Should You Buy NVIDIA Ahead of Earnings? Dear Reader, Last week, all eyes on Wall Street were laser-focused on economic data. Specifically, investors got a fresh look at the most recent Consumer Price Index (CPI), retail sales and Producer Price Index (PPI) reports. And unfortunately, all three missed economists’ expectations.

Here’s a quick review of the numbers...

Consumer Price Index (CPI): Headline CPI rose 0.3% in January and was up 3.1% in the past 12 months. That was higher than economists’ expectations for a 0.2% month-over-month increase and a 2.9% annual increase. Core CPI, which excludes food and energy, increased 0.4% in January and was up 3.9% in the past 12 months. This was also a little hotter than forecasts for a 3.7% annual pace and a 0.3% month-to-month rate.

U.S. January Retail Sales: Retail sales fell 0.8% in January, which was substantially lower than economists’ expectation for a 0.2% decline. This month-over-month decline marks the largest fall since March 2023. Out of the 13 categories noted in the report, nine saw decreases from a month ago.

Producer Price Index (PPI): The PPI rose 0.3% in January and 0.9% in the past 12 months. Economists were looking for an increase of just 0.1% for the month. Core PPI, excluding food, energy and trade margins, surged 0.6% in January and rose 2.6% in the past 12 months.

The bottom line is that even though these reports disappointed investors, inflation is still cooling – just not as quickly as economists had hoped.

In the meantime, Wall Street’s attention will shift back to earnings this week. And so far, this earnings season has been simply stunning...

According to FactSet, 79% of S&P 500 companies have now announced quarterly results, and 75% of these companies exceeded analysts’ earnings expectations. The S&P 500 is now anticipated to achieve fourth-quarter earnings growth of 3.2%, up from 2.9% last week and previous expectations for a 1.4% decline in the final week of January.

For example, this week, Wall Street is anxiously awaiting a big earnings report: NVIDIA Corporation (NVDA).

The leading artificial intelligence (AI) chipmaker will post quarterly results on Wednesday. As a result, the company has dominated the headlines recently, with many folks anticipating a “blowout” quarterly report.

The fact is, as our friends at Bespoke Investment Group recently pointed out, AI stocks now account for 10% of the global market cap. And NVIDIA is a leading – if not THE leading – AI stock right now, so it’s no wonder the stock has attracted a lot of attention.

So, with that in mind, in today’s Market 360 , we’ll take a look at the expectations for NVIDIA’s earnings announcement. We’ll also review why this stock has emerged as a market leader – and how we found this stock ahead of the crowd over at Growth Investor. Then, I’ll share where you can find fundamentally superior stocks that truly represent the crème de la crème of the market. Why NVIDIA is Leading the Market Higher It’s no secret that NVIDIA has been one of my favorite stocks for many, many years.

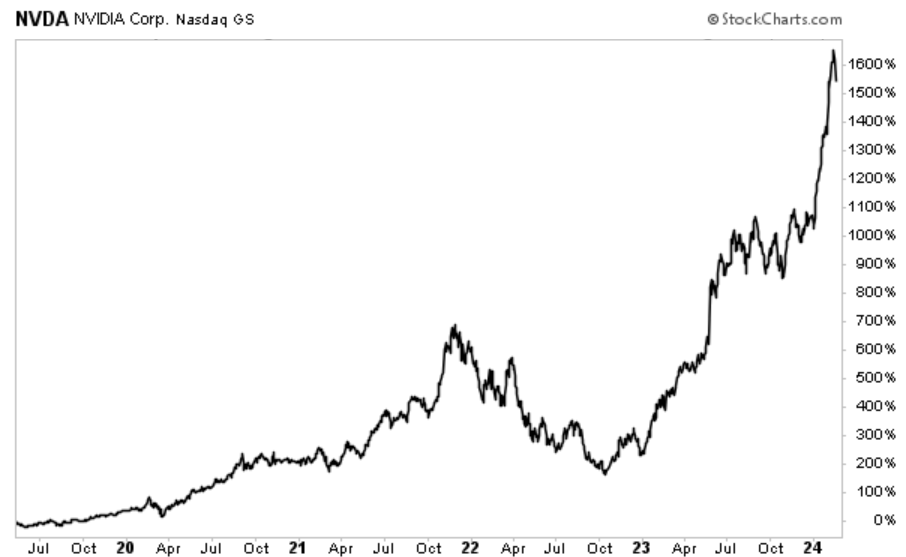

I have recommended the stock in numerous services over the years, and it never disappoints me. For example, I added NVIDIA to the Growth Investor Buy List back in May 2019 – and since then, we are up a stunning 1,530%!  The reality is artificial intelligence stocks have attracted a lot of attention since the start of the year, and NVIDIA is the new leader of the so-called “Magnificent Seven.” The stock is up more than 40% this year alone.

