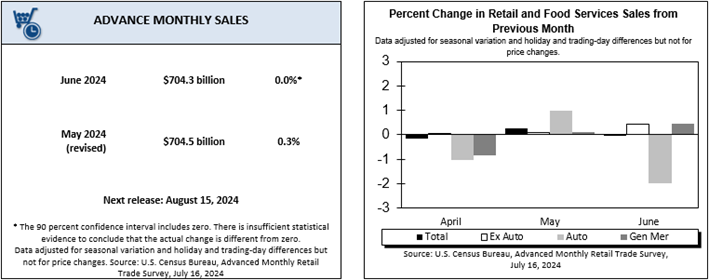

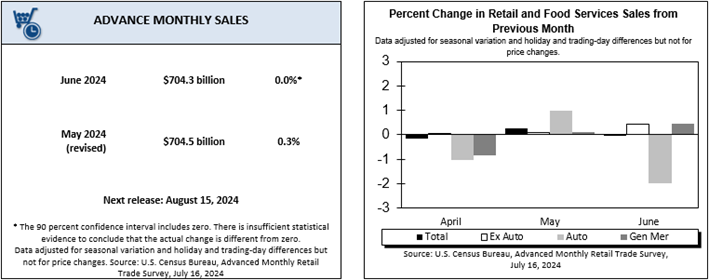

The Important Details of Today’s U.S. Retail Sales Report Dear Reader, Last week was all about the latest inflation reports and the start of the second-quarter earnings season. As you may recall from last Friday’s Market 360, the CPI reading for June was stunning, while the PPI was disappointing. But both readings showed that inflation is cooling. And as I discussed in Saturday’s Market 360, the second-quarter earnings season is shaping up to be a good one. Following Citigroup, Inc.’s (C), JPMorgan Chase & Company’s (JPM) and Wells Fargo and Company’s (WFC) quarterly results, the analyst community is growing much more optimistic this earnings season. According to FactSet, analysts are calling for 9.3% earnings growth and 4.8% earnings growth in the second quarter. This is also above analysts’ initial estimates for 8.9% earnings growth on June 30. Now this week, the big economic news was today’s U.S. retail sales report for June. So, in today’s Market 360, let’s take a closer look at the retail numbers. I’ll also share what the data means for the Federal Reserve, as well as the report the central bank (and Wall Street) will be analyzing closely. Plus, I’ll share a different event that’s on the horizon… one that could rock the stock market. Digging Into the Retail Numbers Retail sales were unchanged in June, above economists’ estimates for a 0.3% decline. Excluding auto sales, retail sales increased 0.8% in June, topping economists’ forecasts for a 0.2% rise. In addition, retail sales in May were revised to 0.3%, up from 0.1%.  Source: Census Bureau

Digging further into the details… - Spending at restaurants and bars increased 0.3%

- Spending on clothing and accessories increased 0.6%

- Both clothing and furniture retailer sales increased 0.6%

- Electronics and appliance stores rose 0.4%

- Nonstore retail sales jumped 1.9%

Although retail sales were flat in June, the details show that the U.S. consumer is more resilient than economists had anticipated. The Economic Report to Watch Next Following the retail sales report, the Atlanta Fed raised its second-quarter GDP estimate from 2% to 2.5%. The 10-year Treasury also dipped below 4.20%. The decline in Treasury yields is great news because it puts pressure on the Fed to cut key interest rates. Remember, the Fed follows market rates; it never fights the tape. As Treasury yields decline, the Fed will need to cut key interest rates to catch up with market rates. Now, we know the Fed is following the economic reports – especially inflation readings – closely to determine when it should cut key interest rates. Fed Chair Jerome Powell reiterated yesterday during a question-and-answer session at the Economic Club of Washington, D.C. that the Fed wants to be more confident before lowering rates. He said that “What increases that confidence in that is more good inflation data, and lately here we have been getting some of that.” Powell also noted that the Fed will likely cut key interest rates before inflation reaches its 2% mandate: The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%. This makes next Friday’s Personal Consumption Expenditures (PCE) reading – the Fed’s favorite inflation indicator – all the more important. If the PCE continues to cool off, then a rate cut is likely. I still think that the Fed should cut rates at its July Federal Open Market Committee (FOMC) meeting, but a September rate cut is the more likely scenario. Analysts now believe there’s a 93.3% chance the Fed cuts rates at its September meeting. Regardless of what I think should happen at the July FOMC meeting, we’ll likely receive a dovish statement. And a dovish FOMC statement combined with further clarity that the September rate cut is forthcoming should propel the stock market higher. The reality is that once the Fed cuts key interest rates, the stock market should broaden out in the following months. What Could Rock the Stock Market Although a Fed rate cut should “turbo boost” the stock market, there’s another financial tidal wave that could rock the stock market. When it makes landfall, its impact will be more violent and more severe than any financial crisis we’ve ever seen. The tidal wave that’s set to wreck our economy is due to artificial intelligence. So, how can you survive? Some might think the best way to survive this tsunami is by moving off the grid or buying gold. But the reality is the way to protect yourself is by investing. Owning stock in world-class companies has always been – and will continue to be – an essential stronghold in times of technological change. The stock market is the only place I know that allows you to align yourself with innovators, entrepreneurs and wealthy corporations gaining a critical early foothold in these new technologies. In other words, it’s time to go stock picking – and I have found nine world-class AI- and quantum computing-related stocks that are great buys now. Click here to learn how you can access this exclusive portfolio of stocks.

(Already a Growth Investor subscriber? Click here to log in to the members-only website.) Sincerely, |

.png)

.png)

No comments:

Post a Comment