|

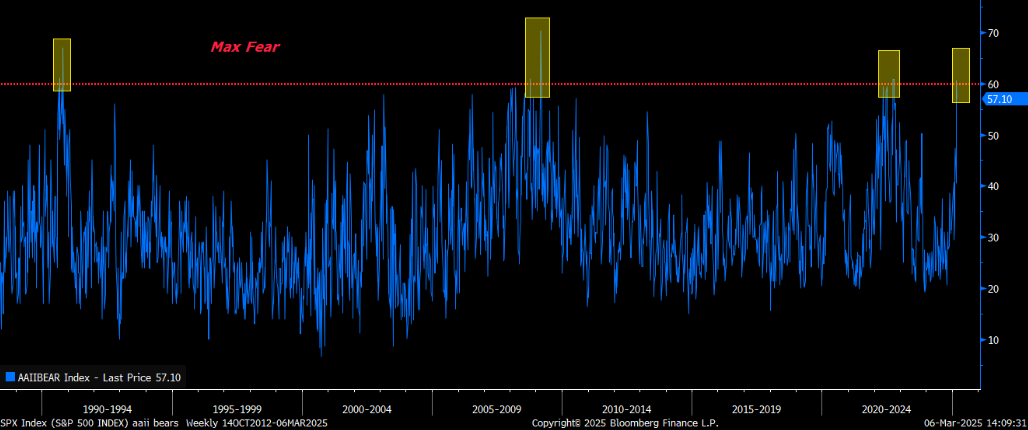

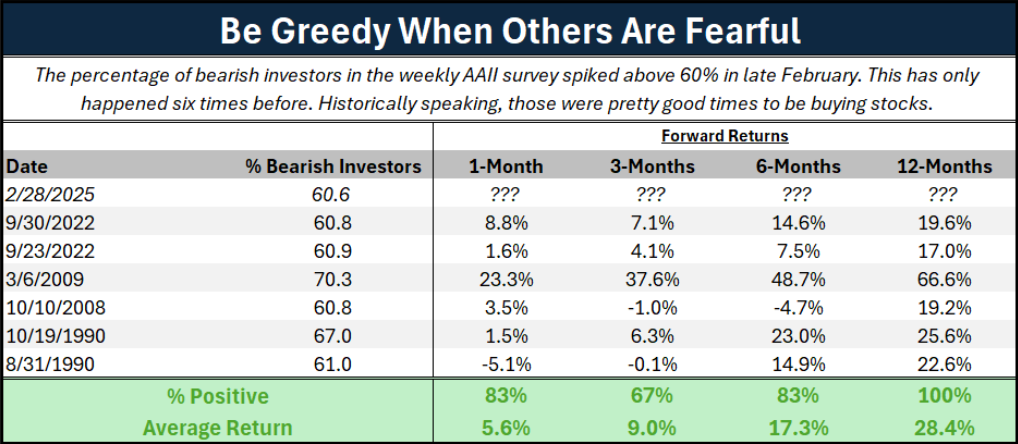

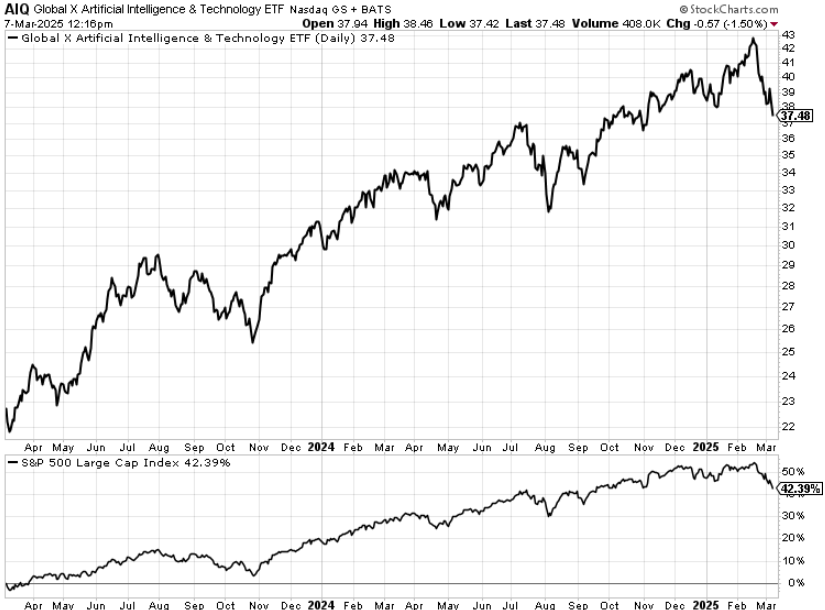

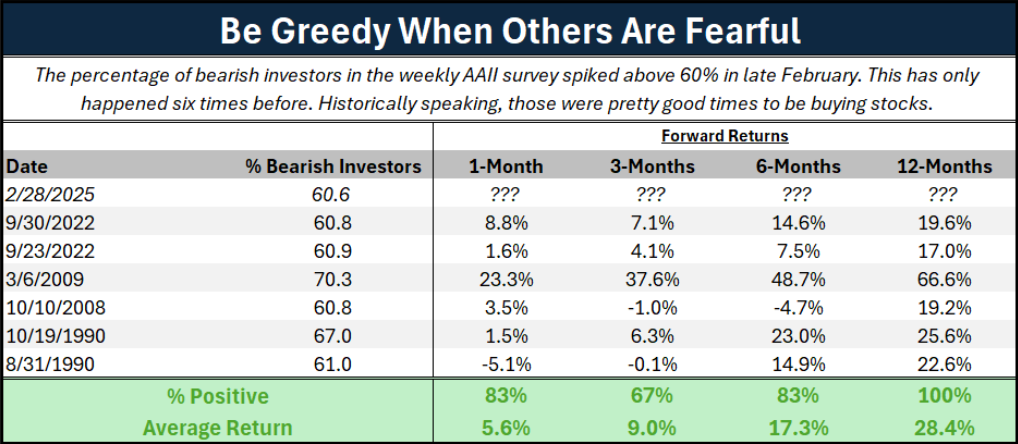

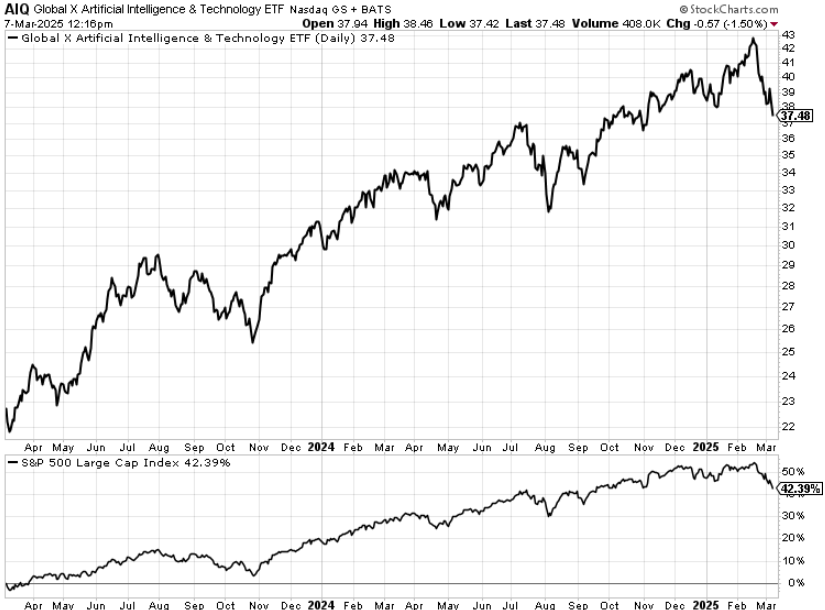

The stock market is crashing right now. But one contrarian indicator suggests that stocks could be close to a major bottom – before they go on to soar about 30% over the next 12 months. You’ve probably heard Warren Buffett’s famous saying: “Be greedy when others are fearful.” Others are certainly fearful right now. According to the weekly American Association of Individual Investors (AAII) survey, ~60% of individual investors are feeling bearish on the market right now. Let’s put that number in context… The AAII has been conducting this survey since the late 1980s. In that time, the percentage of bearish investors in the survey has surpassed 60% only six times before. We saw surges like this twice in late 1990, twice during the 2008 financial crisis, and twice during 2022’s red-hot inflation plight. In other words, investor sentiment is historically negative right now.  Who can blame them? We’re in the midst of the biggest global trade war in nearly a century. Layoff announcements last month spiked to their highest level since July 2020, surging 245% to 172,017. Consumer sentiment is crashing, -9.8% from January, according to the University of Michigan’s survey. Federal spending cuts are rattling the job market. One estimate for U.S. GDP growth has plunged from +2.3% last quarter to -2.8% this quarter. Things look bleak right now. No wonder investors feel so bearish. But history suggests that when investors are feeling this bearish, it is always a good time to be buying stocks… Bearishness Can Be a Contrarian Indicator In late 1990, when the number of bearish investors spiked above 60% in the AAII’s weekly survey, the stock market was in the final innings of a big crash. Between