It’s clear to me that both NVIDIA and Super Micro Computer, Inc. (SMCI) are the top AI picks right now, and the reason why is simple: Hardware is beating software.

Microsoft has invested in OpenAI, the makers of ChatGPT, but they have not been able to monetize it the way that Wall Street wants them to. So, in my opinion, all the money to be made in AI right now is in hardware – and both NVIDIA and Super Micro Computer are hardware companies. NVIDIA makes AI chips, and Super Micro Computer uses NVIDIA’s AI chips on their fast servers for the cloud.

And business is booming at both companies.

I reviewed SMCI’s quarterly results in detail in a previous Market 360 (click here to read it now ). The company posted 71.5% year-over-year earnings growth and 100% year-over-year sales growth. It also upped its outlook for the third quarter and fiscal year 2024.

Now, NVIDIA will announce results for its fourth quarter and fiscal year 2024 tomorrow – and Wall Street has been growing more and more excited for the report by the day. Personally, I anticipate NVIDIA’s earnings report and guidance will signal that AI dominance will continue.

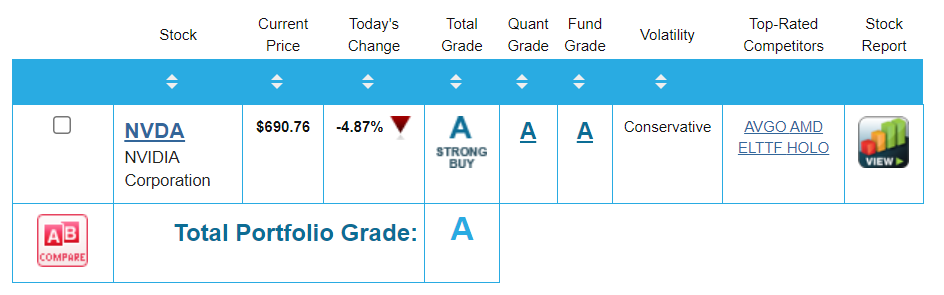

Fourth-quarter earnings are expected to surge 387.5% year-over-year to $4.29 per share, and the analyst community has increased earnings estimates by 24% over the past three months. So, I anticipate another big earnings beat; NVIDIA posted double-digit earnings surprises in each of the last three quarters. And I fully expect NVIDIA shares to soar higher in the wake of a quarterly earnings beat. Is NVDA Still a Good Buy? Now, if you don’t already own shares of NVIDIA, you may be wondering... is it still a buy? According to my Portfolio Grader, the answer is an emphatic yes.  As you can see, the stock earns an A-rating for its Quantitative Grade and an A-rating for its Fundamental Grade and an A-rating for its Total Grade. This is a stock with superior fundamentals that is also backed by persistent buying pressure, i.e., money is flowing into the stock.

Now, you may be a little worried about premiums and multiples with this stock. I encourage you not to worry. We still have a long way to go in the AI rally; we’re in the very early stages right now. Also, NVIDIA only trades at about 25 times this next year’s earnings estimates.

I am fine with paying a bit of a premium for NVIDIA right now. The stock has a low price-to-earnings ratio one year out – and triple-digit forecasted earnings and sales growth. So, NVDA remains the crème de la crème in the AI space right now. Now, NVIDIA isn’t just a great AI stock. It’s also a great example of a fundamentally superior stock… and our stunning gain is evidence of what happens when you find one of the future market leaders ahead of the pack. Finding the New Market Leaders Ahead of the Crowd... Now, even though we were ahead of the crowd, I think NVDA will continue to lead the market higher. But I also believe the next market leaders will emerge from my Growth Investor Buy Lists.

The reality is that focusing on fundamentally superior stocks works. Over at Growth Investor, we’ve seen wave-after-wave of positive earnings announcements dropkick and drive stocks higher.

In fact, there are still a lot of Growth Investor companies scheduled to announce results in the upcoming weeks. This week alone, we have 18 Buy List companies slated to release results. And considering the vast majority of our Growth Investor stocks continue to post better-than-expected results, I anticipate positive earnings beats to further propel our stocks higher.

In February alone, one of our Buy Lists has soared 13.1%. In comparison, the S&P 500 is up about 3.3%.

Needless to say, I’m pleased with the results from our Growth Investor stocks so far – and ecstatic that so many of our stocks responded positively to these results. And I expect much of the same from NVDA and the rest of our upcoming earnings reports.

That’s because my Growth Investor Buy List stocks are the crème de la crème of the stock market – the stocks that are primed to post strong earnings results. If you join me at Growth Investor , you’ll get immediate access to my Buy Lists today. Not only that, but you will also get access to my Monthly Issues, Weekly Updates, Special Market Podcasts – and much more.

Click here to sign up for Growth Investor now.

(Already a Growth Investor subscriber? Go here to log in to the members-only website.) Sincerely, |

| Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) and Super Micro Computer, Inc. (SMCI) |

No comments:

Post a Comment