Strange Options Secret (NOT Day Trading!) (From Monument Traders Alliance)

Is Super Micro Computer a Buy After Shares Sink 20% on Earnings?

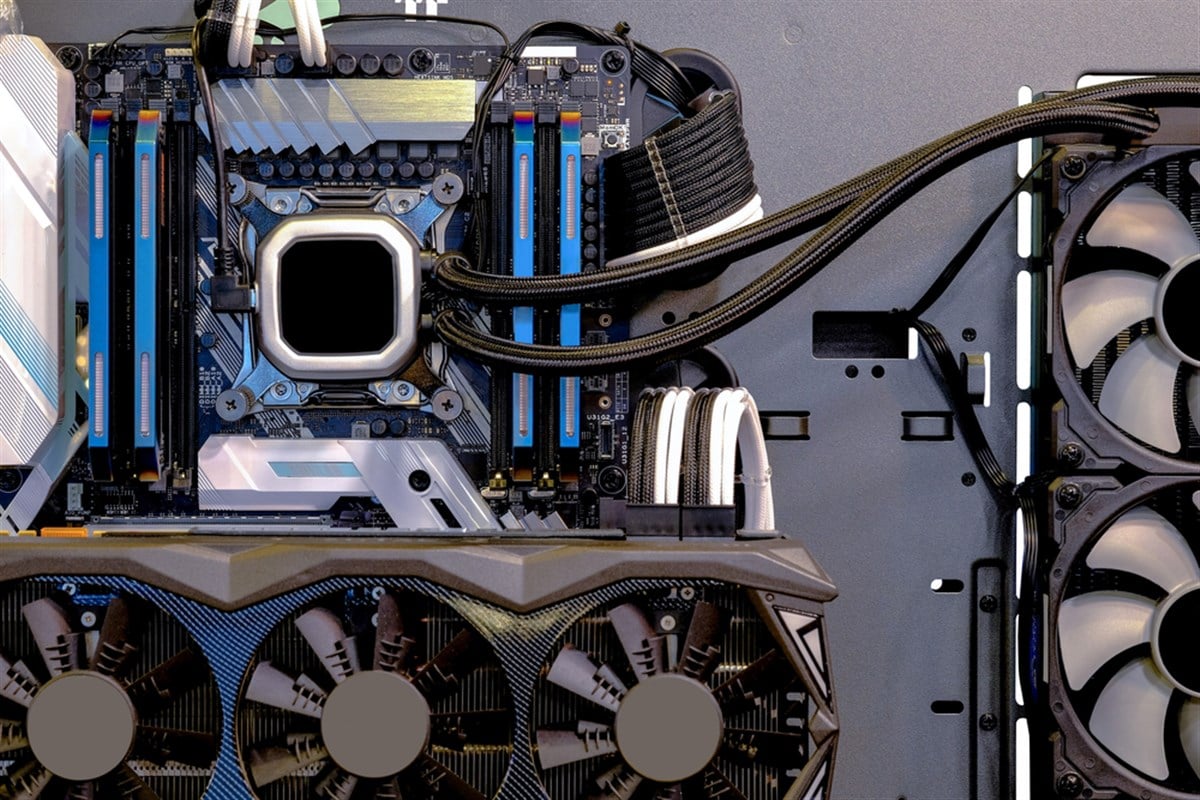

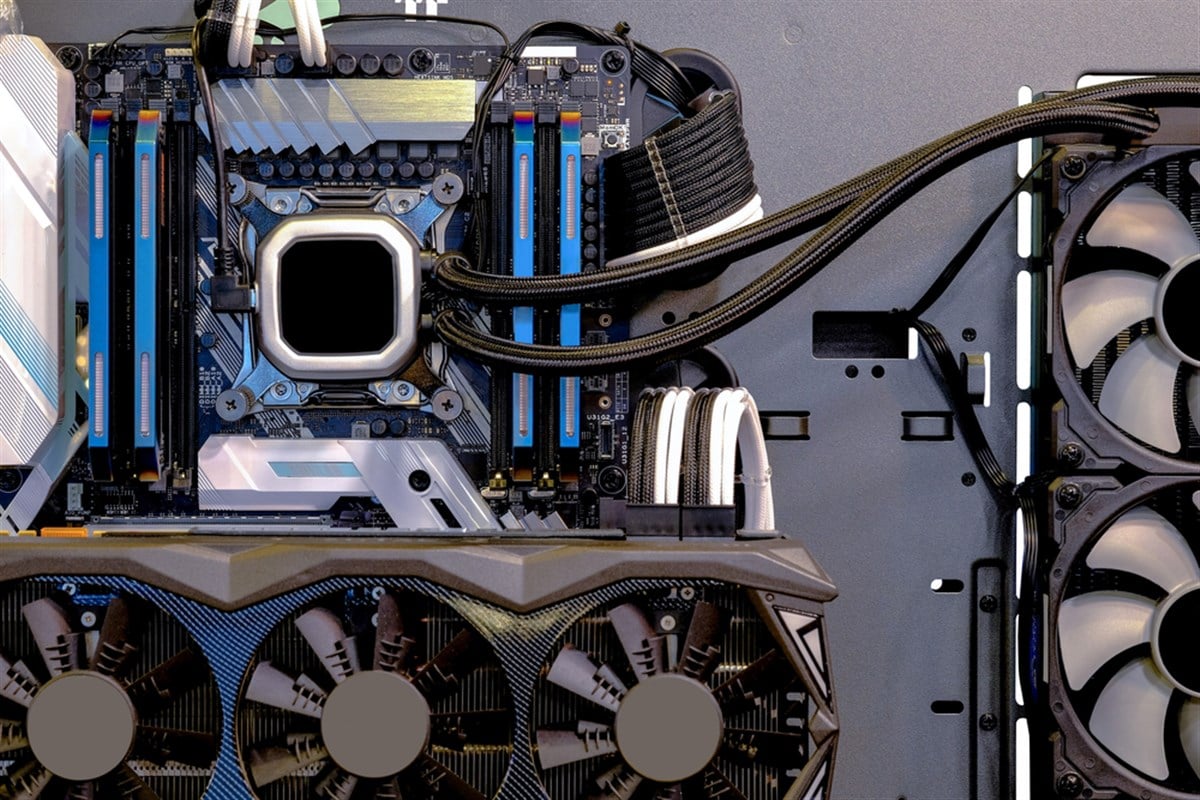

Super Micro Computer (NASDAQ: SMCI) has been an extremely hot stock in 2024, with a total return of nearly 80%. The technology company has vastly outperformed the market and its sector. The Technology Select Sector SPDR Fund (NYSEARCA: XLK) has returned only 7%. The company made the news recently when it announced a 10-for-1 stock split, which will greatly reduce its share price while keeping its overall value the same. The stock split will take effect on Oct. 1, 2024. The company reported fiscal Q4 2024 financial results on Aug. 6, 2024. To provide more context around these earnings, let's review the firm's operations, review important aspects of the report, and examine an outlook on the stock. Super Micro: Servers and Liquid Cooling Racks Super Micro Computer’s principal business is making servers and server storage systems. Servers are home to key computer components such as the motherboard, central processing unit (CPU), and, in the case of high-performance AI computing, the graphics processing unit (GPU). These components together run applications and process data. Servers are closely housed together in racks in data centers. These racks provide essential needs like cooling and power to the servers. Super Micro also makes these racks. Super Micro’s partnership with NVIDIA (NASDAQ: NVDA) in using the company’s GPUs for its servers has contributed largely to its success. Super Micro’s server racks use liquid cooling, which is more efficient than air cooling in cooling servers. Data centers emit large amounts of heat and require maintaining optimal temperatures to operate efficiently. Super Micro Computer CEO Charles Liang says liquid cooling can reduce data center costs by as much as 40%. Super Micro Slashes Margins to Grow Market Share Super Micro missed dramatically on adjusted earnings per share (EPS) compared to analyst estimates, coming in at $6.25. This was an earnings surprise of -23% and an increase of 78% from last year. Revenue grew 143% from the previous year but barely exceeded analysts’ expectations. Super Micro wants to grow liquid cooling’s industry market