Which Magnificent Seven Stock Is NOT a Buy After Earnings? Dear Reader, I absolutely loathe the month of August. Every year, Wall Street and Europe take an extended summer hiatus. So, not only is there a lack of liquidity in the market, but the trading algorithms are also left in charge of Wall Street. The combination can create “air pockets” and leave the market more susceptible to manipulation. Now, I had hoped this August would buck the typical market seasonality, as the stock market tends to be better behaved during a presidential election year. Candidates will promise everything and anything on the campaign trail, and that tends to boost both consumer and investor confidence. In addition, strong second-quarter earnings results and an upcoming key interest rate cut by the Federal Reserve were also set to propel stocks higher. Instead, the stock market kicked off the month of August with a temper tantrum. The S&P 500, Dow and NASDAQ dropped 3.2%, 2.7% and 4.7%, respectively, in the first two trading days of the month. The selling then intensified on Monday because of the unwinding of the Japanese yen carry trade. As I explained in Tuesday’s Market 360, a carry trade refers to an investor borrowing in a currency with low interest rates and then reinvesting in assets with higher yields. In this case, investors had borrowed in yen due to Japan’s low interest rates and invested in the U.S. dollar for currency appreciation and higher interest rates. But when the Bank of Japan hiked key interest rates, the yen soared. Meanwhile, the U.S. dollar weakened due to the latest economic data and expectations for key interest rate cuts. The rise in the yen forced investors to close out of their yen carry trades, which, in turn, knocked down the Japanese stock market. Japan’s Nikkei 225 index fell 12.4% – its biggest one-day decline since Black Monday of 1987. The spike in the yen and the plunge in the Nikkei 225 triggered a global market selloff on Monday. The Korean KOSPI Composite Index fell 9%... India’s S&P BSE SENSEX and NIFTY 50 indices dropped 2.7% and 2.7%, respectively… and Bitcoin sank 11%. In the U.S., the Dow fell 2.6% and the S&P 500 dropped 3%. This was the Dow’s and S&P 500’s biggest one-day declines since September 2022. Tech stocks were also hit hard, as the NASDAQ plunged 3.4%. You can see the stock market bloodbath in this heat map below:  Source: finviz

