As you may know, there’s a group of stocks known as “dividend aristocrats” because they’ve steadily raised their dividends for the last 25+ years.

Three of the best known are Exxon Mobil, Johnson & Johnson and Procter & Gamble.

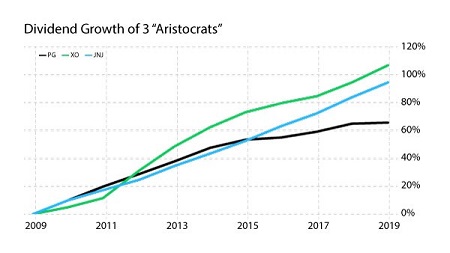

Here’s a chart of their dividend growth from 2009 to 2019…

Not bad, right?

I’m sure long-time shareholders are very happy with their quarterly checks.

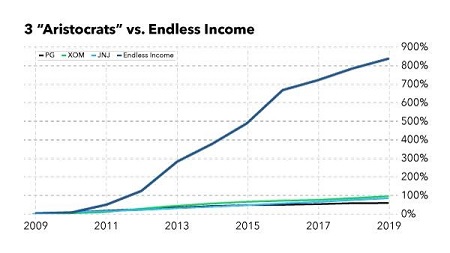

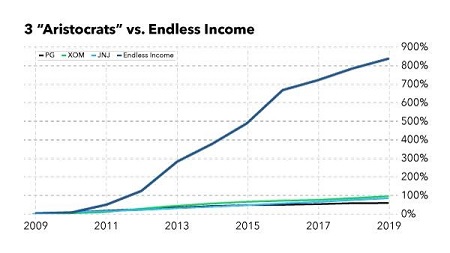

But I’m going to add another line to the chart … a line that represents an investment strategy I call Endless Income stream.

As you can see, Endless Income beat the dividend growth of the three “Aristocrats” by around 8-to-1.

And it’s not just dividend stocks Endless Income has outperformed…

This 20-year chart by JPMorgan (1998 — 2017) shows how Endless Income stacks up against every other mainstream investment.

And, more importantly, I’ll reveal how you could start receiving money from Endless Income as soon as 30 days from now.

No comments:

Post a Comment