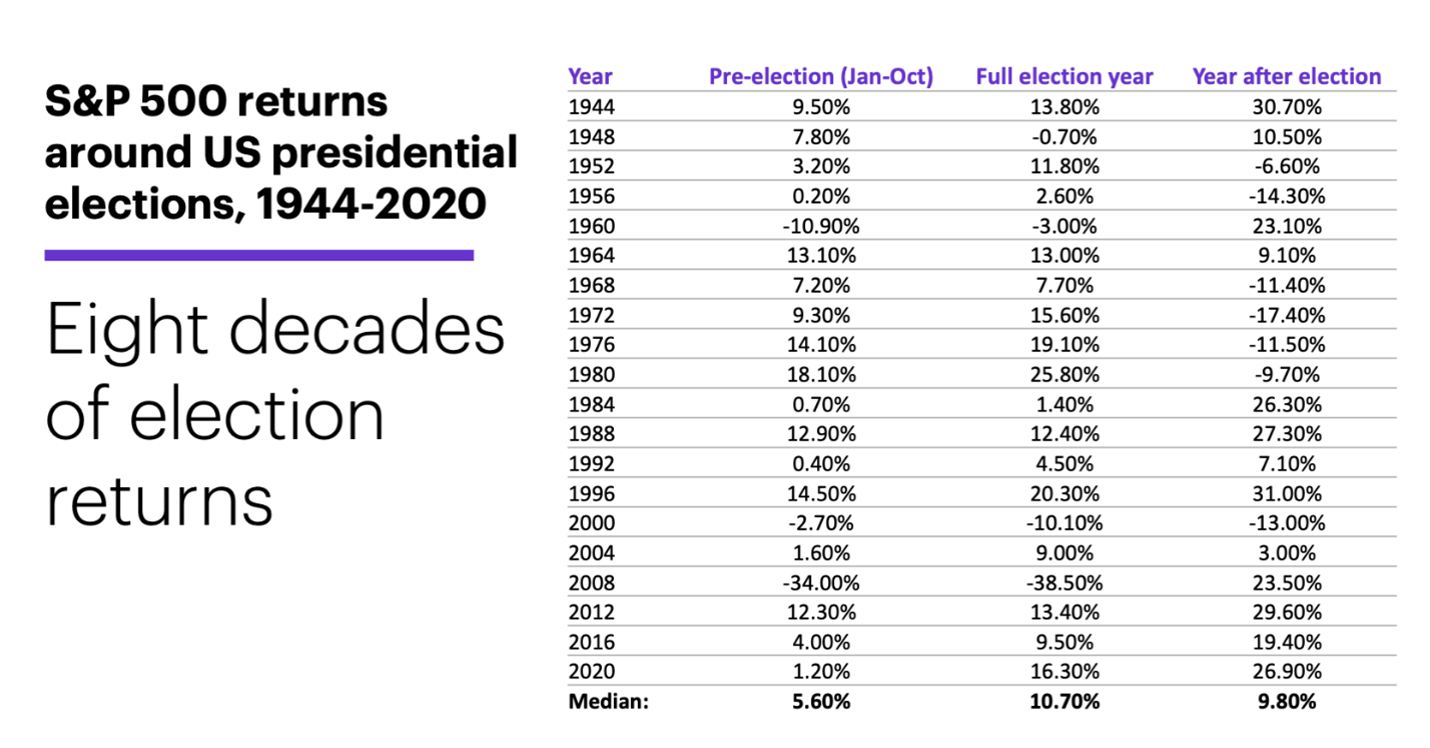

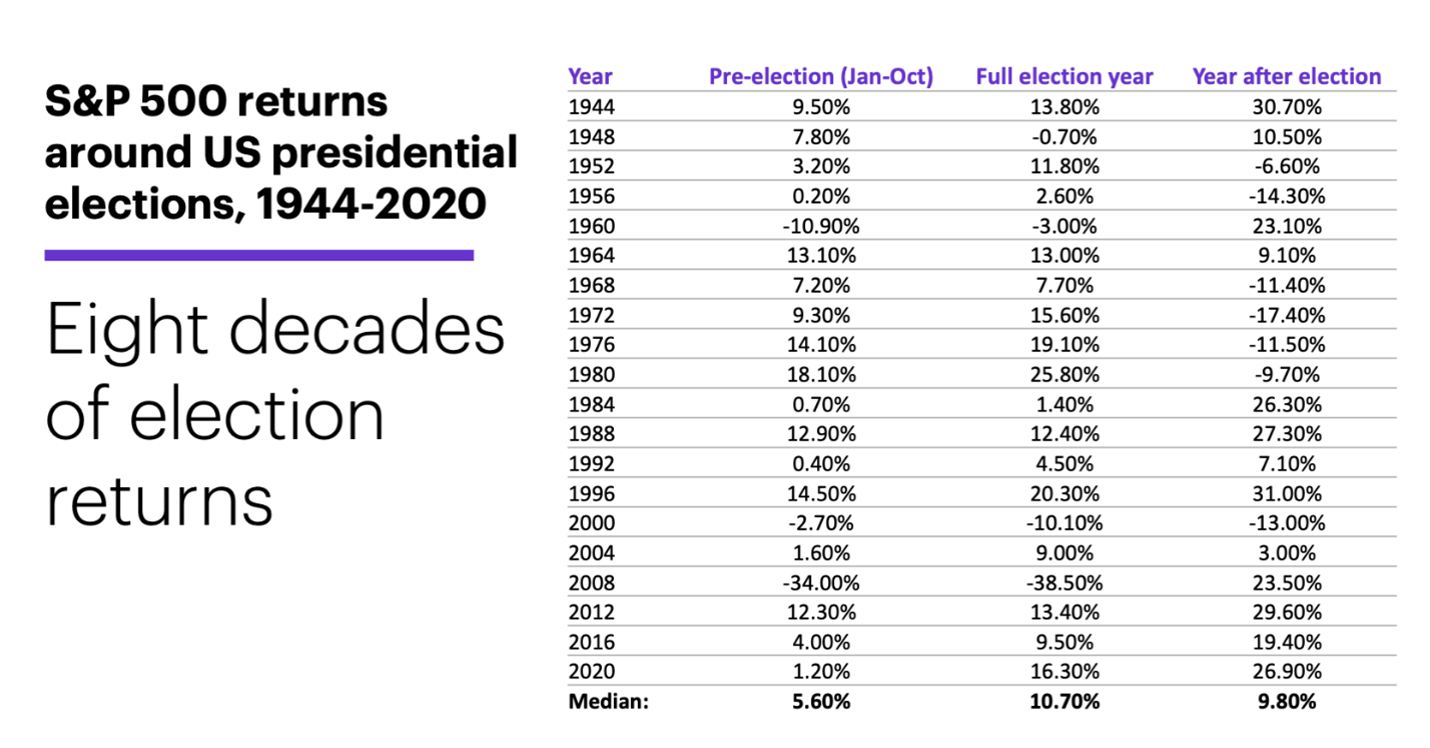

The months leading up to the presidential election are historically good for the stock market, too. For example, between 1944 and 2020 there have been 20 presidential elections, and the S&P 500 has posted a positive return in 16 of the 20 presidential elections. In the 10 months before the election, the S&P 500 has gained a median 5.6%. You can see for yourself in the chart below.  Source: E*TRADE

This presidential election year is shaping up to be no different. The S&P 500, Dow and NASDAQ have hit a slew of record closing highs and are up 9.1%, 3.2% and 8.2% year-to-date, respectively, as we go to press.

The fact of the matter is the stock market traditionally rallies right up to the presidential election because candidates tend to lift both consumer and investor spirits with their endless promises.

Case in point: Biden is promising student loan relief again, despite the fact that the Supreme Court ruled in July 2023 that student loan relief is not legal. So, the latest student loan relief promised to government workers and other parties will also likely be struck down by federal courts. Yet Biden bragged that “The Supreme Court blocked it,” and added, “but that didn’t stop me.” The good news is the economy is now the No. 1 election issue, followed by border security and foreign wars. The situation for the U.S. economy is that it is good for the top 20%, but bad for the bottom 20%. The top 20% tend to own homes and stocks, which are appreciating, while the bottom 20% are struggling with inflation and buying homes.

