The Dow Adds Amazon to Its Roster – Does That Make It a Buy? Dear Reader, Back in the day, there was a journalist named Charles Dow who began his career reporting at the Kiernan Wall Street Financial News Bureau.

Then, in 1822, Dow began to work closely with Edward Jones, and the two founded Dow, Jones & Co. Together, Dow and Jones published the Customers’ Afternoon Letter, which was a daily financial news bulletin. Later, they would consolidate a number of publications into what would become The Wall Street Journal.

In this daily two-pager, Dow and Jones detailed a summary of the day’s financial news. It quickly achieved over 1,000 subscribers and was regarded as an important news source for investors. During this time, Dow wrote about many concepts that are well-known among investors today.

For instance, the Dow Theory is still widely used today. This theory states that the market is in an upward trend if one of its averages hits a high followed by another average hitting a high. This would confirm that the move is real.

But perhaps his greatest legacy, aside from The Wall Street Journal, was the Dow Jones Industrial Average.

On May 26, 1896, Dow and Jones officially established the Dow Jones Industrial Average using the top 12 stocks in the market at that time. At the time, the average was mostly comprised of industrial firms and railroads. By 1916, the number of companies included in the index increased to 20, and it was bumped up again in 1928 to the current level of 30 companies.

For the longest time, when people talked about general market price trends, they would reference the Dow as a benchmark. It’s about as American as apple pie in the finance world.

Today, however, the S&P 500 is more representative of the economy. With companies that are dominating the market like NVIDIA Corporation (NVDA) and others that have been a top player for years like Apple, Inc. (AAPL), the S&P 500 features 500 of the leading U.S. publicly traded companies.

And due to the fact that the Dow is less oriented toward technology stocks, it has lagged the S&P 500 in recent years. In fact, over the past year, the Dow has climbed nearly 20% while the S&P 500 has surged more than 30%.

On Monday, in an effort to catch up to the S&P 500, the Dow adjusted its roster. So, in today’s Market 360, I’ll detail the changes the Dow made. Then, I’ll share what this means for the stock that was added… and where I think investors should focus on. The Dow’s Big Shakeup Now, before we dive into the latest addition to the Dow, it is important to note that the index is weighted by price, not market capitalization. This means that the higher-priced stocks have more of an impact on how the index moves.

And this Monday’s addition will surely impact the index. I’m talking about Amazon.com, Inc. (AMZN).

On Monday morning before the opening bell, Amazon replaced drugstore chain Walgreens Boots Alliance (WBA). This marks the first change to the Dow since 2020, when Salesforce, Inc. (CRM), Amgen, Inc. (AMGN) and Honeywell International, Inc. (HON) replaced Exxon Mobil Corporation (XOM), Pfizer, Inc. (PFE) and RTX Corporation (RTX), formerly known as Raytheon Technologies, Inc.

But the question is... why did the stock get added?

Well, it is due to the three-for-one split by another company in the Dow… Walmart, Inc. (WMT). As I mentioned above, the Dow is weighted by price. And given the stock split for Walmart, this will reduce its weight in the index, so the Dow needed to rebalance itself.

When it came to picking the stock to cut, Walgreens was the obvious choice. The drugstore chain has struggled in recent years – the stock is down by about 34% in the past year, and has lost nearly 62% of its value in the past five years. Plus, at an $18 billion market cap, it’s hard to make the case that the company belonged in an index that’s supposed to represent the broader economy. And given the fact that it had the lowest price of all the companies in the index, it made the most sense.

Following the swap, Amazon ranks 17 out of the 30 stocks in the Dow.

Now, this addition of Amazon is a clear reflection of the dominance the “Magnificent Seven” tech companies have on the markets.

Just look at the S&P 500 last year. The “Magnificent Seven” accounts for 30% of the index’s market value. And fueled by the artificial intelligence boom, this group of stocks helped boost the S&P 500 to record highs in 2023.

So, adding Amazon to the Dow should help the index get back to a more modern standing, and in turn, help the index catch up with the S&P 500. Is Amazon a Buy? Now, this addition may cause investors to wonder whether this this is a good time to buy into an exchange-traded fund (ETF) that tracks the Dow, or buy stock of Amazon.

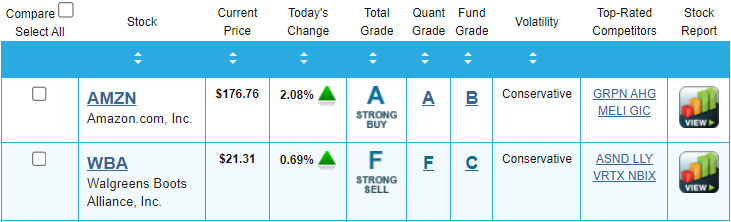

Let me just say that, personally, I am not a big fan of ETFs and would not recommend investing in an ETF like the SPDR Dow Jones Industrial Average ETF Trust (DIA) (or any other kind, for that matter). I've explained why in previous Market 360 articles (you can go here to read more). Now, if we consider the fundamentals, switching WBA for AMZN was the right call, based on what my Portfolio Grader says. Currently, AMZN earns an A-rating and WBA holds an F-rating.  So, yes, AMZN is a “Buy” right now.

While it is true that AMZN will have even more visibility and likely see more institutional buying pressure (it popped to a new 52-week intraday high following the move to the Dow) as a result, this doesn’t necessarily mean the stock is going to soar.

In fact, after rallying more than 7% to $171.81 on February 2 following its earnings results on February 1, it was back down to $170.31 on February 5 (the next trading day). While AMZN did recover in the last week of the month, that bounce is mostly thanks to NVIDIA’s earnings report lifting the broader market.

The reality is that Amazon has a $1.8 trillion market cap, and its move to the Dow was probably long overdue. So, I would argue that there are better stocks out there with even more upside... Where to Look Instead... The fact of the matter is money is beginning to pour into other stocks that are prospering from explosive sales and earnings growth.

And the batch of stocks I am expecting to benefit the most are the small- and mid-cap stocks.

The reality is that there are great opportunities in small- and mid-cap stocks that can outperform these heavyweights this year. I’m talking about quality stocks with superior fundamentals that will continue to boast strong earnings and sales growth.

And my Accelerated Profits Buy List is chock-full of stocks like this.

In fact, our Buy List is up a whopping 14% in February so far, which has more than triple the Dow’s 2.2% gain and more than double the S&P 500’s 5.1% rise. With results like that, I am confident we are invested in the crème de la crème over at Accelerated Profits, and that our stocks should continue to rally strongly.

Now, one of the reasons I’m so confident is because the system I use in Accelerated Profits harnesses the power of financial superintelligence to help me pinpoint companies that are primed to post strong earnings results – sending their stocks soaring as a result.

I call this income generator the Quantum Cash project. And it is nothing short of one of my greatest professional achievements.

At its core, Quantum Cash uses a series of AI algorithms to constantly scout massive amounts of data, looking for patterns. Many of these patterns are nonlinear, meaning you’re not going to be able to see them with the naked eye. But the more data you feed it, the more patterns it can spot.

To learn more about my Quantum Cash system and how I incorporate it into Accelerated Profits, click here.

(Already an Accelerated Profits member? Click here to log in to the members-only website now.) Sincerely, |

No comments:

Post a Comment