Don't Miss Today's Key Market Insights and Information

| | | | | | | | | | | | | Today’s TBUZ TV

I got 2 major things out of last night's speach. Interest rates lower and crude lower. Be sure to listen to today's TBUZ TV for my levels in the market.

"Don't sit down and wait for the opportunities to come. Get up and make them." ~ Madam C.J. Walker

This Week at DTI

Wednesday

- In Person Futures class

- 12pm ET - Genesis (Learn More)

- 8pm ET - Midweek Market Update (Register)

Thursday

- In Person Futures Class

- 12pm ET - Afterburner Alerts (Learn More)

Friday

- 3pm ET - Weekly Wrap Up (Register) Market Review - Chuck Crow HighlightsAlthough the market on Monday did push slightly above the Friday high in overnight trading, by the time we made it to the cash market open on Monday morning, the gains were already being challenged. Before Monday was done we traded below the February low and followed that downtrend into Tuesday. The broader market was not able to recover.

1. MRVL At the start of this week we were watching to see if Marvel Technologies (MRVL) could rally back above 92.08 with broader market support. MRVL did move up in overnight trading, and even after the cash open they bounced a little to 92.88, but they did not have broader market support. The stock made it down to 83.24 on Tuesday. It also made it back up to 91.81. That area of resistance between today’s high of 91.81 and the cash market high on Monday at 92.88 is still valid, even after the broader market drop off. The overall uncertainty, especially in regards to the tech sector, has me a little concerned. However, I do still feel that if this stock moves up past resistance during the cash market it is still a valid earnings play. Three months ago this stock was acting similar. On December 3 the high was a hard fought 98.72. The open on December 4 was 112.33 and the high was 119.88.

The if part is important here. If the broader market can hang on tomorrow, then MRVL could be set up for an earnings rally. Even if it is not as strong as it was in December, this stock could climb. That “if” part looms almost too large though. The risk in the face of the broader market could be an issue.

2. The Broader MarketTaking the broader market into consideration we should look towards the ES futures. ES futures opened this week at 5967.50 and had moved up to 6000.50 prior to the cash market opening on Monday morning. They were trading at 5984.75 at the cash market open. Within the first hour they had dropped to 5930.50. Though they did try to stabilize, by the end of the day the ES had moved down to a low at 5821.75. Aside from being down over 140 points, the low had exceeded the February low which was set on Friday, February 28 at 5848.00. The start of March was not bullish at all. The market then compounded those low points by pushing all the way down to 5744.00 on Tuesday morning. The high on Tuesday was 5884.00. We are considering a long position for a stock reporting earnings at the end of the day on Wednesday. What I would like to see is Wednesday’s market exceed 5884.00 without making a new low. If for some reason the broader market drops to yet another low, then do not try to buy this stock. We need at least the semblance of stability before we push further.

REVEALED: THE “RETIREMENT CALENDAR” OUR TEAM SPENT $500,000 TO DELIVER TO YOU! LEARN MORE HERE

Key News and Probabilities

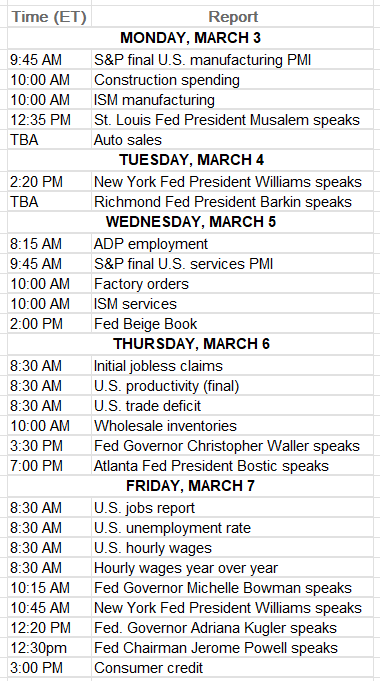

The big news this week will be the employment report on Friday.

Probabilities for the week are mixed. I think we might have some more buying than what the probabilities are showing.

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the DTI Trader team or Tom Busby will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

| | | | | |

|

|

|

|

|

| | |

|

Today’s TBUZ TV I got 2 major things out of last night's speach. Interest rates lower and crude lower. Be sure to listen to today's TBUZ TV for my levels in the market.

