How I Learned to Love (and Profit From) Volatility | | | Editor’s Note: There’s a reason most investors want to see the Fed cut rates. It will provide a clear signal … a definite direction. Most investors fear volatility.

But traders don’t fear the volatility – they relish it!

Why? Because volatility can lead to outsized gains!

A few months ago, our colleague Jonathan Rose launched Masters in Trading Live and the feedback has confirmed everything we knew about Jonathan.

For more than 16 years, Jonathan traded in the “pits” of some of the biggest exchanges in the world – including the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

Aside from just his trading skills, he is a gifted teacher with a skill for simplifying trading concepts. If you’ve watched even one of Jonathan’s Masters in Trading Live videos, you know what I mean.

Next week, during a special Masters in Trading event, Jonathan is going share the details behind one of the most consistent and lucrative trading strategies he discovered over 15 years as a professional trader.

His approach is based on a "quantitative" formula that's predicted major market moves time after time. In fact, over the last three years, 90.3% of the calls Jonathan made using this formula have gone up. During the event, you’ll discover how to use this formula to find gains as high as 197%, 317%, or even 1,147%—all in 30 days or less.

Sign up here now in order to join us on May 8 at 10 am Eastern as Jonathan pulls back the curtain and shares how he makes big profits – no matter which way the market moves.

| |

Dear Reader,

Today, I’m going to pass along a secret about making money in the markets that you won’t hear in the mainstream press.

When you read about this idea, you’ll think I’m crazy.

But if you stick with me, I’ll show you how I’ve used this controversial idea to make gains of 197%… 317%… and 1,147% in 30 days or less.

Now that I have your attention, let me tell you why this idea is so controversial.

A survey by Allianz Life reveals that more than 6 in 10 investors fear market volatility.

You may even be one of them.

And that’s only natural.

Times of extreme volatility – when markets go through huge ups and downs – are dangerous for most investors.

That’s because when markets are volatile, investors’ emotions get the better of them.

They panic and sell near bottoms… Then they panic and buy near tops. So it’s no surprise mainstream headlines make volatility sound like a terrible thing.

But as I’ll show you today, you shouldn’t fear volatility. You should embrace it.

Without it, there would be no outsized profits. Don’t Run from Volatility – Run to It Before I explain why you should embrace volatility, let me introduce myself.

My name is Jonathan Rose.

For more than 16 years, I traded in the “pits” of some of the biggest exchanges in the world – including the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

If you’ve seen the movie Trading Places, you’ll know what I mean. These exchanges are where thousands of traders used to use hand signals to buy and sell everything from stocks and options… to grains and pork bellies.

I’ve seen guys make more money in a few weeks than many people will earn in their entire lives.

And I’ve personally made millions of dollars over the course of my career.

So, I know what it takes to become a successful trader.

And it’s really not as hard as most people think.

The problem is most people are emotional investors. They let volatility get the best of them.

But I’ve learned that that there are three keys to reining in your emotions: - A strategy that gives you an edge

- The right vehicle to boost your returns

- And a solid trading plan that helps you stay in the game for the long run

If you’re not using these three keys, you may as well throw your money away. The Best Way to Harness Volatility If you want to harness the power of volatility, the best strategy is to trade options.

These are contracts that give the buyer a right—but not the obligation — to buy or sell stocks at an agreed-upon price at a specific time.

And they give you huge leverage over stocks. That means you can pull forward decades’ worth of gains in as little as 12 months.

Now, most folks think options are risky. And your broker may tell you to run away from them.

But options actually limit your downside risk. That’s because with the type of fixed-risk option trades I recommend, you can never lose more than your initial investment.

And if your options trades are winners, they give you leverage – or extra oomph – over the movement in stocks.

But you don’t have to take my word for it.

Just look at the chart below. It shows the price of online broker Robinhood (HOOD).  On Feb. 23, I recommend my readers buy call options on HOOD. These pay off when the price of the underlying stock rises.

The trade I recommended came out to a combined 52% gain. So, folks who followed me could’ve made $1,300 on a $2,500 investment in just 20 days.

