Geopolitical Unrest Is Revealing a Golden Opportunity in Cryptos | | | Editor’s Note: With all the hype around the Bitcoin Halving, I’ve been getting a lot of questions about cryptocurrencies. I don’t have a big problem with them, and I understand why people like cryptocurrencies. However, I invest solely in stocks and don’t recommend cryptocurrencies.

If you’re interested in cryptocurrencies, then I have good news for you. InvestorPlace Senior Analyst Luke Lango – our in-house crypto expert – covers cryptos extensively. In fact, Luke and his team created a powerful quant system to find cryptocurrencies in the early stages of big technical breakouts. It’s similar to his system that uncovers equities before they surge in price.

Luke doesn’t want anyone to miss out on the big upside potential in cryptocurrencies following the Bitcoin Halving, so tomorrow, April 23, at 10 a.m. Eastern time, he is taking part in The Breakout Crypto Project to unveil his brand-new system and show investors how they can experience the upside in altcoins while also minimizing risk. Click here to reserve your spot now.

The Bitcoin Halving isn’t the only catalyst set to drive cryptocurrencies higher, and Luke notes another that could trigger a massive crypto rally. To learn more, check out his article below.

Take it away, Luke... | | | | Dear Reader,

Last week, Israel launched a counterattack against Iran in response to its drone and missile strike against Israel days earlier. While it appeared that the conflict might be easing, now tensions in the Middle East are heating up. The region may be on the verge of all-out war.

Which means it’s time to buy gold, right?

Not so fast.

These recent geopolitical developments may actually offer a huge reason to buy a completely different asset … one that tends to soar in times of geopolitical conflict.

Think back to 2020’s COVID-19 outbreak, when the global economy shut down for months on end. The following year, in 2021, Bitcoin (BTC-USD) popped 40%; and around 70 other cryptos soared more than 1,000.

It was a blockbuster year for the crypto markets.

What about the political upheaval surrounding the 2016 U.S. presidential election? That was a tense time for Americans, who felt uneasy and irreconcilably divided. Financial markets were volatile. Yet, the following year, BTC rose almost 1,000% – another blockbuster year for the crypto markets.

And back in 2012, just like we’re seeing today, tensions in the Middle East were flaring. The U.S. Consulate in Libya was attacked, as well as a CIA office nearby. Israel assassinated a high-ranking Hamas military leader. A veteran American war photographer was killed in Syria. Yet, despite those escalations, Bitcoin soared 4,500% in the following year.

You get the point.

Despite their bad reputation as a “risky asset,” cryptos tend to soar in times of geopolitical chaos.

And that’s exactly where we find ourselves right now… Current Geopolitical Tensions: Bullish for Cryptos? Tensions are flaring between Israel and Hamas, much like they did in 2012.

And here in America, political tensions are flaring as well – much like they did in 2016. Plus, recession fears are running rampant, too, just as they did in 2020.

Today we face a mix of the exact same situations that led to massive crypto rallies over the past decade. And we expect a similar outcome here…

Especially because the Fourth Bitcoin Halving is finally upon us.

Indeed, once every four years, Bitcoin undergoes a “halving” event, wherein the production rate of new BTC is cut in half. That lowers supply and, according to Econ 101, raises demand (and price).

