NVIDIA and AMD Make Their Next Move in the AI Chip War Dear Reader, There was some big news in the AI sector this week.

On Sunday, NVIDIA Corporation (NVDA) teased its next AI chip. And then on Monday, at the Computex tech conference, Advanced Micro Devices Inc. (AMD) unveiled its newest AI chip. This comes as AMD seeks to establish itself as an AI leader and contender against the clear winner right now: NVIDIA.

So, in today’s Market 360, let’s take a look at what we know about the new chips from both NVDA and AMD. Then, we’ll consider which stock is the better buy right now – and I’ll also share how to separate the real winners from the AI boom from the ones that are trying to play catch-up. The Next Generation of Chips Let’s start with NVIDIA. NVIDIA’s Rubin NVIDIA CEO Jensen Huang announced its latest AI chip architecture, dubbed “Rubin.” This latest addition quickens the company’s already accelerated pace of AI chip advancement.

I should note that the Rubin reveal follows the March announcement for the upcoming “Blackwell” model, which won’t even ship until late 2024. Huang also shared plans for a Blackwell “Ultra” chip in 2025 and the next-generation Rubin platform for 2026.

While Huang didn’t provide many details, the gist is that the Rubin platform will use a new form of high-bandwidth memory and ultrafast switch, enabling even greater performance. And Huang stated that: We’re at the cusp of a major shift in computing. With our innovations in AI and accelerated computing, we’re pushing the boundaries of what’s possible and driving the next wave of technological advancement. Now, this turnaround from the Blackwell model to the newest Rubin model took place in less than three months. So why the rush?

Well, it is estimated that NVIDIA holds a commanding 80% share of the data center GPU market. But competitors like AMD (with its Instinct GPU series) are furiously trying to compete for their piece of the pie. So, this quick shift stresses how the AI chip market is reaching a frenzy, and NVIDIA is working hard to stay at the top. AMD’s Ryzen AI 300 Series During a keynote address at the Computex conference, CEO Lisa Su unveiled unveiled new AI chips for data centers and advanced laptops. The Ryzen AI 300 series will be for AI laptops, while the Ryzen 9000 series will be for desktops. When it comes to gaming and content creation, Su said these chips will be “the world’s fastest consumer PC processors.”

Ryzen processors will be integrated into AI-powered computers through partnerships with Microsoft, HP, Lenovo, and Asus.

Su stated: AI is our number one priority and we’re at the beginning of an incredibly exciting time for the industry as AI transforms virtually every business, improves our quality of life, and reshapes every part of the computing market. As generative AI-enabled PCs and laptops begin to hit the market, it could create a boom in demand as consumers seek to upgrade their devices. But this could take some time to play out.

AMD is an early mover in the AI CPU space, with some estimates pegging its market share as high as 90%. That won't last forever, but next year alone, the share of AI-powered PCs is expected to climb from 2% to 16%, according to Morgan Stanley.

Meanwhile, analyst forecasts are calling for the company’s sales to increase by as much as 28.4% in 2025. Don’t Fall for the AI Hype Following all the news from the AI sector this week, it can be easy to get caught in the hype and blindly buy into any AI stock an investor may think could be the next AI winner. But just because a company is claiming it, doesn’t mean it’ll happen.

I’m talking about AMD, of course. Now, don’t get me wrong, AMD is working on some exciting things. The company is likely to play a key part in the rollout of AI to PCs and laptops for individual consumers.

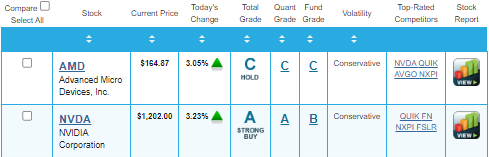

But when you compare the fundamentals of AMD to NVDA, it is clear which company you should be putting money into, and which to avoid. You can see for yourself in the Portfolio Grader report card below.  While NVDA holds a total grade of A, making it a strong buy, AMD holds a total grade of C, making it a hold. And if you dig deeper, you can see that NVDA holds an A-rating for its Quantitative Grade and a B-rating for its Fundamental Grade, showing the company has superior fundamentals. Meanwhile, AMD holds a C-rating for both its Quantitative Grade and Fundamental Grade, signifying that the fundamentals just aren’t there. NVDA has also been a stronger performer this year. As of this writing, so far in 2024, NVDA is up almost 140%, while AMD is up only about 13%.  Plus, NVDA should get a boost from its 10-for-1 stock split today. (The split-adjusted price will go into effect on June 10.)

A stock split occurs when a company divides shares of its stock into smaller units. From a fundamental perspective, it does not change the company or its value.

As a shareholder, it simply changes the amount of shares that you own. Companies tend to split shares to make their stock more accessible to retail investors. In NVIDIA’s case, shareholders will receive nine additional shares for each share they previously owned. This will cut the value of each share to a 10th of its prior value.

Now, NVIDIA isn’t a stranger to stock splits. In fact, the company has gone through five stock splits, most recently in 2021. Following its latest 4-for-1 split, shares have more than quadrupled. The Real Market Winners Folks, fundamentally superior stocks will ALWAYS win out. That’s why I recommended NVDA in Growth Investor in May 2019, and why it’s remained a key holding in my Buy List. And now, it’s up more than 2,700% on my Buy List.

But stocks like this aren’t always the easiest to find in the market.

And that’s why I encourage you to join me at Growth Investor today. By signing up, you’ll gain immediate access to both my Buy Lists which are chock full of fundamentally superior stocks. Not only that, but I will keep you in the loop on how these stocks fundamentals are doing, and alert you when it’s time to cut ties with stocks that don’t fit the bill anymore.

Likewise, you’ll be able to read all the special reports I have put together for my Growth Investor members, as well as all my previous Weekly Updates, Monthly Updates, Podcasts and more.

Click here to become a member of Growth Investor today.

(Already a Growth Investor member? Click here to access your members-only website now.) Sincerely, |

No comments:

Post a Comment