Why You Shouldn't "Sell in May and Go Away" Dear Reader, There is a popular Wall Street adage you’ve maybe heard: “sell in May and go away.”

This originated from the old London saying, “sell in May and go away, come back on St. Leger’s Day.” Now, St. Leger Stakes is a famous fall horse race – the final race in the British Triple Crown – that has taken place in the U.K. dating back to 1776.

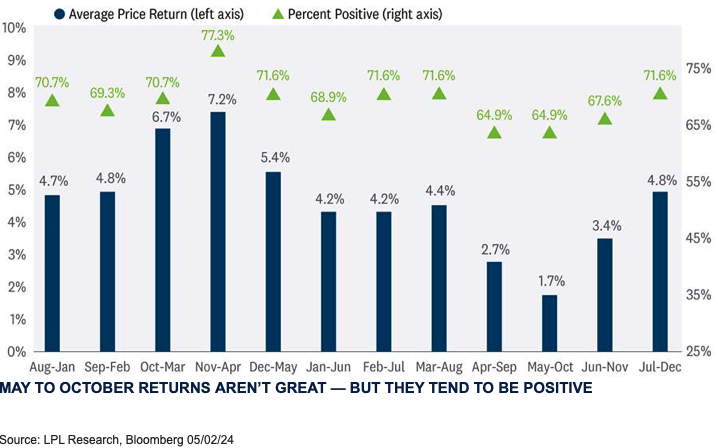

However, when it comes to Wall Street, the saying is used to express the traditional weakness of the market during the summer months, usually from May to October. Just take a look at the graphic below which highlights the rolling six-month returns for the S&P 500 across all 12-month periods since 1950.  Source: Financial Advisor Magazine

Clearly, the May through October time frame has historically been underwhelming. But I don’t want you to blindly follow this “sell in May” advice.

If you’ve been following me for a while, then you know I hate Wall Street’s adages, especially the “sell in May” one. In fact, in my opinion, there is one group of stocks where investors should avoid following the “sell in May” crowd this year, or else they’d be making a huge mistake.

I’m talking about small-cap stocks.

The reality is there’s an interesting phenomenon in play right now that’s expected to help small- and mid-cap stocks in the coming months. So, in today’s Market 360, we’ll go over why I think this year will be the summer of small-cap stocks. Then, I’ll share the best place to find these small-cap winners. The Summer of Small Caps Historically, the six-month period between November and April is the strongest time of year for smaller-cap stocks. This historical precedence held true in the most recent six-month period, with the Russell 2000 rising 18.7% from the beginning of November 2023 through the end of April 2024.

Interestingly, prior to the dismal month of April, the Russell 2000 had soared nearly 28% higher in the five months from November to March.

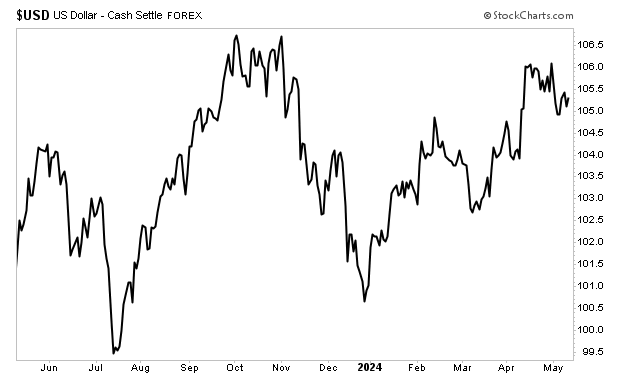

The question now is: Will smaller-cap stocks be able to bounce back from the April dip and continue to climb higher this year? Or will “sell in May and go away” prevail? Well, seasonality aside, there is an interesting phenomenon taking place right now that should help both small- and mid-cap stocks. I’m talking about the fact that the U.S. dollar is very strong right now, with the currency sitting near its highest level since November.  There are a few reasons why the U.S. dollar continues to strengthen.