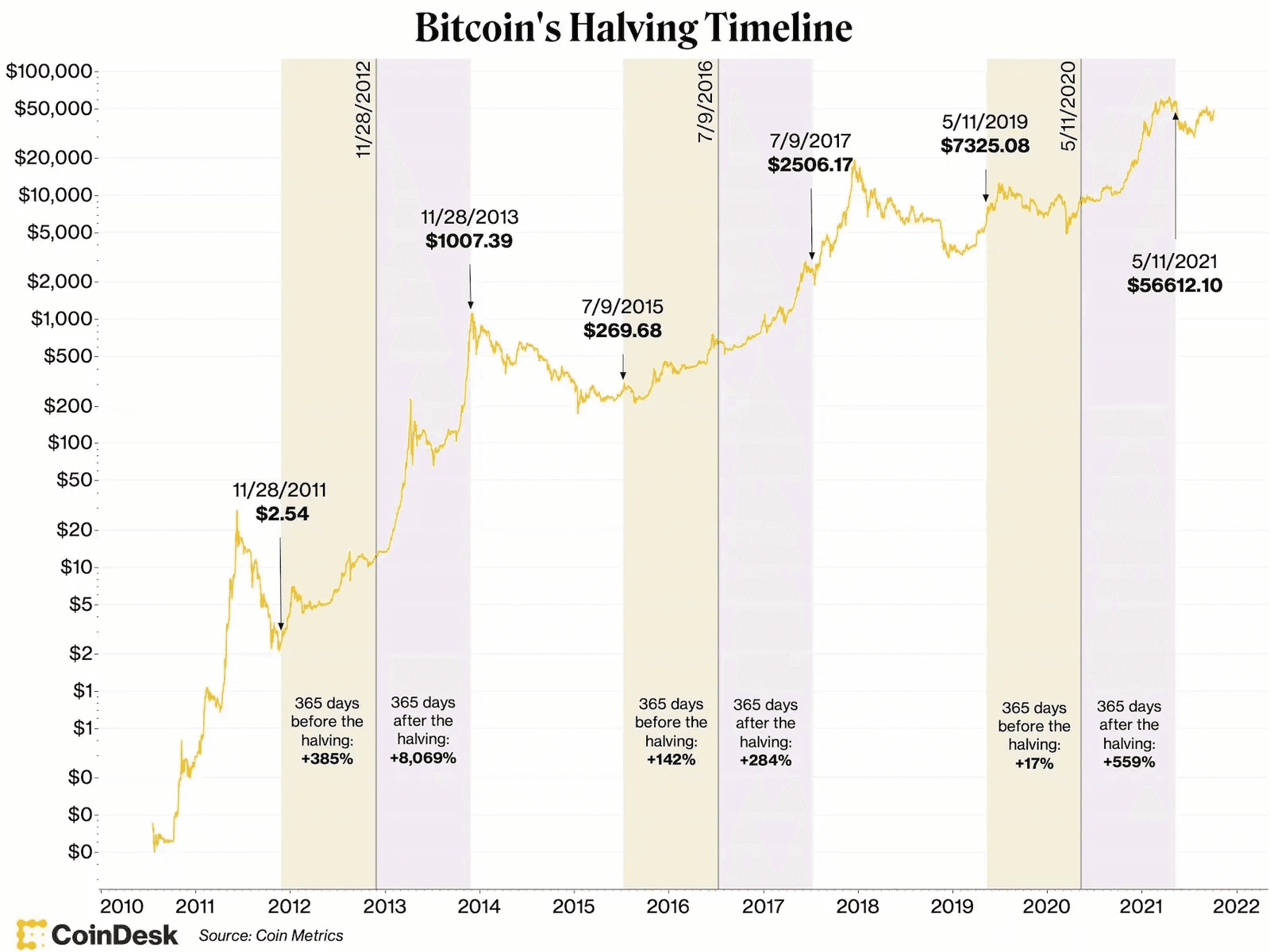

Cryptos tend to soar around these halving events. And the gains are particularly large after the halving… - In the year before the First Bitcoin Halving, BTC rose almost 400%. But in the year after, it soared more than 8,000%.

- In the year before the Second Bitcoin Halving, BTC rose about 140%. Then in the year after, it soared almost 300%.

- And in the year before the Third Bitcoin Halving, BTC climbed 17%. But in the year after, it soared more than 550%.

You can see all that in the chart below from CoinDesk.  Bitcoin always rallies before a halving event. But, more importantly, it always soars afterward.

And the Fourth Halving occurred last Friday at around 8:30 p.m.

This marks the start of a huge new bull market in cryptos. And we’ll likely see dozens upon dozens of cryptos soar 1,000%-plus in the coming months. The Final Word

So, what cryptos should you be buying to give yourself a chance to make major returns in 2024?

Well, my team and I have developed a powerful quantitative system to help traders interested in crypto achieve just that.

To put it as succinctly as possible, it uses the core quantitative stage analysis strategy we employ in my stock-trading services and modifies it slightly to find cryptocurrencies on the verge of a breakout – tokens that could soar hundreds of percent in a matter of days, weeks, and months.

This quant trading system has already proven highly successful in stock-picking. And now, it’s precision-tuned to master gains in the crypto market – just in time to reap the rewards of the Fourth Bitcoin’ Halving.

That’s why, tomorrow, Tuesday, April 23, at 10 a.m. Eastern, I’ll be unveiling this tool at The Breakout Crypto Project. And investors can leverage it to potentially win big with cryptos as they enter the most exciting part of this boom cycle.

Sign up now to make sure you’re in place to learn all about this quant system. Sincerely, |

No comments:

Post a Comment