The Latest Inflation Report, the Fed and What It Means for the Market Dear Reader, Yesterday, we got a fresh look at the latest Personal Consumption Expenditures (PCE) price index reading, which PCE rose 0.3% in January.

The good news is that the numbers were not as bad as some people feared, and it continued to tick lower. So, in today’s Market 360, we will take a look at what the report said and what it means for the likelihood of key interest rate cuts later this year. I’ll also tell you what I think the Federal Reserve should do (and why), what could go wrong in this market, as well as give you a preview of the latest Growth Investor Monthly Issue.

Let’s dive in... Making Sense of the PCE Numbers Now, before we begin, I should point out that this report is important because the PCE is the Fed’s favorite inflation indicator. And Fed Chair Jerome Powell has made it clear that the Fed wants to see the core PCE reading in this report to be at 2% on an annual basis.

Yesterday’s report showed that the PCE rose 0.3% in January and is up 2.4% in the past 12 months. Core PCE, excluding food and energy, increased 0.4% in January and is up 2.8% in the past 12 months.

That was the largest monthly gain in a year for core PCE, but it did fall in line with economists’ expectations. However, prior to this report, the six-month annualized rate for PCE was below the Fed’s 2% target for two months in a row. With the latest monthly reading, the six-month reading is now 2.5%

So, the good news is that core PCE continued to tick lower. But this latest reading means it’s much more likely that the Fed will wait to cut key interest rates.

Now, I have been saying for a while that the Fed should hurry up and cut rates. But the market is digesting these fresh numbers, and according to the CME FedWatch Tool, there is now only a 24.6% chance of a rate cut in May. In June, however, there is a 67% probability of a rate cut. I should add that some of my Growth Investor members have asked why I am so insistent that the Fed cut rates sooner than later. The simple answer is that deflation from China is spreading to the U.S., which is why wholesale goods prices have declined for four straight months. We have already witnessed Chinese deflation destroying the market for electric vehicles (EVs) and solar panels in the U.S., for example. And the situation is only getting worse.

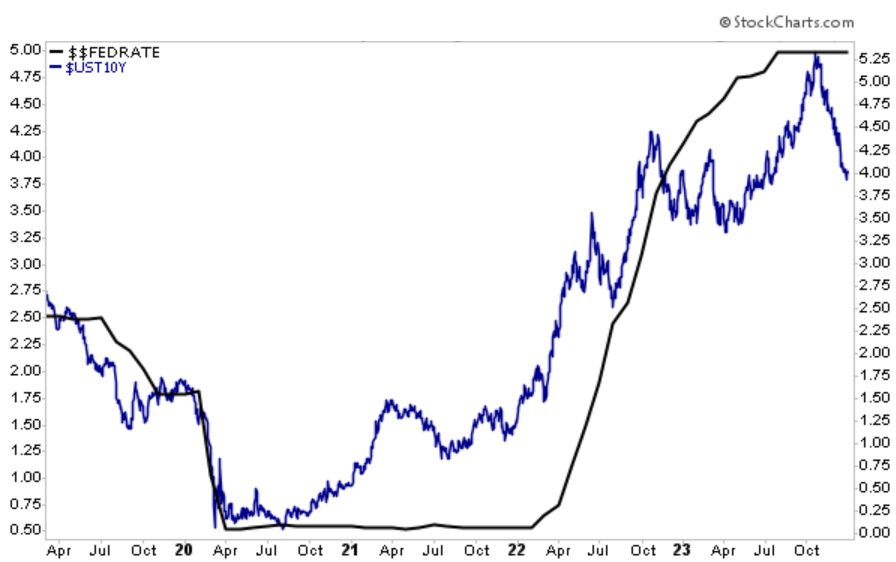

So, the Fed has to be careful, since they are well above market rates. The Fed’s current target rate is 5.25-5.50%. The 10-year Treasury yield, meanwhile, is at about 3.9%.  This means the Fed needs to cut at least three times this year to get back in line with market rates. However, if deflation spreads, then several Fed rate cuts will be required to keep the U.S. economy from tipping into a recession. Looking Ahead to a Strong Year Now, the market has had an incredibly strong start to the year. The S&P 500 has gained about 7.7% year to date, while the Dow is up 3.7% and the NASDAQ has climbed an impressive 8.5%.

Meanwhile, over at Growth Investor, my Buy List has surged more than 18% year-to-date!

It’s clear to me that 2024 is off to an even stronger start than 1999, a year when I had multiple portfolios soar more than 100%.

But there’s still a lot of uncertainty out there with the potential to derail the stock market. So, aside from the Fed delaying rate cuts, what exactly could go wrong? That's what I answer in today's Growth Investor Monthly Issue for March. (Join today so you can access the issue as soon as it’s released.)

Overall, there are certainly events and developments that could cause stocks to hit the pause button on the recent rally. But I remain bullish that stocks will overcome these setbacks and continue to push higher through yearend.

The reality is institutional buying pressure has remained robust in fundamentally superior stocks, like my Growth Investor stocks. As the earnings environment improves and earnings growth accelerates this year, I suspect this buying pressure will only intensify. In addition, the Fed will cut key interest rates this year, and stocks historically rally in presidential election years.

That’s why, in the latest issue of Growth Investor, I also recommend four new additions to our Buy Lists. I also discussed the latest developments for our Top Stocks, which have been on a roll... my Top 5 High-Growth Investments stocks are up an average 15% and my Top 3 Elite Dividend Payers stocks are up an average 7.4% in February alone.

The fact is earnings momentum has accelerated, and institutional investors are growing more fundamentally focused – and that’s created a buying frenzy in my Growth Investor stocks.

The even better news is that my Growth Investor stocks’ earnings continue to outpace the S&P 500. For the fourth quarter, my average Buy List stock posted 17.9% average annual sales growth and 147.5% average annual earnings. In comparison, the S&P 500 reported 4% average sales growth and 3.2% average earnings growth for the fourth quarter.

I still expect my Growth Investor stocks to rally right up to the November presidential election, as strong earnings and falling interest rates propel them higher.

So, you still have time to learn more about the four stocks we added in the March issue of Growth Investor. Given that I expect fundamentally superior growth stocks to attract the majority of the $8.8 trillion in cash currently sitting on the sidelines, I expect these new picks – and the rest of the stocks on our Buy List – to have a banner year!

To get full access to my new Growth Investor Monthly Issue as soon as it’s published, click here.

(Already a Growth Investor subscriber? Go here to log in to the members-only website.) Sincerely, |

No comments:

Post a Comment