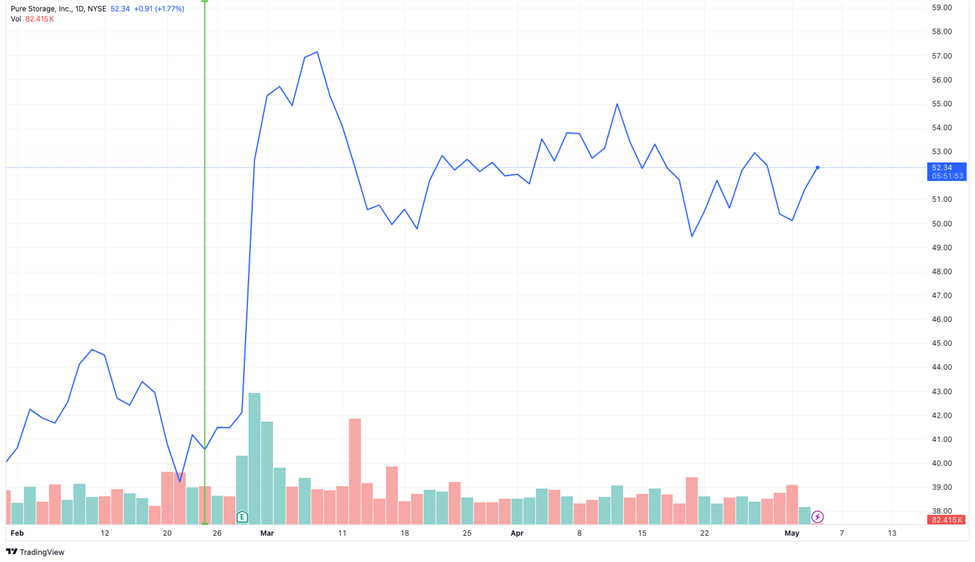

That same day, I made another recommendation – on digital storage company Pure Storage (PSTG). And once again, I was right on the money...  My followers had the chance to almost triple their money over in just 22 days.

Now, PSTG is up 131% over the past 12 months.

But folks who followed my trade had the chance to pull forward all of those gains (and more) in about three weeks.

That’s what I mean about the power of leverage. Even better, this strategy works regardless of market conditions. So, you can use options to make triple-digit gains even in bear markets.