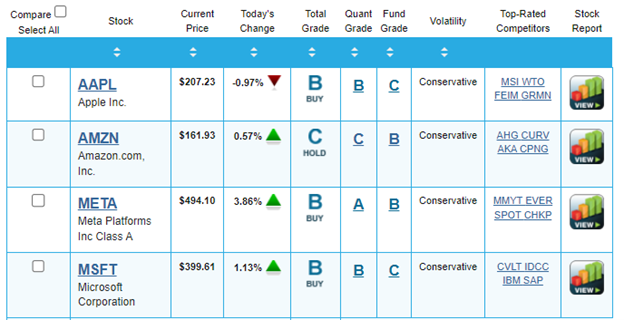

I should also add that the Magnificent Seven – Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA) and Tesla, Inc. (TSLA) – saw nearly $1 trillion in market valuation erased on Monday. But before this selloff occurred, Wall Street was laser-focused on the Magnificent Seven’s earnings. We heard from Amazon, Apple, Meta Platforms and Microsoft last week, so in today’s Market 360, let’s review their results. I’ll also share if they’re good buys after earnings… and the market shockwave that could send stocks spiraling next. Amazon.com, Inc. (AMZN) – Thursday, August 1 Amazon reported mixed results for its second quarter after the closing bell. Earnings rose 94% year-over-year to $1.26 per share, up from earnings of $0.65 per share a year ago. This topped earnings estimates of $1.03 per share by 22.3%. Revenue increased 10.1% year-over-year to $147.9 billion, falling short of expectations for $148.56 billion. The company’s cloud segment, Amazon Web Services (AWS), reported $26.28 billion in revenue, representing 19% growth from the year prior. This beat estimates for $26.02 billion in revenue. Advertising revenue jumped 20% to $12.77 billion but fell short of expectations for $13 billion. Amazon also issued weak guidance for its third quarter. It expects third-quarter operating income between $11.5 billion to $15 billion, lower than the consensus estimate for $15.3 billion. Third-quarter revenue is forecast to be between $154 billion and $158.5 billion, or 8% to 11% year-over-year revenue growth. Amazon also expects to continue to benefit from artificial intelligence demand. Company management commented: As companies continue to modernize their infrastructure and move to the cloud, while also leveraging new Generative AI opportunities, AWS continues to be customers’ top choice as we have much broader functionality, superior security and operational performance, a larger partner ecosystem, and AI capabilities like SageMaker for model builders, Bedrock for those leveraging frontier models, Trainium for those where the cost of compute for training and inference matters, and Q for those wanting the most capable GenAI assistant for not just coding, but also software development and business integration. And during the earnings call, CEO Andy Jassey was also optimistic about how AI will impact the company: The reality right now is that while we’re investing a significant amount in the AI space and in infrastructure, we would like to have more capacity than we already have today… I mean, we have a lot of demand right now, and I think it’s going to be a very, very large business for us. Apple Inc. (AAPL) – Thursday, August 1 After the market closed, Apple announced fiscal third-quarter earnings that exceeded expectations. The company reported $1.40 earnings per share on $85.78 billion in revenue, or 11.11% year-over-year earnings growth and 4.9% year-over-year revenue growth. Analysts were expecting $1.35 earnings per share on $84.53 billion in revenue, so Apple reported a slight earnings and revenue surprise. Apple’s revenue was driven by iPhone sales, which accounted for 46% of the company’s total sales during the quarter. iPhone revenue came in at $39.29 billion, just beating expectations for $38.81 billion. However, it represented a nearly 1% year-over-year decline. Apple’s Services division, which includes hardware warranties and subscriptions like Apple TV+, reported $24.21 billion in sales, representing 14.1% growth from the same quarter a year ago. This was slightly above analyst estimates calling for $24.01 billion in revenue. Its Mac division reported $7 billion in sales, up 2.5% from the same quarter a year ago. Apple’s iPad division saw the biggest increase, with sales rising 24% year-over-year to $7.16 billion. The strength was due to the release of new, updated iPads for the first time since 2022. Apple CEO Tim Cook also commented on AI in the earnings press release: During the quarter, we were excited to announce incredible updates to our software platforms at our Worldwide Developers Conference, including Apple Intelligence, a breakthrough personal intelligence system that puts powerful, private generative AI models at the core of iPhone, iPad, and Mac. Meta Platforms, Inc. (META) – Wednesday, July 31 Meta Platforms announced better-than-expected results for its second quarter after the market closed. Earnings climbed 73.2% year-over-year to $5.16 per share, up from earnings of $2.98 per share a year ago. Revenue rose 22% year-over-year to $39.07 billion revenue – Meta’s fourth-straight quarter of growth that exceeded 20%. Analysts expected $4.73 earnings per share on $38.31 billion in revenue, so the company posted a 9.1% earnings surprise and a 2% revenue surprise. Meta’s ad impressions (whenever an ad appears on a screen for the first time) increased 10% year-over-year across its apps including Facebook and Instagram. The average price per ad also rose 10%. In addition, Meta saw about a 7% increase in 3.27 billion daily active people (DAP), up from 3.07 billion a year ago. During the earnings call, CEO Mark Zuckerberg noted that AI is giving Meta a more competitive edge in its digital advertising market. He also says: The ways that it’s improving recommendations and helping people find better content, as well as making the advertising experiences more effective, I think there’s a lot of upside there… Those are already products that are at scale. The AI work that we’re doing is going to improve that. Looking ahead, Meta expects third-quarter revenue to be between $38.5 billion and $41 billion, topping estimates for $39.1 billion. Microsoft Corporation (MSFT) – Tuesday, July 30 Microsoft achieved solid results in its fourth quarter in fiscal year 2024. Revenue grew 15% year-over-year to $64.7 billion, topping estimates for $64.39 billion. Intelligent cloud revenue totaled $28.5 billion, while personal computing revenue accounted for $15.9 billion. Fourth-quarter earnings rose 10% year-over-year to $22.0 billion, or $2.95 per share. Analysts expected earnings of $2.93 per share. However, Microsoft’s AI business, namely Azure Cloud, came in just shy of expectations. Azure Cloud revenue rose 29%, below expectations for a 31% increase. Sales in their AI-cloud division of $28.5 billion were short of analysts’ estimates for $28.7 billion, according to FactSet. Looking ahead to the next quarter, Microsoft anticipates Azure revenue growth to be between 28% and 29%. In the earnings call, CFO Amy Hood explains that Microsoft has partnered with third parties to get its AI back where it should be: We are constrained on AI capacity, and because of that, we’ve… signed up with third parties to help us… You do see us investing a lot in build so we can get back to a more balanced place. I should also add that for Microsoft’s fiscal year 2024, it reported total revenue of $245.1 billion and earnings of $88.1 billion, or $11.80 per share. That represented 16% annual revenue growth and 22% annual earnings growth. The consensus estimate called for full-year revenue of $244.94 billion and earnings of $11.80 per share. The Stock to Avoid Is… With the exception of META, which soared 6% on Thursday in the wake of its earnings results, the other Magnificent Seven trended lower following their quarterly reports. Apple was also hit by news that Warren Buffett had sold almost half of his stake in Apple. Of course, a dip in stock price can also represent a good buying opportunity. So, are these Magnificent Seven stocks good buys after earnings? Let’s see what my Portfolio Grader says.  Apple, Meta and Microsoft all receive a B-rating, which makes them a Buy. However, Amazon earns a C-rating, which makes it a Hold. I should also note that it is the only stock that holds a C-rating for its Quantitative Grade, which tells us that institutional buying pressure is dwindling. The Next Shockwave to Hit the Markets While the market is calming down a bit now, there is another event that could shock the markets. It’s so serious that I call it a financial tsunami. When this tidal wave makes landfall, its impact will be more violent and more severe than any financial crisis we’ve ever seen. And this financial tsunami that’s set to wreck our economy is due to one sector: artificial intelligence. So, how can you survive? Some might think the best way to survive this tsunami is by moving off the grid or buying gold. But the reality is the way to protect yourself is by investing. Owning stock in world-class companies has always been – and will continue to be – an essential stronghold in times of technological change. So, it’s time to go stock picking – and I have found nine world-class AI- and quantum computing-related stocks that are great buys now. Click here to learn how you can access this exclusive portfolio of stocks. (Already a Growth Investor subscriber? Click here to log in to the members-only website.) Sincerely, | .png)

.png)

No comments:

Post a Comment