share from 1% to 15% over the next 12 months. To achieve this massive level of market share growth, Super Micro is sacrificing its margins. Its gross margin fell 580 basis points from the same quarter last year and 430 basis points from the most recent quarter. The adjusted EPS miss and margin contraction were the reason shares fell 20% on the day of the release. Super Micro had to cut its margins much more than expected to achieve the level of revenue that analysts projected. This margin cut likely came in the form of both lower prices and higher costs. The firm sold more to a hyperscale customer than expected, which has strong bargaining power due to its large size. It also paid higher prices on parts to get them quickly and grow its market share. It appears to be doing so, claiming that it grew five times faster than the industry average over the last 12+ months. It also believes it accounted for 70% to 80% of liquid cooling system shipments in June and July of 2024. The company also issued full-year fiscal 2025 revenue guidance at a midpoint of $28 billion, 16% higher than analysts expected. The question is how much more Super Micro will have to drop its prices to achieve this. However, it said it expects margins to “return to normal ranges by the end of 2025." Is Now a Buying Opportunity for Super Micro Stock? With only a 15x forward P/E ratio, now could be a good buying opportunity for Super Micro. Based on the firm’s rapid sales growth for the quarter, investments in AI are clearly still strong. The strategy to acquire customers and get them entrenched in the firm’s systems has short-term costs but should be a long-term benefit. Server racks are large structures with high switching costs, so the company should be able to secure customers in the long run if it can get them initially and continue building relationships. It is also good to see that Super Micro is extremely committed to this strategy and is willing to have a bad quarter to pursue it. Several Wall Street analysts lowered their sentiment on the firm after the earnings release. These analysts lowered their price targets by an average of 25%. Among them, the average price target for Super Micro is $755, implying an upside of 48%. Written by Leo Miller Read this article online › Recommended Stories: |

No comments:

Post a Comment