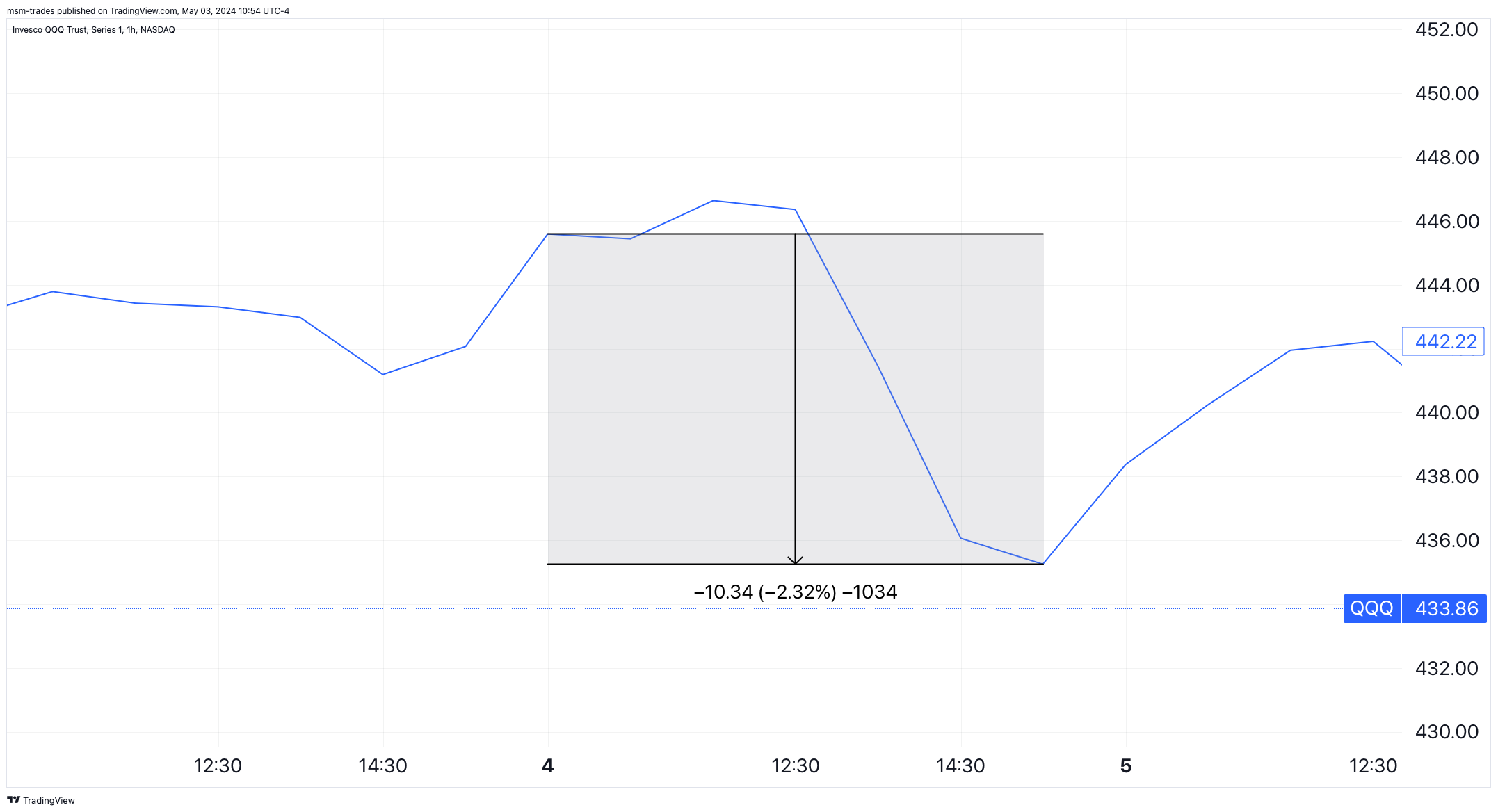

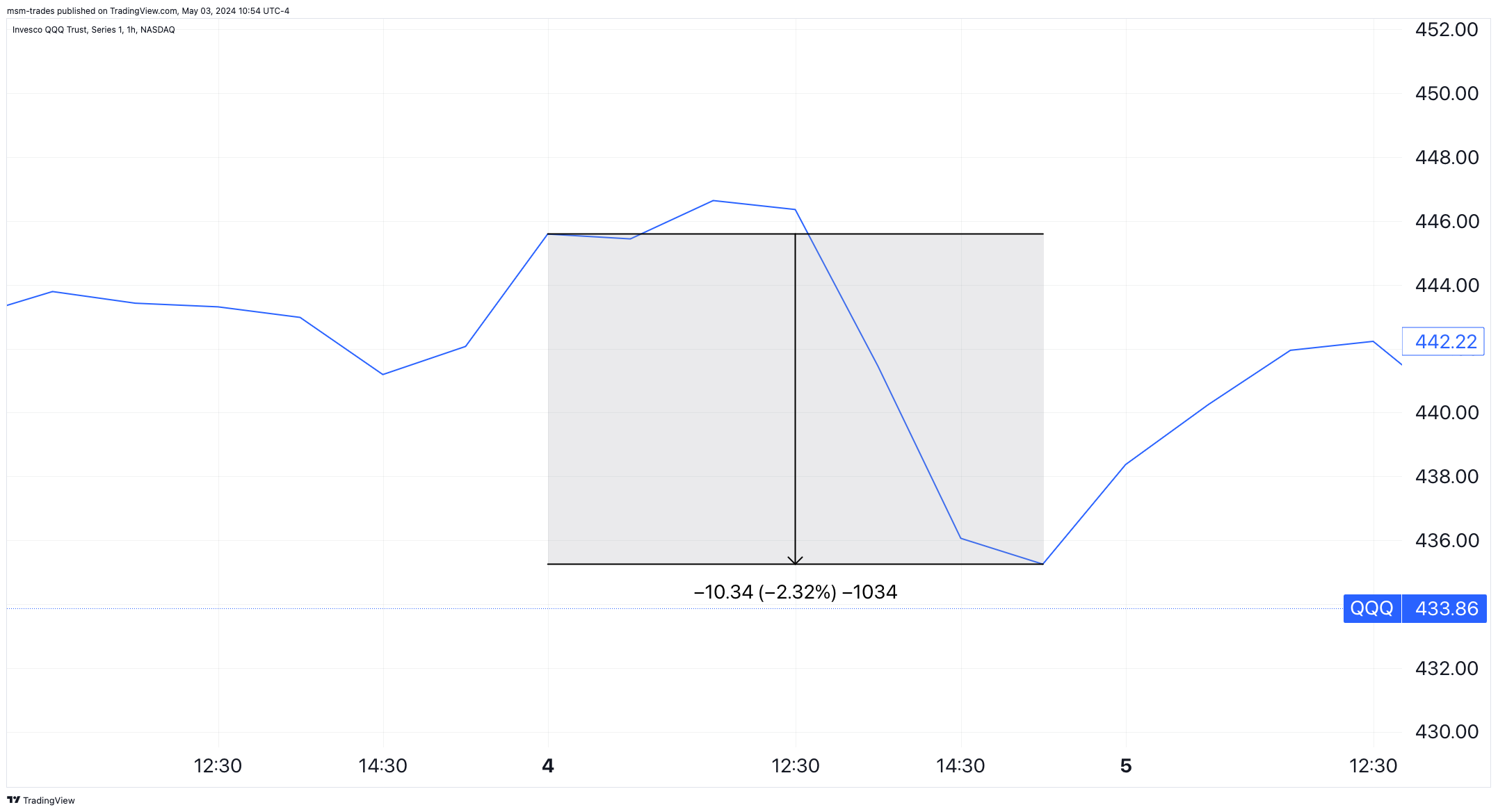

The chart below shows the Invesco QQQ Trust (QQQ). It’s an index fund that tracks the biggest tech stocks in the U.S.

On April 4, I predicted that the QQQ was about to drop... And I told my followers to trade the coming downside move.  Sure enough, my call was right on the money.

QQQ dropped almost 2% by next morning. And I recommended to close this trade out for a 279% return… in a day.

I’m not saying this to brag. I just want to show you the power of making money from volatility.

Now, compare that to what a long-term investor might make… Making Money at Warp Speed From 1802 to 2012, investment returns in U.S. stocks averaged 6.7% per year.

At that rate, you’d double your money in about 11 years… And you’d triple it in about 17 years.

Those are solid returns – for the Average Joe. But you’re reading Market 360 because you don’t want to be an Average Joe.

You want to make life-changing wealth soon, so you can enjoy the lifestyle it affords you.

If you’re ready to make the leap from Average Joe investor to master trader, I’d like to invite you to my Masters in Trading Summit on Wednesday, May 8, at 10 a.m. Eastern.

I’ll show you how I’ve used my options strategy to generate more than $4 million as a trader in 2008… a year when the S&P 500 dropped 38.5%.

I’ll also reveal my No. 1 indicator to find trades that go up 90.3% of the time.

And I’ll share the results of a live experiment that lasted about six weeks, in which I closed seven out of seven trades for an average gain of 125%.

As a bonus, if you reserve your seat now, you can watch my three-part High Probability Options crash course – free. Just follow this link for access.

And whether you join me on May 8 or not, please remember… When most people hear the word volatility, they see fear ahead.

But for market pros, volatile markets are the best opportunities to make truly life-changing wealth.

And right now, I see an opportunity for you to make returns in 10 months that most people wait 10 years for.

So make sure to mark May 8 on your calendar. And click here to reserve your seat and get your free bonus…

The creative trader always wins,

Jonathan Rose

Founder, Masters in Trading

|

No comments:

Post a Comment