Will This Energy Stealth Rally Continue? Dear Reader, Both the month of April and the second quarter are off to a bumpy start, and all major indices are continuing to slip lower. So far this month, the S&P 500, Dow, and NASDAQ are down 4.6%, 5.1%, and 4.7%, respectively.

This is primarily due to the hot Consumer Price Index (CPI) reading for March. As I discussed in last Saturday’s Market 360, headline CPI rose 0.4% in March and was up 3.5% in the past 12 months – topping economists’ forecasts for a 0.3% monthly increase and a 3.4% annual increase.

The Producer Price Index (PPI) was a little better. The PPI rose 0.2% in March, which was below economists’ estimates for a 0.3% gain. Headline PPI was up 2.1% in the past 12 months – the biggest jump in nearly a year. However, this was still below economists’ expectations for a 2.2% increase.

The 10-year Treasury yield spiked in the wake of the CPI report on Wednesday, climbing as high as 4.568% – a level not seen since November 2023 – and now stands at about 4.62%.

This poses a big problem for the Federal Reserve. Earlier in the year, the central bank had hinted it would cut key interest rates in June. But with inflation still high, it will likely have to postpone its rate cuts until July or later. And Fed Chair Jerome Powell pretty much confirmed that earlier this week.

Now, while the broader market may be pulling back… there is one sector that’s exhibited relative strength in April. In fact, it’s quietly rallied all year long.

It’s not tech, the Magnificent Seven companies or AI stocks…

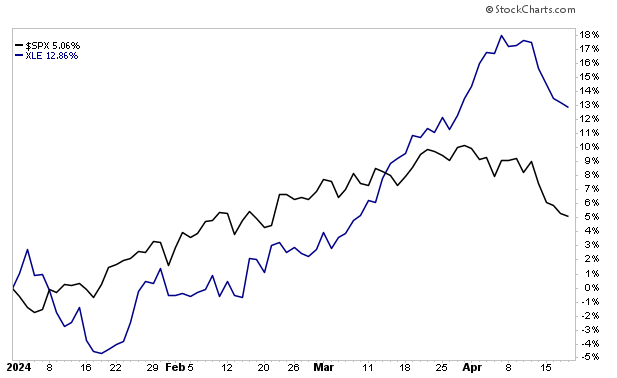

I’m talking about the energy sector. The energy sector fell about 1.3% in 2023 (in comparison, the S&P 500 climbed about 26%), but it has been in a stealth rally since the beginning of this year. In fact, the Energy Select Sector SPDR Fund (XLE) is up 12.9% year-to-date compared to the S&P 500’s 5.1% gain.  The reason energy stocks are doing so well is simple… oil prices are up.

Crude oil prices have rallied 15% so far this year, while West Texas Intermediate (WTI) crude oil reached $87 per barrel before leveling off recently around $85. That’s the highest level since mid-October last year.  This, of course, is good for energy stocks. But the big question is, will this rise in oil prices continue?

That’s the question I’ll answer in today’s Market 360. I’ll explain the two major factors contributing to the rally in the energy sector. I’ll also share why I think energy stocks deserve a place in just about every investor’s portfolio – and where you can find the best of them. Two Factors Behind Oil’s Resurgence Factor No. 1: Geopolitical Tensions

The biggest and most obvious cause of oil’s strength is ongoing geopolitical tensions in the Middle East as well as between Russia and Ukraine.

The latest development came last Saturday when Iran launched over 300 drones and missiles into Israel. This was a retaliation for an attack on the Iranian consulate in Damascus, Syria earlier this month.

Now, Israel has pledged to respond with a show of strength in the wake of this unprecedented attack. But after Israel’s war cabinet meeting on Sunday, it remains to be seen whether this will occur.

On April 2, Ukraine launched a drone attack on Russia’s third-biggest oil refinery. While this didn’t cause critical damage, the reality is that four of Russia’s refineries have been attacked by Ukraine in recent months.

These Ukrainian strikes are part of a bid to reduce fuel supplies to the Russian military, as well as to cut revenues from exports that Moscow uses to fund the war. Now, the White House has been concerned that these attacks will impact global energy markets, and it has urged the Ukrainians to focus on military targets instead.

But my big concern is that Ukraine may eventually target Russia’s pipeline from the Arctic. If this happens, the pipeline would be offline for three years – and oil prices could easily surge to $100 per barrel. Factor No. 2: OPEC Production Cuts

The second factor is the production cuts from OPEC+.

On April 3, the oil cartel confirmed that it is extending its previously announced production cuts through the second quarter. This means there will be about 2.2 million barrels of oil per day off of the market through June.

This is a big move that’s likely to keep oil prices elevated while geopolitical tensions are high.

I should also mention that this comes at a time when higher seasonal demand kicks in. The fact is demand picks up in the Northern Hemisphere as temperatures begin to rise. Just in time for the summer driving season, too.

Gas prices have gone up 15% this year, averaging $3.57 per gallon in the U.S., according to AAA. And since more people live in the Northern Hemisphere than the Southern Hemisphere, this causes higher demand. Add it all up, and this serves as a launching pad for energy prices. Where You Can Find the Best Energy Stocks Higher energy prices are expected to persist in the near term, which is why energy has been a bright spot in an otherwise rocky market in April.

And the fact of the matter is it makes sense to hold the energy stocks – one reason being diversification. These stocks often “zig” when the tech stocks “zag,” so they can actually lower the risk of your portfolio. Plus, any unexpected escalation or geopolitical shock could send oil prices skyrocketing, which would obviously benefit energy stocks as well.

For that reason, I think just about every portfolio should have some exposure to energy stocks.

As far as the energy sector goes, there are a lot of options. Personally, I like the LNG tankers and the energy refiners, and I also think a lot of the integrated energy stocks make sense right now.

And my Accelerated Profits Buy List is the perfect place to find them.

In fact, four of my Accelerated Profits energy stocks have ticked up higher this year, with gains ranging from 15% to 40% year-to-date.

Now, I expect the momentum to continue during the first-quarter earnings season that’s currently underway. But the reality is that just about all of the stocks on our Accelerated Profits Buy List should do well. That’s because my Buy List is full of fundamentally superior stocks, which are currently characterized by 31.2% average forecasted sales growth and 276% average forecasted earnings growth.

So, I expect my Accelerated Profits stocks to post wave-after-wave of positive surprises. And that, in turn, should dropkick and drive these stocks, including energy my ones, even higher this quarter.

To gain full access to my Accelerated Profits Buy List – including my favorite energy plays – become a member of Accelerated Profits today.

(Already an Accelerated Profits subscriber? Click here to access the members-only website.) Sincerely, |

No comments:

Post a Comment