Is The Biggest Bubble Ever About to Pop? Dear Reader, We’ve certainly seen our share of bubbles burst over the last century…

Think about the housing bubble of 2008, the dot-com bubble of the late ’90s, and even the stock market crash of 1929...

When you look at these bubbles, there’s a common trend. In each case, as the bubble grew, people were overly optimistic and piled their investments into these hot markets. But when reality struck and those bubbles started to burst, panic set in and people fell over each other trying to pull their money out...

It’s human nature, really. When investors are gripped by fear, they start selling off their assets in a frenzy, desperately trying to convert them back into cash, which they see as a safe haven.

Now there’s another bubble about to pop… but the situation is much different.

You see, what we saw with the 1929 market crash, the dot-com boom and bust, and the housing crash of 2008 are what we call “asset bubbles.” Those crashes are perfect examples of what happens when the value of assets like stocks, real estate, or other investments soar too high. Eventually, reality catches up, prices drop, and the bubble bursts as people rush to sell their assets for cash.

However, the bubble I’m talking about is not an asset bubble.

It’s a cash bubble – and it’s massive. The $8.8 Trillion Cash Bubble Instead of a rush out of assets and into cash, there’s going to be a mass exodus out of cash and into assets.

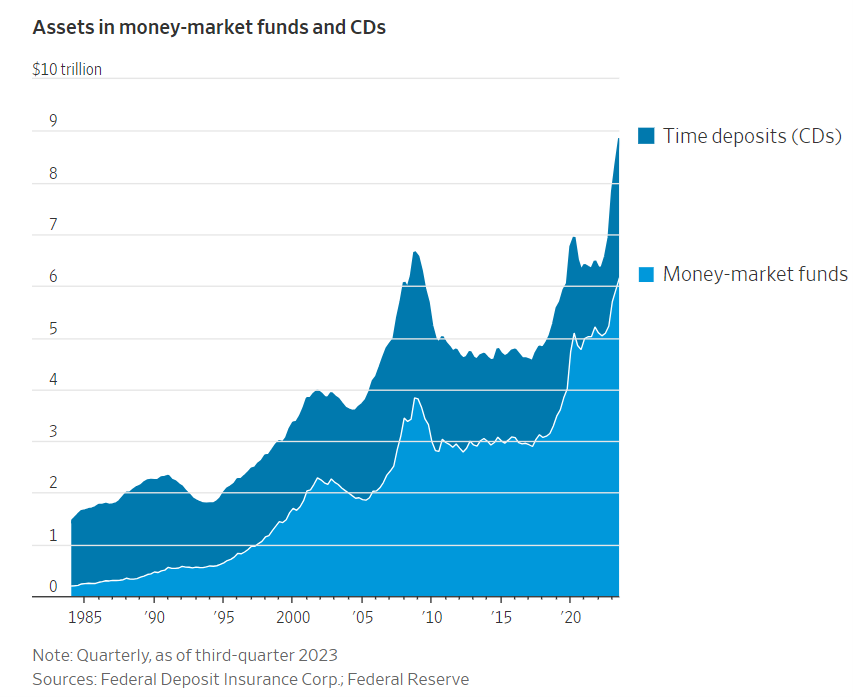

And I’m talking about trillions of dollars. According to a recent report in The Wall Street Journal, Americans have parked an estimated $8.8 trillion in money market accounts and certificates of deposit (CDs).

That’s $8.8 trillion in cash sitting on the sidelines. Just take a look at this chart…  Source: The Wall Street Journal Since 2020, we’ve been seeing a really interesting trend develop. With the stock market so unpredictable, many folks started moving their money into cash. It seemed like the safest bet, right? The markets were like a roller coaster, and nobody wanted to lose their hard-earned money chasing stock gains.

Now, fast forward to 2023, and this trend accelerated aggressively. In 2023 alone, we witnessed a staggering $1 trillion being pulled out of the stock market and tucked away, which only pumped more air into this cash bubble.

Think about it... $8.8 trillion worth of capital just sitting on the sidelines. I’ve been in this business for four decades, and I’ve never seen anything like it... In the history of the stock market, there has never been this much cash sitting on the sidelines in money market funds. But the thing is, all this money won’t be on the sidelines for much longer…

I predict we’re going to start seeing that trend do a hard U-turn. So, what will inspire all this cash to pour in from the sidelines… and how can we use it to our advantage?

That’s what I’ll be addressing in my Emergency Cash Bubble Briefing on Wednesday, March 13, at 1 p.m. Eastern. Click here to register now.

Make no mistake... The financial fallout of these events is coming. As I’ll show you on Wednesday, it is closer than most folks think.

I believe this bubble will be a make-or-break moment for millions of Americans. Many will be caught by surprise, and I don’t want you to be one of them.

Now is also a crucial time to protect your money and potentially make a fortune by acting ahead of the news. And if you follow my playbook, I believe those who prepare could potentially build an entire retirement nest egg with just a few small moves…

So, during the Emergency Cash Bubble Briefing, I will also outline my game plan step-by-step.

That’s why it’s vital that you mark your calendar for Wednesday, March 13, at 1 p.m. Eastern, and sign up for the event now to stay up to speed for my upcoming Emergency Cash Bubble Briefing. Sincerely, |

No comments:

Post a Comment