One reason is that Treasury yields soared to new heights in April. The 10-year Treasury yield bounced as high as 4.7% on April 25, up from 4.2% at the end of March. And the primary culprit for the bounce: Inflation remained persistently high, so the Federal Reserve hinted that key interest rate cuts will be postponed until later this year.

Not only did the latest consumer and wholesale inflation data come in hotter than expected last month, but the Fed’s favorite inflation indicator, the Personal Consumption Expenditure (PCE) index, also rose more than economists anticipated. Core PCE, which excludes food and energy, rose 0.3% in March and was up 2.8% in the past 12 months. Economists expected a 0.3% month-to-month rise and a 2.7% year-over-year increase.

Clearly, inflation remains stubbornly higher than the Fed’s 2% target, and that squelched a lot of investors’ hopes that rate cuts were forthcoming this summer.

Still, the Fed historically cuts key interest rates before presidential election years. And this year should be no different, with Fed Chair Jerome Powell noting that rate cuts are still in the pipeline. However, the Fed is not expected to cut key interest rates in June, in what would have been coordinated rate cuts with the Bank of England and European Central Bank.

So, higher Treasury yields and the postponement of rate cuts both helped the U.S. dollar strengthen.

The problem with a strong greenback is that it pinches the profits of multinational companies, as they’re paid in eroding currencies. You may recall that about half of the S&P 500’s revenue is from outside the U.S., so many multinationals’ top and bottom lines have been hurt by the strong U.S. dollar.

So, when multinational companies are struggling, institutional investors typically gravitate to more domestic companies – and that equates to boosting their allocations in small- and mid-cap stocks. The fact is that small- and mid-cap stocks are more domestic in nature, and the strong U.S. dollar tends to add handsomely to their top and bottom lines. Where to Find the Small-Cap Winners Folks, we have already been seeing this play out during the first-quarter earnings announcement season. Just look at small-cap stocks in my Breakthrough Stocks Buy List, such as The Vita Coco Company (COCO), which reported 100% year-over-year earnings growth. Or Powell Industries, Inc. (POWL), which announced a massive 294.1% year-over-year earnings growth.

And those are just two examples of the incredible earnings growth that small-cap stocks have posted this earnings season. But the reality is there are plenty more examples in our Breakthrough Stocks Buy List. In fact, 24 companies in our Buy List have released results this earnings season. Of those, 19 have exceeded analysts’ expectations, three posted in-line earnings and two missed estimates. Our average earnings surprise is a whopping 41%, as our Buy List stocks have posted earnings surprises between 4% and 133%.

Now, for more than 30 years, my Breakthrough Stocks strategy of investing in small- to mid-cap stocks has consistently generated market-beating returns.

And that’s certainly been the case this year. Our Buy List is up an average 16% so far in 2024 – double the S&P 500’s 9.5% rise.

But the party is just getting started... The S&P 500 is expected to achieve an average earnings growth of 11% for 2024. Our Breakthrough Stocks Buy List, meanwhile, has average forecasted earnings growth of 138.5%!

The bottom line is that the “smart money” is on the move. And my small- and mid-cap Breakthrough Stocks continue to attract persistent institutional buying pressure – and many of our stocks have exhibited tremendous relative strength recently.

So, even though there may be a lot of folks jumping on soapboxes, telling you to “sell in May and go away” in the near term, I encourage you to block out the noise. The reality is that it should be a very good summer for small-cap stocks.

It has been an incredible first-quarter earnings season, and I expect wave-after-wave of positive results to continue to propel our small- and mid-cap stocks higher throughout the year. So, if you aren’t confident in your stocks leading up to the summer months, check out my Breakthrough Stocks Buy List for picks to load up in your portfolio. I suspect that we’re still in the early innings of what could be a remarkable year for our stocks.

Click here to join me today.

(Already a Breakthrough Stocks member? Click here to log in to the members-only website now.) Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

The Vita Coco Company (COCO) and Powell Industries, Inc. (POWL) |

No comments:

Post a Comment