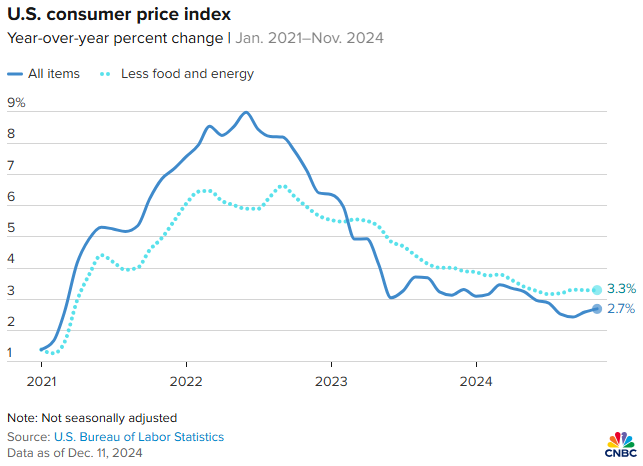

Inflation Moderates, but Remains Sticky – Here's What it Means for Rate Cuts... Dear Reader, One of the more popular Thanksgiving side egg dishes is Deviled Eggs. And, of course, the most important ingredient to make this dish is eggs; you can’t make it without them. The most basic recipes call for at least six large eggs, which makes about 12 Deviled Eggs. As someone who’s hosted many Thanksgivings over the years, I can tell you that 12 isn’t enough. You’ll need to at least double it. Unfortunately, in this current economic environment, a dozen eggs isn’t cheap. This week’s latest Consumer Price Index (CPI) revealed that egg costs jumped 8.2% in November and are now up 37.5% in the past 12 months! Likewise, the Producer Price Index (PPI) revealed that the price of chicken eggs soared 54.6% in November at the wholesale level. This November, the reason behind the big jumps in egg prices was the bird flu on the West Coast. Unfortunately, the bird flu started in January 2022 and has ravaged many of the egg-laying flocks in the U.S. over the past two years. The CDC reports that about 105 million birds in the U.S. have been affected by the disease. However, it wasn’t just egg prices that went up in November. So, in today's Market 360, let's take a look at what else the CPI and PPI revealed. We'll also discuss what the inflation data means for the Federal Reserve and future rate cuts… and how to best position your portfolio. Let’s get into it… Digging into the Details Consumer Price Index CPI rose 0.3% in November, which was in line with economist’s expectations, but slightly above 0.2% in October. Year-over-year, the CPI rose 2.7%, which was also in line with estimates and just slightly above October’s annual rate of 2.6%.  Core CPI, which excludes food and energy, rose 0.3% in November and is up 3.3% in the past 12 months. I should add that core CPI has been at 3.3% now for four straight months.

Digging deeper into the numbers, nearly 40% of the monthly increase came from owners’ equivalent rent (OER), or shelter costs. The index rose 0.3% in November and was up 4.7% year-over-year. The silver lining is that the rate of increase was actually down last month, as October recorded a 4.9% annual increase and a 0.4% month-to-month rise. However, shelter costs need to fall dramatically lower to push CPI lower. The other factor that added to the rise in consumer prices in November was food costs. The food index increased 2.4% in the past 12 months, with a 0.4% month-to-month rise last month. As we discussed, egg prices surged 8.2%. Producer Price Index The PPI showed wholesale inflation jumped more than expected last month. The index, which measures the prices that producers get for their goods and services, rose 0.4% in November, up from expectations of 0.2%, and 3% in the past 12 months. This marks the largest year-over-year increase since the 4.7% jump in February 2023. Core PPI, which excludes food, energy and trade, rose 0.2% which was in line with expectations. Year-over-year, core PPI rose to 3.4% which was above economist expectations for 3.2%. Looking deeper into the numbers, final demand goods increased 0.7% which was the largest increase since the 1.1% rise this past February. And 80% of this increase can be attributed to the 3.1% increase in foods. Additionally, demand services prices rose 0.2%. This was led by trade services which jumped 0.8%. The troubling sign here is the fact that wholesale inflation continues to accelerate. And this is adding fuel to the belief that progress on bringing inflation down has slowed. Seeing as the PPI is a leading indicator of potential future inflation at the consumer level, we can assume that consumer inflation could be brewing under the surface. What This Means for Rate Cuts Despite the slight uptick in consumer inflation in November, the fact is inflation as a whole has moderated. I should also add that Treasury yields have remained relatively steady. In fact, they only made a slight move higher in the wake of these reports. The 10-year Treasury yield currently sits at around 4.3%, and the current fed funds target range is 4.5%-4.75%. And since the Fed never likes to fight market rates, that bodes well for next week’s Federal Open Market Committee (FOMC) meeting on December 17 and 18. Therefore, a 0.25% cut next week is practically guaranteed. I should also add that right now the Fed is actually more concerned about employment than inflation. The reality is that they don’t want to see a deterioration in the unemployment rate, so the odds of a key interest rate cut were already high. (I briefly touched on last week’s jobs report here.) I’m not the only one expecting another rate cut. According to the CME FedWatch tool, there is currently a 97.1% probability of a rate cut. Looking ahead to 2025, though, the rate-cut outlook is less certain. Thankfully, the Fed’s new “dot plot” survey will also be released next week, which should provide more clarity on the trajectory of key interest rates in the New Year. Personally, I suspect the Fed will slow down its respective key interest rate cuts in the New Year. So, before we turn the page to 2025, investors need to be prepared for whatever that means to the market, and the best defense for that is a strong offense of fundamentally superior stocks. That is why you need to make sure your portfolio is chock-full of fundamentally superior stocks – like the ones I recommend in Growth Investor. Here, I recommend companies across a variety of sectors to ensure that you're investing in stocks that will "zig" when others "zag" – which will give your portfolio an extra boost when the broader market rallies, as well as protect it if the broader market turns south. Click here now to access my latest Growth Investor research. Sincerely, | .png)

.png)

No comments:

Post a Comment