Your NVIDIA Questions, Answered... Dear Reader, Before I get into today’s piece, I want to thank everyone who joined me yesterday afternoon for the Emergency Cash Bubble Briefing event.

During the event, I discussed the $8.8 trillion cash bubble that is poised to burst. This cash bubble has been ballooning for years now, forcing people to rush out of cash and plunge head-first into the stock market.

As I mentioned in this emergency briefing, when this bubble bursts a lot of investors might get hurt. But the good news is that investors who prepare and act soon have the chance to make life-changing gains. That’s why I’m sounding the alarm for my readers – I want to help investors avoid the devastation that’s coming.

So, during my Emergency Cash Bubble Briefing yesterday, I shared details of the stock system I developed that can identify when certain stocks are about to get hit with a wave of capital. I talked more about this, and my investing game plan for this cash bubble, during the event. But don’t worry if you missed it! You can click here to watch the replay now.

Now, switching gears to today’s Market 360, I want to share my answers to some questions about NVIDIA Corporation (NVDA) and AI that I received recently. I’ll also share how you can get your hands on some of my favorite AI picks in the market right now... Answering the Most Asked AI Questions There is one stock that has been the most talked about in the headlines so far this year: NVIDIA Corporation.

NVIDIA is now the undisputed leader of the Magnificent Seven. This stock has led the overall market rally this year, with gains of 77% year-to-date. After becoming a trillion-dollar company last year (by market cap), it blew through the $2 trillion mark this year – and is currently valued at about $2.2 trillion.

Given the surge in this stock and the attention it has garnered from institutional and individual investors alike, NVDA is the stock I get asked the most about these days. So, let’s go over a few of these questions today… “What is your target price for NVDA?”

I don’t typically set target prices. I’d rather ride the stocks as long as they continue to rank well in Portfolio Grader.

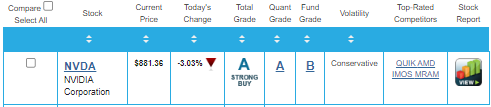

Now, for those of you who want to trade or take profits off the table, that’s fine. But we don’t want to sell outright. That’s because, as you can see below, NVDA earns a B-rating for fundamentals and an A quantitative grade, giving it a total grade of A in Portfolio Grader.  In other words, the stock still has robust forecasted earnings and revenue growth, positive analyst revisions and persistent buying pressure. All of which should drive this stock even higher. “What is the next NVDA?”

Honestly, there is not another stock out there right now that could be considered the next NVDA. This company has explosive sales and earnings growth that no other company can replicate right now.

For the current quarter, analysts expect NVDA’s sales to surge 240.7% year-over-year and for earnings to soar 413.3% year-over-year. The stock has also benefited from positive analyst revisions.

You simply cannot find better earnings and sales growth than that!

The bottom line: NVIDIA still represents our best bet on the red-hot AI craze. And given its strong earnings and sales growth, it should continue to meander higher in the upcoming weeks and months.

Now, having said that, there are other AI-related stocks that I like. And that’s exactly what I covered in the Emergency Cash Bubble Briefing. (In fact, I even gave away one pick in the briefing that I think every investor who is interested in AI should own... You could even make the case that its fundamentals are perhaps even better than NVIDIA’s.)

“You have said before that 80% of our tech portfolio should be invested in NVDA. Do you still believe this?”

Let me be very clear: NVDA should not account for 80% of your personal portfolios or even 80% of your tech portfolio. I am simply saying that NVDA should account for the bulk of your artificial intelligence stocks.

For example, let’s say you own NVDA and a handful of other AI stocks in your portfolio. When considering your AI-related positions, NVDA should account for your biggest allocation.

Essentially, it is very important to allocate your positions properly to help control your portfolio’s underlying volatility. So, while you don’t want to overweight it with NVDA – it should be your largest AI position. I just want to reiterate this because I think this gets lost in the hype. Currently, AI hardware is where the profits are. And since AI applications and software require a massive amount of computing power, any company looking to incorporate AI needs NVIDIA’s best-in-class chips. Period.

That being said, the reality is that AI will be necessary for every company to better understand its customers. For example, AI will hurt storefront retailers that do not adapt accordingly, while those with a big online presence – and that know their customers – will prosper.

So, to profit in the current environment, you want to be invested in companies that are properly incorporating AI into their businesses or stand to directly profit from it.

That’s why I’ve used my system to flag five stocks with the most profit potential from the current AI boom. And as I explained in the Emergency Cash Bubble Briefing, this boom is just getting started, and I’m confident a large chunk of the money that’s sitting on the sidelines right now will flow into these five stocks.

During my Emergency Cash Bubble Briefing , I revealed one of my top five picks. It is one of my biggest winners over at Breakthrough Stocks recently, up over 295% for the year so far!

But this is only one of the five stocks my system is flagged. The other four stocks are reserved for members of Breakthrough Stocks.

This is my premium service designed to spot high-quality small-cap stocks that are primed to surge from explosive trends like AI. And the goal is to make subscribers aware of these stocks before the rest of the market catches on.

Now, there’s still time to catch the replay of my Emergency Cash Bubble Briefing if you haven’t already...

The rebroadcast is available right now – but only for a limited time. In it, you’ll learn about the wave of cash that’s about to hit the market – and why I think my five AI picks are primed to benefit.

You’ll also learn how you can become a member of Breakthrough Stocks , where you’ll get one to two new early-stage investment opportunities with massive upside potential nearly every month. And if you sign up today, you’ll get access to a handful of my brand-new AI-focused special reports.

You can catch the replay of my Emergency Cash Bubble Briefing by clicking here now.

(Already a Breakthrough Stocks member? Click here to log in to the members-only website now.) Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) |

No comments:

Post a Comment