Since the bottom 20% are dominated by younger people and some minorities, Joe Biden’s base has some severe cracks in it. He also cannot campaign like most candidates, due to his age, so he is counting on expensive ads to get votes.

The Democrats no longer have Twitter and all the fake bots to push a certain narrative that would favor President Biden. Elon Musk’s purchase of Twitter (now X) has gotten Tesla, Inc. (TSLA) kicked out of the S&P 500 ESG Index and disinvited from the World Economic Forum in Davos, Switzerland, since Musk has largely eliminated fake bots designed to shape opinion. Ironically, intelligence agencies around the world, including the CIA and National Security Agency (NSA), were apparently in the “bot” business to shape opinion and wield influence.

The bottom line: We need to be prepared for some twists and turns in the presidential race this year.

But it’s not just the presidential election that we need to keep an eye on; the Federal Reserve bears watching, too. Specifically, the May 1 Federal Open Market Committee (FOMC) meeting. My friend, who is also an experienced analyst, predicts Fed Chair Jerome Powell will say six words that could change the course of the stock market and the election during that meeting.

I don’t want you to be blindsided, so I’ve asked him to join me as a special guest at my Election Shock Summit so he can share his prediction and what steps investors must take if they want to protect their portfolios. Again, it will be held on Wednesday, April 10, at 8 p.m. Eastern time. I look forward to seeing you there.

Sign up for the Election Shock Summit now and reserve your spot. Sincerely, |

.png)

.png)