mid-July and mid-October 1990, the S&P 500 lost ~18%. Then, over the next 12 months, the index rose more than 20%. In late 2008 and early 2009, when the number of bearish investors again spiked above 60%, the market was in the final innings of another big crash. Stocks plunged around 30% between mid-October and mid-March – but soared more than 60% higher over the next 12 months. In late 2022, when the number of bearish investors most recently spiked above 60%, the stock market was – you guessed it – in the final innings of a crash. Between mid-August and September’s end that year, stocks slid more than 16%. Over the next 12 months, the market rallied about 20%. In other words… every previous occasion that investor sentiment was as negative in the AAII’s weekly survey as it is today… stocks were in the process of bottoming after a crash. Then they proceeded to soar over the next 12 months. Average forward 12-month returns? Nearly 30%!  The Final Word Of course, this data doesn’t mean stocks are guaranteed to soar over the next 12 months. But it is a noteworthy data point that suggests maybe… just maybe… we should follow Buffett’s advice and be greedy now when others are fearful. The S&P 500 is currently languishing right around its ‘ultimate’ support level: the 200-day moving average. If the market bounces here, we think that would be a strong buy signal. As for which stocks to buy on the rebound, we like AI stocks a lot. Those assets have enjoyed quite strong and steady growth for the past two years. The Global X Artificial Intelligence and Technology ETF (AIQ) is a good proxy for the industry at large. And from March 2023 to today, it has risen more than 40%.  We think there will continue to be strong growth in that sector moving forward. But we like a specific subset of stocks even more. Learn more about those breakout stocks before they roar higher. Sincerely, |

No comments:

Post a Comment