"Don't sit down and wait for the opportunities to come. Get up and make them." ~ Madam C.J. Walker

This Week at DTI

Wednesday

- In Person Futures class

- 12pm ET - Genesis (Learn More)

- 8pm ET - Midweek Market Update (Register)

Thursday

- In Person Futures Class

- 12pm ET - Afterburner Alerts (Learn More)

Friday

- 3pm ET - Weekly Wrap Up (Register) Market Review - Chuck Crow HighlightsAlthough the market on Monday did push slightly above the Friday high in overnight trading, by the time we made it to the cash market open on Monday morning, the gains were already being challenged. Before Monday was done we traded below the February low and followed that downtrend into Tuesday. The broader market was not able to recover. 1. MRVL At the start of this week we were watching to see if Marvel Technologies (MRVL) could rally back above 92.08 with broader market support. MRVL did move up in overnight trading, and even after the cash open they bounced a little to 92.88, but they did not have broader market support. The stock made it down to 83.24 on Tuesday. It also made it back up to 91.81. That area of resistance between today’s high of 91.81 and the cash market high on Monday at 92.88 is still valid, even after the broader market drop off. The overall uncertainty, especially in regards to the tech sector, has me a little concerned. However, I do still feel that if this stock moves up past resistance during the cash market it is still a valid earnings play. Three months ago this stock was acting similar. On December 3 the high was a hard fought 98.72. The open on December 4 was 112.33 and the high was 119.88.

The if part is important here. If the broader market can hang on tomorrow, then MRVL could be set up for an earnings rally. Even if it is not as strong as it was in December, this stock could climb. That “if” part looms almost too large though. The risk in the face of the broader market could be an issue. 2. The Broader MarketTaking the broader market into consideration we should look towards the ES futures. ES futures opened this week at 5967.50 and had moved up to 6000.50 prior to the cash market opening on Monday morning. They were trading at 5984.75 at the cash market open. Within the first hour they had dropped to 5930.50. Though they did try to stabilize, by the end of the day the ES had moved down to a low at 5821.75. Aside from being down over 140 points, the low had exceeded the February low which was set on Friday, February 28 at 5848.00. The start of March was not bullish at all. The market then compounded those low points by pushing all the way down to 5744.00 on Tuesday morning. The high on Tuesday was 5884.00. We are considering a long position for a stock reporting earnings at the end of the day on Wednesday. What I would like to see is Wednesday’s market exceed 5884.00 without making a new low. If for some reason the broader market drops to yet another low, then do not try to buy this stock. We need at least the semblance of stability before we push further.  REVEALED: THE “RETIREMENT CALENDAR” OUR TEAM SPENT $500,000 TO DELIVER TO YOU! LEARN MORE HERE REVEALED: THE “RETIREMENT CALENDAR” OUR TEAM SPENT $500,000 TO DELIVER TO YOU! LEARN MORE HERE  Key News and Probabilities

The big news this week will be the employment report on Friday.

Probabilities for the week are mixed. I think we might have some more buying than what the probabilities are showing.

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

Important Note: No one from the DTI Trader team or Tom Busby will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

|

ABOUT US: We believe that the opportunity for financial literacy and freedom belongs to all people, not just those who already have years of investing experience. Diversified Trading Institute provides an array of educational services and products that will help you navigate the markets and become a better investor. Trading is made simple through our online forum full of trading techniques to give you the best tools to kick-start your investing journey. We offer collaborative webinars and training; we love to teach. No matter the opportunity, we bring together a strong community of like-minded traders to focus on analyzing market news as it’s presented each day.

DISCLAIMER: FOR INFORMATION PURPOSES ONLY. The materials presented from Diversified Trading Institute are for your informational purposes only. Neither Diversified Trading Institute nor its employees offer investment, legal or tax advice of any kind, and the analysis displayed with various tools does not constitute investment, legal or tax advice and should not be interpreted as such. Using the data and analysis contained in the materials for reasons other than the informational purposes intended is at the user’s own risk.

DISCLAIMER: TRADE AT YOUR OWN RISK; TRADING INVOLVES RISK OF LOSS; SEEK PROFESSIONAL ADVICE. Diversified Trading Institute is not responsible for any losses that may occur from transactions effected based upon information or analysis contained in the presented. To the extent that you make use of the concepts with the presentation material, you are solely responsible for the applicable trading or investment decision. Trading activity, including options transactions, can involve the risk of loss, so use caution when entering any option transaction. You trade at your own risk, and it is recommended you consult with a financial advisor for investment, legal or tax advice relating to options transactions. Please visit https://www.dtitrader.com/terms-of-service-2/ for our full Terms and Conditions. Unsubscribe

This email was sent to phanxuanhoa60.trade1357@blogger.com by Diversified Trading Institute

3929 Airport BLVD, Ste 2-208, Mobile, AL 36609

DTITrader.com |

No comments:

Post a Comment