3 Big Banks Release Their Q2 Results... Should You Buy? Dear Reader, Folks, the second-quarter earnings season is finally here… and it’s shaping up to be a good one. As I mentioned in Friday’s Market 360, FactSet projects the S&P 500 will achieve earnings growth of 9.3% in the second quarter and 4.8% revenue growth.

If the actual growth rate is 9.3%, it would not only be the fourth-consecutive quarter of year-over-year earnings growth, but also the highest year-over-year earnings growth rate since the first quarter of 2022. Three of the big banks - Citigroup Inc. (C), JPMorgan Chase & Co. (JPM) and Wells Fargo & Company (WFC) – marked the official start of earnings season with their second-quarter earnings reports yesterday morning. Last week, FactSet expected the Financial sector to post 4.3% earnings growth, but the Banks industry was anticipated to post a 10% earnings decline. Excluding the Banks industry, the Financial sector’s expected earnings growth rate was 14.8%. Following their results, the Financial sector is now forecast to achieve 10.7% earnings growth in the second quarter, with the Banks industry expected to report 7% earnings growth. This is a significant earnings revision, so let’s use today’s Market 360 to review Citigroup’s, JPMorgan Chase’s and Wells Fargo’s to review their quarterly numbers. I’ll also share if they are good buys right now. And then, I’ll reveal how you can prepare for an incoming financial wave that could shock the market (hint: it has nothing to do with earnings). Citigroup Inc. (C) Citigroup announced earnings of $1.52 per share on $20.14 billion in revenue, topping estimates of $1.39 per share and $20.07 billion in revenue. This compares to earnings of $1.33 per share and $19.4 billion in revenue in the same quarter a year ago. Banking revenues jumped 38% to $1.6 billion, thanks in part to the strength in Banking and Corporate Lending. Investment Banking revenue increased 60% year-over-year to $853 million due to investment grade bond issuance, while Corporate Lending rose 7% to $756 million, excluding mark-to-market on loan hedges.

CEO Jane Fraser noted in the earnings press release: Our results show the progress we are making in executing our strategy and the benefit of our diversified business model… Markets had a strong finish to the quarter leading to better performance than we had anticipated… The recent stress tests again showcased strength on our balance sheet… We will continue to execute our transformation and our strategy so we can meet our medium-term targets and continue to further improve our returns over time. Although shares of Citigroup opened higher following the earnings report, they turned lower in afternoon trading. JPMorgan Chase & Co. (JPM) JPMorgan reported adjusted earnings of $4.40 per share on $50.2 billion in revenue. Analysts were calling for earnings of $4.19 per share and revenue of $49.87 billion, so the bank beat estimates on both the top and bottom lines. Banking & Wealth Management slipped 5% to $10.4 billion, while Markets & Securities Services revenue increased 8% to $9 billion and Markets revenue climbed 10% to $7.8 billion. Investment Banking fees surged 50%. JPMorgan Chase CEO Jamie Dimon also provided comments on the U.S. economy and inflation. Regarding the economy, he said: While market valuations and credit spreads seem to reflect a rather benign economic outlook, we continue to be vigilant about potential tail risks. These tail risks are the same ones that we have mentioned before. The geopolitical situation remains complex and potentially the most dangerous since World War II – though its outcome and effect on the global economy remain unknown. As for inflation, Dimon commented: Next, there has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world. Therefore, inflation and interest rates may stay higher than the market expects. And finally, we still do not know the full effects of quantitative tightening on this scale. JPMorgan is sticking to its full-year net interest income forecast of $91 billion, excluding trade revenue. JPM shares fell more than 2% in early trading on the heels of the report. Wells Fargo & Company (WFC) Wells Fargo reported earnings of $1.33 per share on $20.69 in revenue. Analysts were expecting $1.29 earnings per share on $20.29 billion in revenue. Consumer Banking and Lending revenue declined 5% to $9 billion, Commercial Banking fell 7% to $3.1 billion, while Corporate and Investment Banking rose 4% to $4.8 billion.

More important, net income declined 9% year-over-year to $11.92 billion, below analysts’ estimates for $12.12 billion.

CEO Charlie Scharf expects net income to improve. In the Citigroup earnings press release he said: We continued to see growth in our fee-based revenue offsetting an expected decline in net interest income. The investments we have been making allowed us to take advantage of the market activity in the quarter with strong performance in investment advisory, trading, and investment banking fees. Wells Fargo also maintained its net income outlook for 2024. It expects net income to decline 7% to 9% to $52.4 billion. Shares of Wells Fargo fell more than 5% on Friday. Are These Banks Buys? Even though Citigroup, JPMorgan Chase and Wells Fargo all beat earnings and revenue estimates, I would not view them as buys.

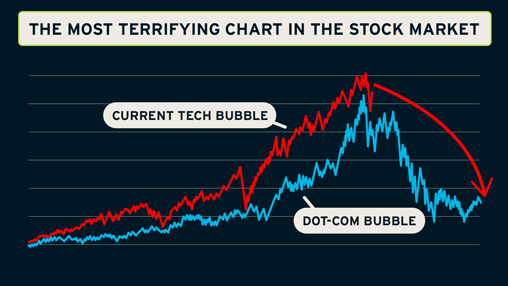

If you’re a longtime reader of mine, you know I’m not a big fan of the “big banks.” That’s because I am an ex-banking regulator and I know they sometimes play fast and loose with their numbers. Back in the late 1970s and early 1980s, when the yield curve was severely inverted, I used to merge two money-losing financial institutions together so they could qualify for FSLIC or FDIC insurance. Essentially, I would take the largest financial institution and merge it into the smaller one, but would re-amortize its assets (e.g., loan portfolio) to make the combined financial institution look better. Even though I could never fix the combined financial institution’s cash flow, I helped them kick the can down the road, since an inverted yield curve is lethal for banks. In other words, I used to put lipstick on a pig. My experience scarred me for life, which is why I rarely recommend banks. The Incoming Financial Wave While Wall Street will likely be mostly focused on earnings over the next six weeks, there’s another financial tidal wave coming that could rock the stock market. When it makes landfall, its impact will be more violent and more severe than any financial crisis we’ve ever seen. The tidal wave that’s set to wreck our economy is due to artificial intelligence. So, how can you survive? Some might think the best way to survive this tsunami is by moving off the grid or buying gold. But the reality is the way to protect yourself is by investing. Owning stock in world-class companies has always been – and will continue to be – an essential stronghold in times of technological change. The stock market is the only place I know that allows you to align yourself with innovators, entrepreneurs and wealthy corporations gaining a critical early foothold in these new technologies.

In other words, it’s time to go stock picking – and I have found nine world-class AI- and quantum computing-related stocks that are great buys now. Click here to learn how you can access this exclusive portfolio of stocks.

(Already a Growth Investor subscriber? Click here to log in to the members-only website.) Sincerely, |

.png)

.png)

No comments:

Post a Comment